Bitcoins Can Earn You A Fortune: Detailed Analysis, Factors Affecting Bitcoin Prices in Canada, Proven Strategies [Updated 2023]

Cryptocurrencies are speculative. Yes, being unregulated, the market forces of demand and supply determined their prices. The roles played by the market operators, speculators, and even anonymous developers make the Bitcoin market highly volatile. Below is a list of the top factors that affect the price of Bitcoin in Canada.

Three Latest Factors Affecting Bitcoin Prices

“I always knew that cryptocurrencies are volatile. But I also knew that celebrated cryptos such as Bitcoin, Ethereum, and Binance Coin are not defrauds.

They rise and fall dramatically, and I sense money-making opportunities there. “But I wish to know some of the best reasons that affect the Bitcoin prices,” said James Brown. He is a resident of the Greater Toronto Area. He recently bought Bitcoins (BTC).

We get frequent queries from investors like James, who want to invest in Crypto space but do not fully know it. It prompted us to release this blog, which tells you the three most striking reasons that affect the Bitcoin prices in Canada.

(I) Market Announcements and News

The crypto market runs on sentiments. Yes, just like a stock market, which rises and crashes in the wake of good or unwelcome news, a crypto market also reacts to different news pieces.

For instance,

The Rise

Elon Musk, the billionaire founder of Tesla, is on the news for his famous crypto-related tweets. On February 8, 2021, Tesla made an official announcement that:

- It had purchased Bitcoins worth USD 1.5 billion and

- From now on, the company will accept payments from its customers as Bitcoins

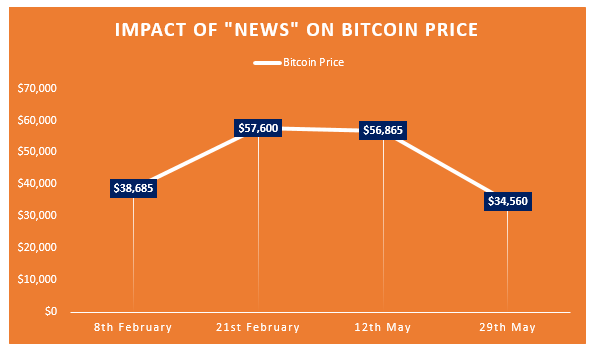

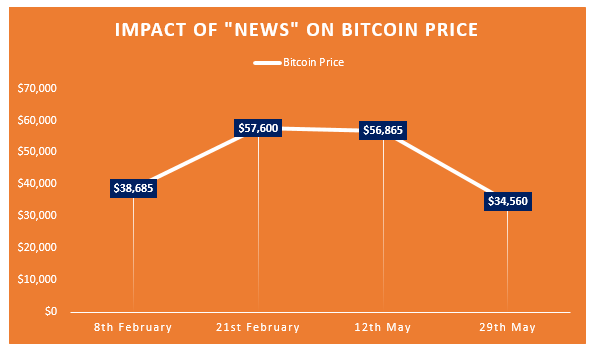

The crypto market reacted to this news, and in a second, the public sentiment towards Bitcoin was highly positive. People started buying Bitcoin, and its price swelled from $38,685 (closing price of February 8, 2021) to $57,600 (closing price of February 21, 2021). It represents an increase of 49% in just 13 days (about 2 weeks).

The Fall

It was in May 2021 that Tesla again made an announcement. This time, the founder announced that Tesla would not accept payments in Bitcoin, as crypto mining consumes a lot of energy.

The crypto market reacted to this news, and the sentiments changed from highly positive to adverse feedback reflected in the prices of Bitcoin, which fell from $56,865 on May 12, 2021, to $34,560 on May 29, 2021. It represents a decrease of 40% in just 17 days (about 2 and a half weeks).

Let us visualize the impact of this “announcement” on the chart below:

Key Takeaway

It shows that the prices of Bitcoin highly depend on the pieces of news and rumors. A positive can push the prices upwards, whereas a negative can make them fall.

(II) The “Halving” – Changes in Bitcoin Protocol

To understand the halving concept, you must know about “bitcoin mining” and “how the miners get rewarded.”

What is Bitcoin Mining and Associated Reward?

In simple terms, Bitcoin mining refers to the process of verification of transactions. The people engaged in Bitcoin Mining are the “miners.” They got a fee in return as Bitcoins.

Further, the miners mine in Blocks and get their fees or reward per block of mined Bitcoin transactions. Mining also allows the new bitcoins to enter the system.

The Halving Concept

The changes in the protocol of Bitcoin also affect its prices. After four years of mining 210,000 Bitcoins, the reward extended to Bitcoin miners got reduced by 50%, about half.

For example, let us assume that a Bitcoin miner gets 1 Bitcoin after mining a block of 5,000 Bitcoin transactions. After halving, this reward got reduced to 0.5 Bitcoins after four years.

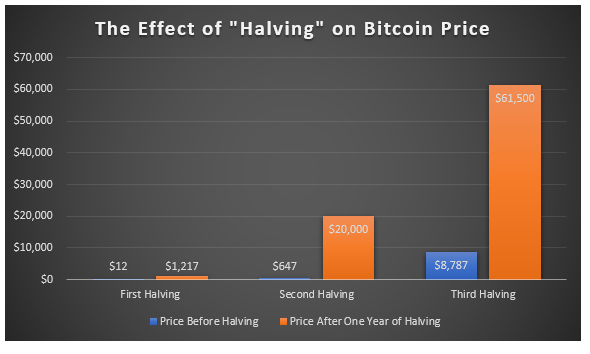

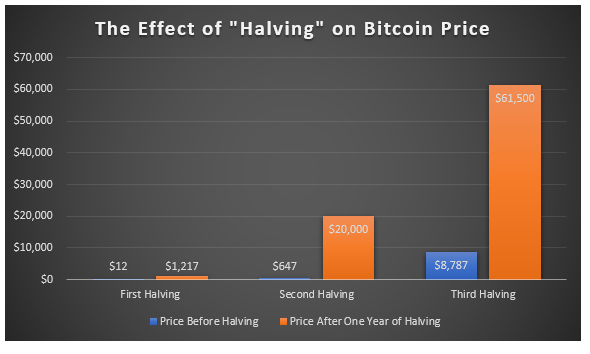

We observed that “Halving” caused a positive impact on the price of Bitcoin by increasing its price. It finds evidence from the stats below:

- The “first halving” occurred on November 28, 2012. The price of one Bitcoin on this date was $12. After one year, the price surged to $1,217 per Bitcoin.

- The “second halving” occurred on July 9, 2016. The price of one Bitcoin on this date was $647. One year, on December 17, 2017, the price surged to $20,000 per Bitcoin.

- The “third halving” occurred on May 11, 2020. The price of one Bitcoin on this date was $8,787. After one year, on April 16, 2021, the price surged to $61,500 per Bitcoin.

Let us visualize the effect of “halving” in the chart below:

(III) The Rising Competition in Crypto Space

It all started with Bitcoin, which is the first and hence the oldest cryptocurrency. Being the first kid on the block, it was popular, and until 2017, over 80% of the crypto transactions were happening in Bitcoin.

It soon changed with the emergence of other cryptocurrencies, especially Ethereum, and the market capitalization of Bitcoin fell from 80% in 2017 to less than 50% by 2022.

This reduced usage directly translates into reduced demand and reduced interest in Bitcoin.

With so many other cryptos almost lining up daily, there is a possibility that the Bitcoin prices will tumble in times to come. However, not all cryptos remain in the market and disappear with time.