Bank of Montreal Practical Account vs. ICICI HiVALUE® Chequing Account

The Bank of Montreal Practical Account is a basic chequing account that serves all your essential banking needs. You can get this account within minutes by clicking on this link.

On the other hand, is the HiVALUE® Chequing Account offered by ICICI Bank Canada. It lets you perform everyday banking with a host of other services. You get all at a nominal monthly fee! Click here to get started.

Let us compare these chequing accounts and see the perfect option for you.

1. Bank of Montreal Practical Account

If you are looking for a basic bank account that serves most of your everyday banking needs, the Bank of Montreal Practical Account can work the best for you.

WELCOME OFFER

Presently this bank account is not offering you any opening cash bonus or family bundle bonus.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | You have a Canadian address. |

| c. | You are a major as per the age of majority set by your province. |

| d. | You must have your Social Insurance Number (SIN) |

- Interest Rate:

- This chequing account does not offer any interest on balances maintained.

- Minimum Balance:

- There is no requirement for any minimum balance

- Transactions:

- Unlimited and free INTERAC e-Transfers, subject to your transaction limit

- You can do 12 free debit transactions every month. Each additional transaction will cost you $1.25 per transaction.

- Monthly Fees:

- There is a monthly fee of $4

- However, you will get a waiver if you are a senior citizen (aged 60 or more)

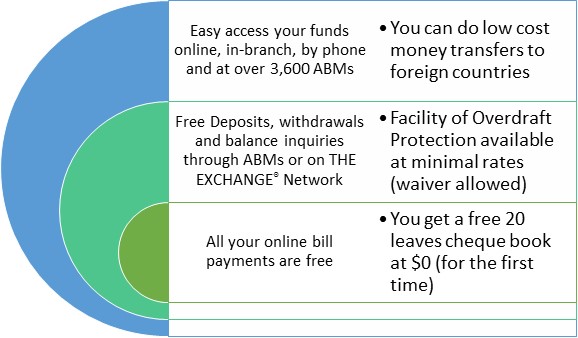

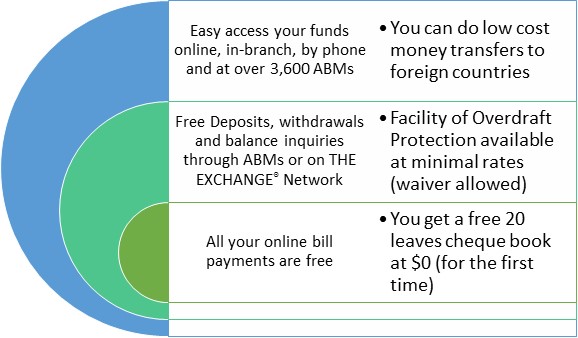

Additional Benefits:

2. HiVALUE® Chequing Account – By ICICI Bank Canada

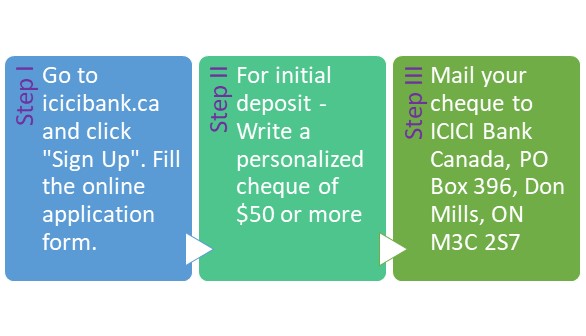

The HiVALUE® Chequing Account serves most of your banking needs. It is available in both Canadian and US Dollars and lets you earn interest too. You can open this account in three easy steps:

WELCOME OFFER

Presently ICICI Bank Canada is not offering any opening cash bonus or introductory offer on this chequing account.

FEATURES

- Eligibility

| a. | You are required to keep the KYC Documents handy. Acceptable documents include – Canadian Driving License, Passport, Permanent Residency Card, Provincial ID, Work Permit, and Health Card |

| b. | You must be a major as per the age of majority set by your province |

| c. | Your name should exactly reflect on the ID document submitted |

*For KYC, you might also be required to click a selfie. Make sure the room is well-lit and the picture is clear.

- Interest Rate:

- You get tiered interest rates in this chequing account. Check the table below:

| Balance Maintained | Applicable Interest Rate |

| From C$ 0 to C$ 1,000 | 0.00% |

| From C$ 1,000.01 to C$ 2,500 | 0.00% |

| C$ 2,500.01 and above | 0.15% |

*The interest is calculated daily on the closing balance and paid monthly.

- Minimum Balance:

- There is no requirement for any minimum balance.

- Transactions:

- 25 Free debit transactions every month

- Monthly Fees:

- There is a monthly fee of $9.95

- You get a waiver if you maintain the minimum daily closing balance of CAD 3,000 or USD 3,000 depending upon the type of your HiVALUE® Chequing Account

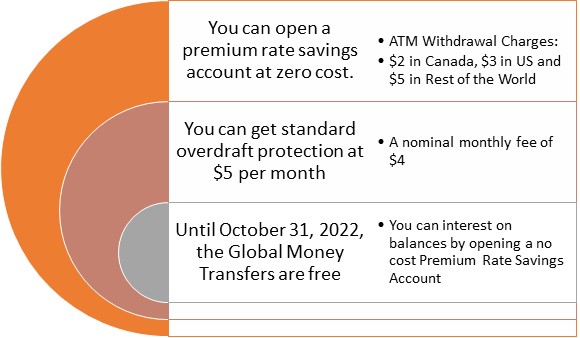

Additional Benefits:

COMPARATIVE ANALYSIS

We compare the common features of the accounts through a table.

| Parameters | Bank of Montreal Practical Account | HiVALUE® Chequing Account – By ICICI Bank Canada |

| Monthly Fees | $4, can be waived only when you are 60+ | $9.95, can be waived on maintaining $3,000 |

| Interest Rates | 0.00% | Up to 0.15% |

| Minimum Balance | Not required | Not required |

| Debit Transactions | 12 free transactions in a month | 25 free transactions in a month |

| Standard Overdraft Protection | $5 per month (cannot be waived) | $5 per month or $5 per transaction (can be waived) |

Out of the five parameters mentioned above, the HiVALUE® Chequing Account – By ICICI Bank Canada scores higher in three of them. There is a tie in one, while the Bank of Montreal Practical Account wins only in one parameter (monthly fees).

OPINION of Expertbyarea. money

Indeed, the HiVALUE® Chequing Account – By ICICI Bank Canada is heads and shoulders above its counterpart. You get 25 free transactions in a month at $9.95. This fee can be waived too when you maintain the minimum balance. The best part is you can even earn interest, which is a rare sight for chequing accounts.

The Bank of Montreal Practical Account offers you 12 free transactions in a month at $4. The additional ones will cost you $1.25 each. To reach the count of 25 (as offered by ICICI Bank Canada), you will pay an additional $16.25 (13 additional transactions x $1.25 each)

.

In effect, with Bank of Montreal, you get a chequing account with 25 transactions at $20.25 ($16.25+$4)

. And, you do not get a waiver, no matter how much balance you maintain!

Thus, in our opinion, HiVALUE® Chequing Account – By ICICI Bank Canada wins the battle.

Do you have something else in mind? Well, evaluate your requirements. Choose the best account that better serves your needs.