Meridian Personal Senior Chequing Account vs. CIBC Smart for Seniors Account

The best time is the second childhood. To make it stress-free, – The Meridian Credit Union offers everyone aged 60 or more, Personal Senior Chequing Account. You can do uninterrupted banking at a $0 monthly fee. Open this account now.

We will compare it with the flexible CIBC Smart for the Seniors Account. You get eligible for it when you are 65 or older. Click here to get this account instantly.

Are you confused? www.ExpertByArea.Money will do a comparative analysis of both these chequing accounts. Connect with our banking experts today for better insights.

1. Meridian Personal Senior Chequing Account

WELCOME OFFER

Presently Meridian CU is not offering introductory benefits or opening cash bonuses on this chequing account.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | You are 60 years or older |

| c. | You have a valid Government ID, like Passport, Driving License, etc. |

- Interest Rate:

- You do not get any interest

- Minimum Balance:

- You are not required to keep any minimum balance

- Transactions:

- Unlimited and Free debit transactions

- Four Interac e-Transfer every month at $0

- Monthly Fees:

- There is no monthly fee

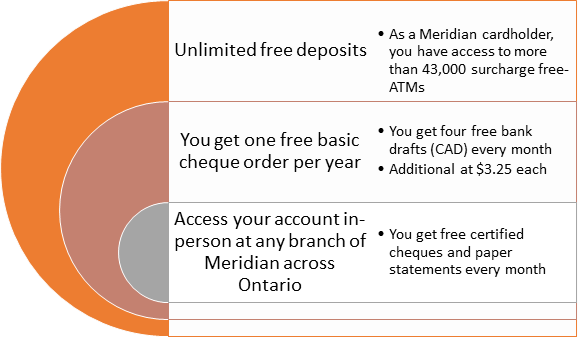

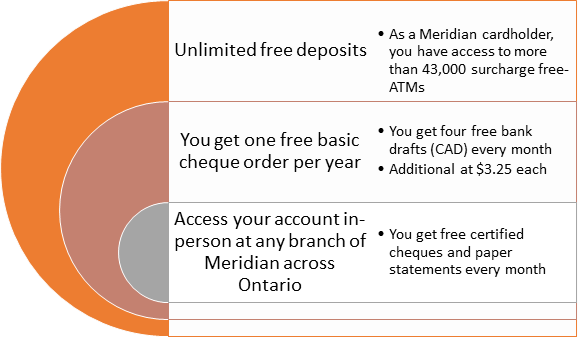

Additional Benefits:

2. CIBC Smart for Seniors Account

WELCOME OFFER

Presently, CIBC is not offering any introductory benefit or an opening cash bonus.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | You must be 65 years or older |

| c. | You have a valid Government ID, like Passport, Driving License, etc. |

- Interest Rate:

- This account offers a 0.25% interest rate on every dollar

- Minimum Balance:

- There is no requirement for any minimum balance

- Transactions:

- Two free debit transactions per month

- You get Free Interac e-Transfer® transactions with the CIBC Smart Account and CIBC Smart™ Plus Account

- Monthly Fees:

- There is a lower monthly fee

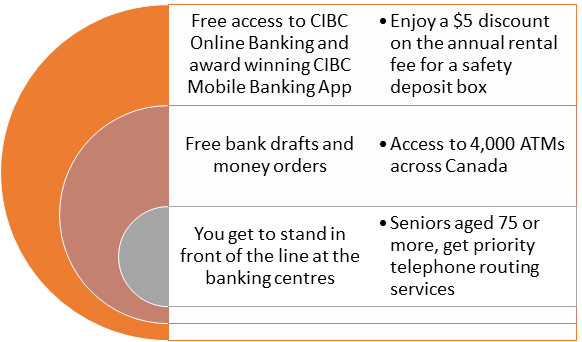

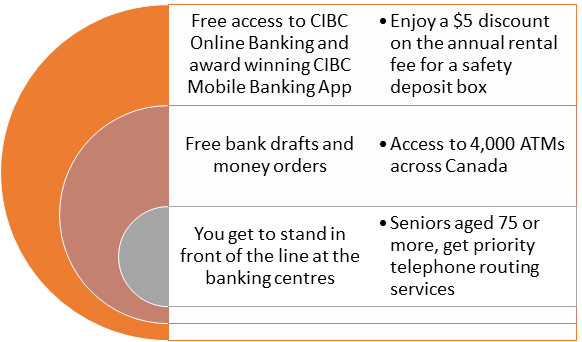

Additional Benefits:

COMPARATIVE ANALYSIS

| Parameters | Personal Senior Chequing Account – By Meridian Credit Union | CIBC Smart for Seniors Account |

| Monthly Fee | $0 | A lower monthly fee |

| Interest Rates | 0.00% | 0.25% |

| Minimum Balance | Not applicable | Not applicable |

| Interac e-Transfer (per month) | Four | Unlimited and Free |

| Debit Transactions (per month) | Unlimited and Free | Two |

Out of the five parameters mentioned above, the CIBC Smart for Seniors Account scores higher in two of them. The Personal Senior Chequing Account–By Meridian Credit Union also scores higher in two parameters, whereas there is a tie in one.

OPINION of ExpertByArea.Money

The CIBC Smart for Seniors Account charges a nominal monthly fee and offers you 0.25% interest on every dollar. The Interac e-Transfer is unlimited and free, but debit transactions are limited to two every month. Also, it requires you to be 65 or more to be eligible.

Whereas the Personal Senior Chequing Account–By Meridian Credit Union has a $0 monthly fee and offers you unlimited debit transactions. But, it does not give you interest and restricts your Interac e-Transfer to four a month. Also, you get eligible for this account as soon as you turn 60.

Are you still confused?

www.ExpertByArea.Money has verified premium experts ready to solve all your financial queries – Have you contacted them yet?

Evaluate your requirements. Choose the best account that better serves your needs.