CIBC Smart Plus Account Vs. Meridian Credit Union Convenience Plus Chequing Account

The CIBC Smart Plus Account makes banking easy to do. It has several benefits and is the best for routine travelers and hefty bank service users. Click here to get started.

The Meridian Credit Union presents convenience Plus Chequing. It is the second largest credit union in Canada. It lets you perform online, mobile, and in-branch telephone banking. Open this account now.

Let us compare these chequing accounts and see the perfect option for you.

1. CIBC Smart Plus Account

WELCOME OFFER

As part of the special chequing offer, you can earn up to $400 ($350 + $50) as an opening cash bonus. However, you must satisfy the following conditions:

- You must be 25 years or older

- Within the first two months, you will get $350, when:

- You make one ongoing direct deposit in your chequing account

- And

- You perform any of the three transactions mentioned below:

- Two ongoing pre-authorized debits

- Two Visa debits

- Two online bill payments, each of $50 or more

- Post this, you are eligible to earn an extra $50. This will happen when –

- Within the first two months:

- You transfer $200 from your new CIBC Smart™ Account into your CIBC eAdvantage® Savings Account

*The bank will credit the cashback of $400 to your chequing account within the first seven months of account opening.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | You should possess valid contact details–Email, phone No., Name, and Residential address |

| c. | You are a major as per the age of majority set by your province. |

| d. | You must have your passport, driver’s license, or any other government I.D. |

- Interest Rate:

- This chequing account does not offer any interest

- Minimum Balance:

- There is no requirement of any minimum balance unless you want to avoid monthly fees

- Transactions:

- You can perform UNLIMITED transactions

- The term “transaction” covers:

- Debit purchases

- CIBC withdrawals (including CIBC ATM)

- Interac e-Transfer® transactions

- Transfers

- Cheques

- Pre-authorized payments

- Bill payments

- Monthly Fee:

| For clients less than 65 years of age | For clients 65 years or older | |

| Monthly Fee | $29.95 | $23 |

*The monthly fee for both types of clients gets reduced to $0 when:

- A daily balance of $6,000 is maintained

Or

- $100,000 in combined eligible savings and investments, including GICs

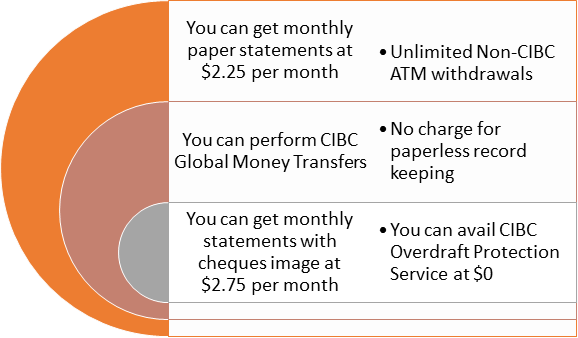

Additional Benefits:

2. Meridian Convenience Plus Chequing Account

WELCOME OFFER

Meridian Credit Union is not offering any opening cash bonus or other introductory offers with this chequing account.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | You have a valid email address |

| c. | You are a major as per the age of majority set by your province. |

| d. | You have your Social Insurance Number (SIN) |

- Interest Rate:

- You do not get any interest in this chequing account

- Minimum Balance:

- There is no requirement for any minimum balance.

- Transactions:

- You can perform UNLIMITED transactions for FREE

- You get 4 FREE Interac e-Transfer every month

- Monthly Fees:

- There is a monthly fee of $12

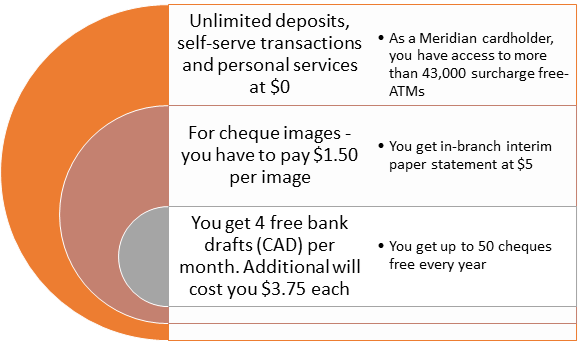

Additional Benefits:

COMPARATIVE ANALYSIS

Let us now compare both these chequing accounts:

| Parameters | CIBC Smart Plus Account | Convenience Plus Chequing Account– By Meridian Credit Union |

| Opening Cash Bonus | $400 ($350 + $50) | Not Applicable |

| Monthly Fees | $29.95 and $23 (for aged 65 years or older) | $12 |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | Not applicable |

| Debit Transactions | Unlimited | Unlimited |

| Interac e-Transfers | Unlimited | Four free per month |

OPINION of Expertbyarea.Money

The CIBC Smart Plus Account offers an impressive opening cash bonus of $400. You can do unlimited banking with this account. However, there is a hefty, but avoidable monthly fee of $29.95 and $23.

Whereas the monthly fee charged by Convenience Plus Chequing Account is nominal at $12, it restricts your Interac e-Transfer to only four transactions per month. It also does not offer you any opening cash bonus.

Evaluate your requirements. Choose the best account that better serves your needs.