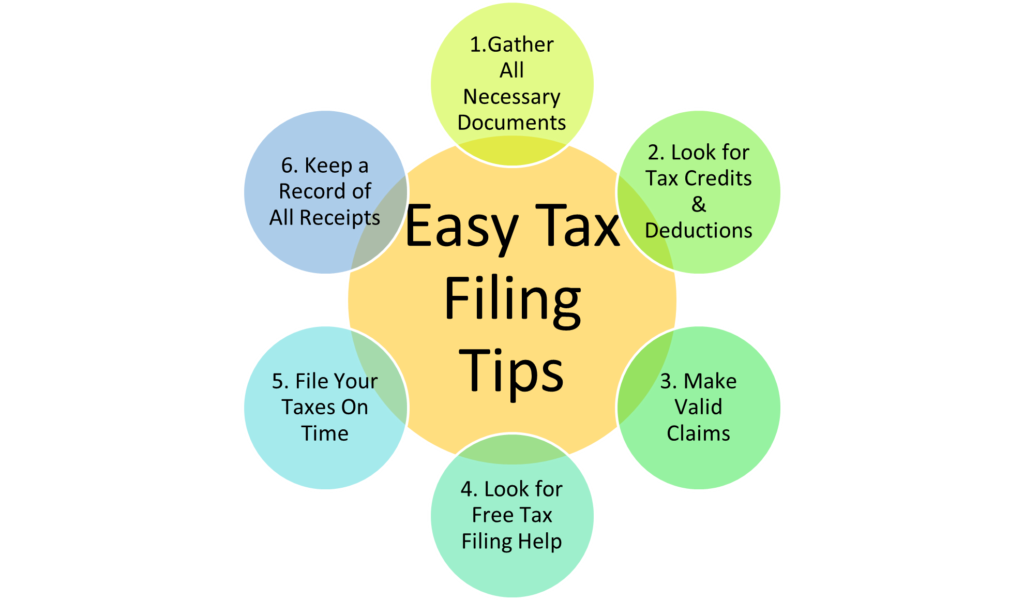

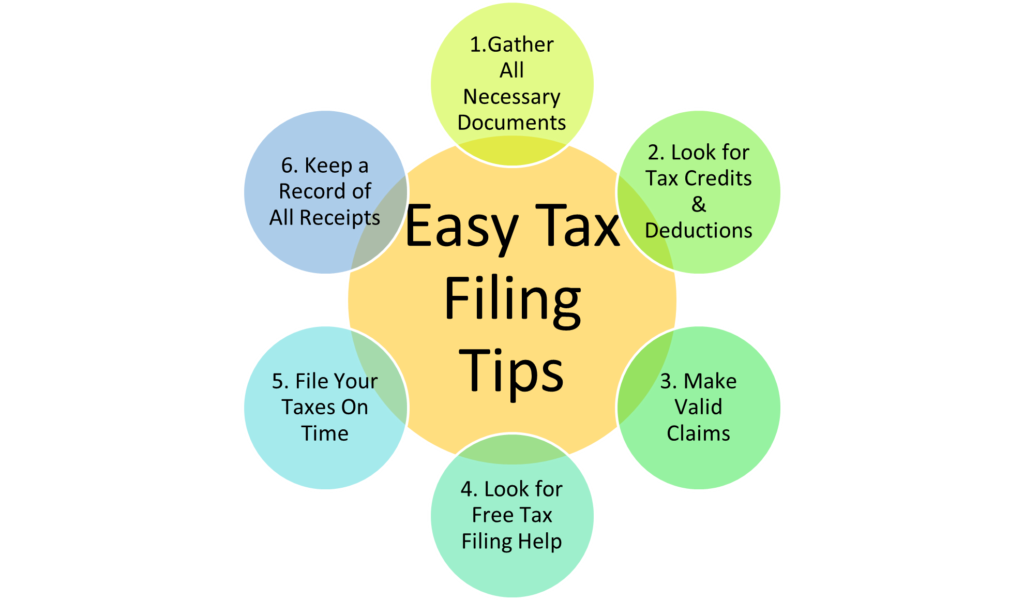

Are you worried about Tax Filing? The Best Four Tips for Making Tax Filing Easy

Image Source: Pixabay

Tax season is a hectic time of the year for many people. You begin to feel dreadful when tax season approaches and begin to drag all of the figures and calculations with it. You are not the only one who feels this way; we all do. That’s right!

Filing your taxes should not turn out to be a headache. And to prevent it from becoming an issue, you must get to work rightaway. The strategy is to take one step at a time and work your way up.

In this blog, we have compiled a list of helpful tips for you. This way, you’ll be able to prevent any unnecessary problems related to filing taxes the following year. Keep reading to know more.

1. Gather all Necessary Documents:

While preparing to file taxes, you need to have certain documents with you. Here is the list of the documents you should have:

- T4 information slip covering income from employment, pension, retirement, annuity, old age security, Canada pension plan, employment insurance, RRSP withdrawal, and other services.

- T5 and other tax slips.

- Receipts, bank statements, and records of expenses to claim credit and deductions such as medical expenses, childcare expenses, moving expenses, etc.

- Social insurance number (SIN) and other personal data.

- Records from an income you get from self-employment.

- Tax package sent by the Canada Revenue Agency (CRA).

2. Look For Tax Credits And Deductions

You need to look for any claims or deductions, which can help you reduce the tax amount. Here are some of the deductions you can file the claim for:

- Childcare and caregiver’s expenses

- Education deductions and credit

- Disability deductions

- Pension and savings plan

- Employment expenses

- Other deductions and credits

3. Make Valid Claims:

You must know what you can claim for and what you cannot. Sometimes people claim for certain expenses such as wedding expenses, a loan taken by a family member, loss on a home sale, etc. If CRA finds that you have made any mistake in filing a claim, they will change the return you will receive.

There are common adjustments that CRA makes, such as:

Change of address, no reply received, missing information, documents in a foreign language, and many more.

So, keep a lookout for all the claims you can file before filing taxes.

4. Look For Any Free Tax Filing Help

If you have a moderate income and are new to tax filing, then the Community Volunteer Income Tax Program (CVITP) can help you a lot. With its help, you can find a tax clinic near you and get your taxes done for free by volunteers.

5. File Your Taxes on Time

If you do not file your taxes on time, the CRA will charge you a penalty. The late-filing penalty is:

- 5% of the balance owing on the due date

- 1% of the balance owing for each full month up to 12 months

So, if you do not pay the amount you owe by the due date, you can also approach the CRA and let them know about your situation. They might be able to help you to adjust through the CRA program debt.

You can also file your taxes online:

As you electronically file your taxes, you can get your refund faster and save a lot of time. You can use the NETFILE or EFILE to file your taxes.

6. Keep a Record of All Receipts:

- After you have filed your taxes, it is a must for you to keep your tax-filing documents for six years.

- It is because when you file your taxes online, the previous tax returns and deductions are reviewed to find out if they are correctly reported.

- The CRA might ask you for the receipts or bank statements for this purpose.

Now that you know how to deal with tax filing, hopefully, you will be able to file your taxes easily. We agree, filing taxes on your own can get a little grueling for you; but with the help of the above-given tips, you will be able to get a step ahead next year.