SCENE®* VISA* Card by Scotiabank- Best For Newcomers to Canada

Welcome to Canada! How are your finances doing out here? Housings and accommodations are expensive.

Researchers have found that a person earning around $2,500 net monthly income will have nothing left after catering to the monthly necessities.

Hence, it’s essential to have a credit card if you’re immigrating to Canada to deal with unforeseen expenses, such as medical emergencies, wallet loss, housing, accommodation, and electricity bill payments.

Luckily, there are plethoras of credit cards available for newcomers to Canada, but not all of them will sound best for you.

SCENE®* Visa* Card Is Best for Newcomers To Canada

The SCENE®* Visa* Card is the most targeted among newcomers to Canada. The card is best suitable for someone who is looking to earn and redeem rewards in every transaction done from that card. The SCENE visa card is one of the best no-annual-fee credit cards in Canada.

From shopping to watching movies, there’s always a scope to collect more earned points without any annual fee. The SCENE®* Visa* Card is ideal for students who have recently immigrated to Canada for higher studies.

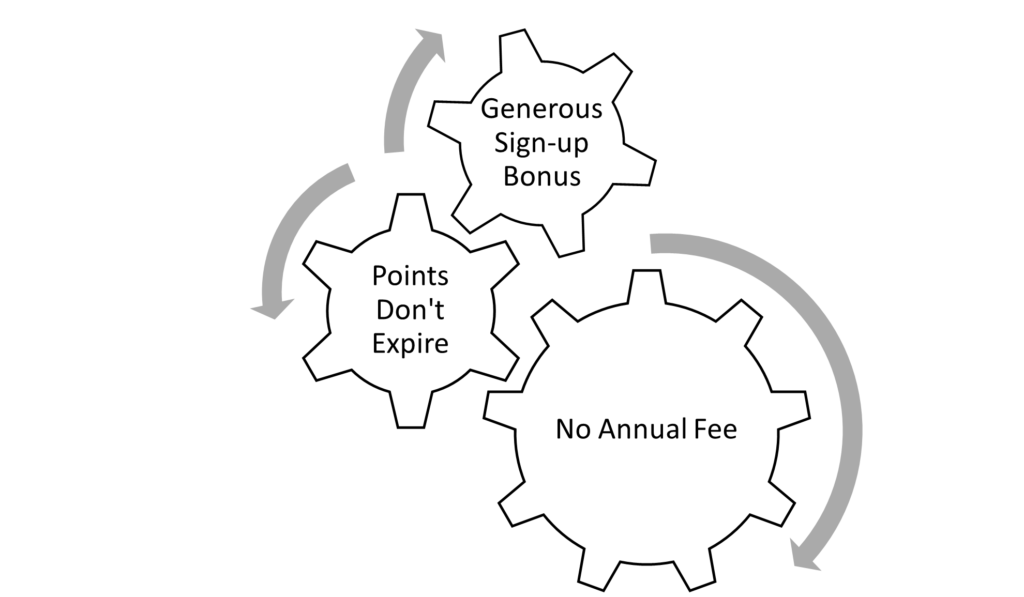

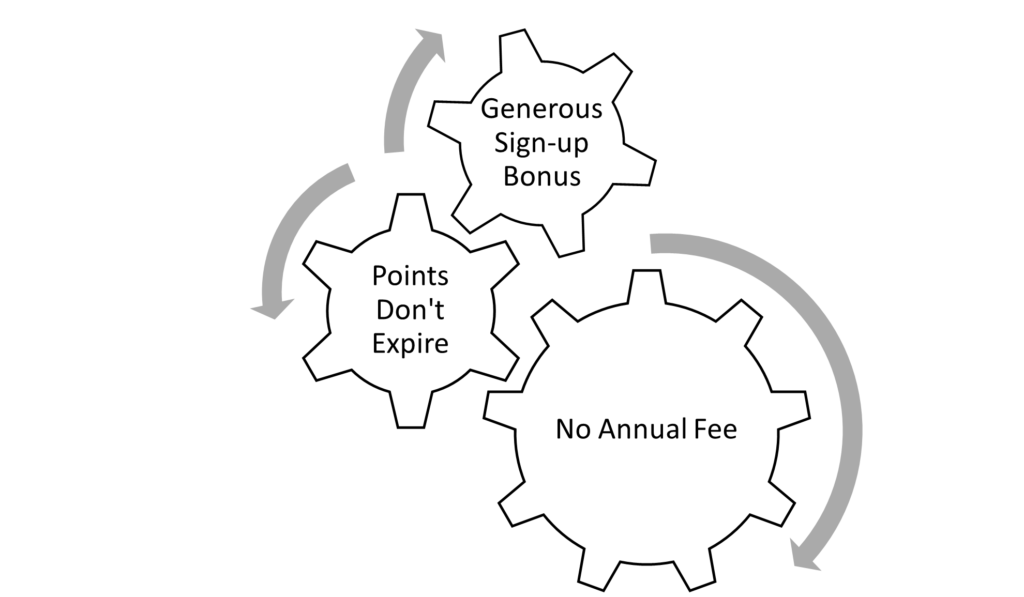

Top Features of SCENE®* Visa* Card

1. Generous Sign-up Bonus

The cardholder can earn up to 5,000 bonus SCENE plus points in your first purchase with your new card of $750 in the first three months (terms and conditions apply). From watching movies to shopping, this card is a convenient way to get your expenses. Can you see any downside with an offer like that?

2. No Annual Fee Charges

Particularly, most credit cards offer around 1 percent of value per dollar and charge annual fees. The SCENE®* Visa* Card has no annual fee, and its accelerated earn rate is about 6.5%.

3. Points Don’t Expire

You can earn and keep your redeemed points as long as you want unless you fail to access your account for two years.

How the Scene VISA Card Compares to Other?

While applying for a credit card in Canada, it’s essential to see how this card is better than other cards compared to no fee, student, and travel credit cards.

Let’s take a look at some other cards to see what they offer.

American Express is the most targeted credit card among frequent travelers. It’s the most comparable card. It charges no annual fee and comes with 10,000 American Express membership reward points for first-time users. The reward points of both Amex and Scene can be used on travel or statement credit at the same value.

Is the SCENE VISA Card For You?

The SCENE Visa card has a couple of things that make it perfect for students and new immigrants to Canada and just starting.

- If you’re a frequent movie-goer, this card is for you. The SCENE visa card gives a payout of around 5%.

But there are some downsides to this card as well:

- The card does not cover free insurance, such as travel insurance to an extended warranty.

- Secondly, the card comes with a maximum limit on the points you can earn (a maximum of 300 points in every transaction and 600 points daily).

Evaluate your requirements and choose the credit card that better serves your needs.