Bank of Montreal Practical Account vs. Scotia Bank Ultimate Package

The Bank of Montreal Practical Account is a basic chequing account that serves all your essential banking needs. You can get this account within minutes by clicking on this link.

The Scotia Bank Ultimate Package allows you to perform everyday banking transactions, such as Purchases, ABM transactions, and even payroll deposits, and pay zero annual fees. You can easily open this account online. Just click here.

Let us compare these chequing accounts and see the perfect option for you.

Bank of Montreal Practical Account

If you are looking for a basic bank account that serves most of your everyday banking needs, the Bank of Montreal Practical Account can work the best for you.

WELCOME OFFER

Presently this bank account is not offering you any opening cash bonus or family bundle bonus.

FEATURES

- Eligibility

- a. You must be a Canadian resident.

- b. You have a Canadian address.

- c. You are a major as per the age of majority set by your province.

- d. You must have your Social Insurance Number (SIN)

- Interest Rate:

- This chequing account does not offer any interest on balances maintained.

- Minimum Balance:

- There is no requirement for any minimum balance

- Transactions:

- Unlimited and free Interac e-Transfer, subject to your transaction limit

- You can do 12 free debit transactions every month. Every additional transaction will cost you $1.25 per transaction.

- Monthly Fees:

- There is a monthly fee of $4

- However, you will get a waiver if you are a senior citizen (aged 60 or more)

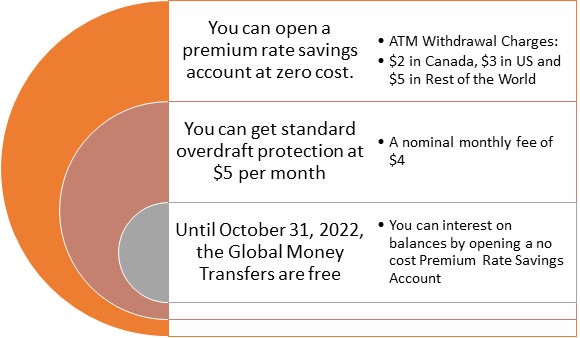

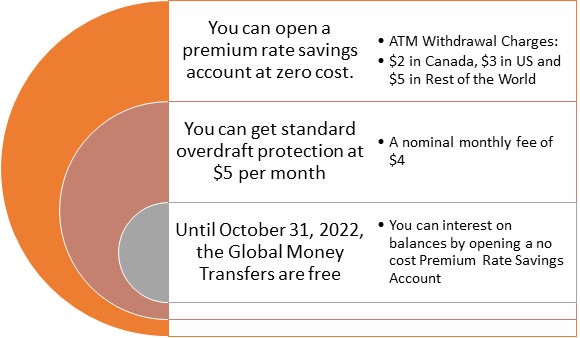

Bank of Montreal Benefits

Scotia Bank Ultimate Package

The Scotia Bank Ultimate Package also serves all your everyday banking needs. You also get access to the SCENE+ Program and can earn exciting rewards.

WELCOME OFFER

When you open a new Ultimate Package account, you earn a welcome bonus of $300. It gets credited to your account within the first 6-months. However, you must complete the following tasks:

- Open the account by September 30, 2022

- Within two months of account opening, you must do any two of the:

- Set up one eligible automated recurring direct deposit. It must recur for three months in a row.

- Set up two eligible separate recurring pre-authorized transactions worth $50 or more. These must also recur for three months in a row.

- Make one eligible $50 bill using online or mobile banking services.

FEATURES

- Eligibility

- You must be a Canadian resident or are in Canada to work or study.

- You must be at least 16 years old.

- You must not be opening a joint account

- Interest Rate:

- You do not get any interest in this chequing account.

- Minimum Balance:

- There is no requirement for any minimum balance.

- Transactions:

- Unlimited debit transactions

- Unlimited Scotia International Money Transfers at no fee

- Unlimited Interac e-Transfer

- Monthly Fees:

- There is a monthly fee of $30.95

- You get a waiver if you maintain a minimum daily closing balance of $5,000 or a combined balance of $30,000 across Ultimate Package and Momentum Savings Account

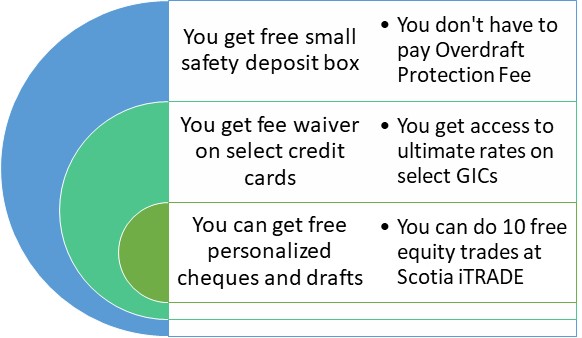

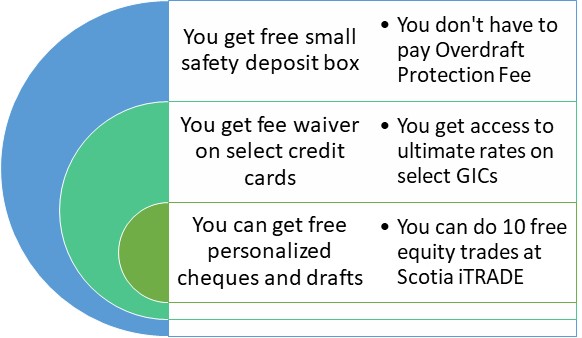

Scotia Bank Benefits

COMPARATIVE ANALYSIS

We compare the features of the accounts through a table.

| Parameters | Bank of Montreal Practical Account | Scotia Bank Ultimate Package |

| Opening Cash Bonus | Not applicable | $300 |

| Monthly Fees | $0 | $30.95, $0 if you maintain a minimum balance |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | Not applicable |

| Debit Transactions | 12 free transactions in a month | Unlimited |

Out of the five parameters mentioned above, the Bank of Montreal Practical Account scores higher in the two of them. There is a tie in two parameters, while Scotia Bank Ultimate Package wins only in one parameter.

OPINION of Expertbyarea. money

Both the chequing accounts mentioned in this article aim to serve your basic banking needs. They do not offer any interest and have no requirement for a minimum balance.

However, what separates them are the features and scalability. With Scotia Bank Ultimate Package, you can earn an opening cash bonus, enjoy unlimited debit transactions, and several additional benefits, such as a credit card fee waiver, access to ultimate GIC rates, etc. But, you will pay a $30.95 monthly fee for all this.

The Bank of Montreal Practical Account would let you enjoy basic banking at zero monthly fees.

Evaluate your requirements. Choose the best account that better serves your needs.

References

- https://www.bmo.com/main/personal/bank-accounts/chequing-accounts/practical/

- https://www.scotiabank.com/ca/en/personal/bank-accounts/chequing-accounts/ultimate-package.html