How does Payment Protection Insurance Help Mental Health in Canada?

In the hustle and bustle of everyday life, our mental health often takes a backseat. Did you know that approximately 500,000 Canadians can’t go to work each week because they’re dealing with mental illness?

But what if I told you that there’s an incredible connection between Payment Protection Insurance (PPI) and your well-being?

In Canada, PPI isn’t just about covering the financial bumps of your life; it’s also a protector of your mental health. Let’s break down how this insurance can be your perfect ally in the battle for your peace of mind.

What’s PPI Insurance?

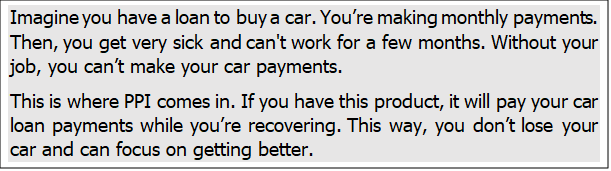

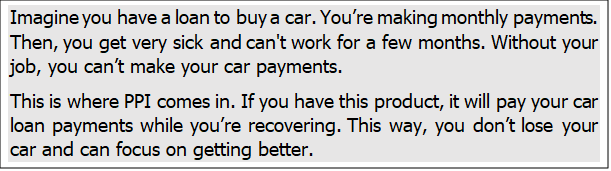

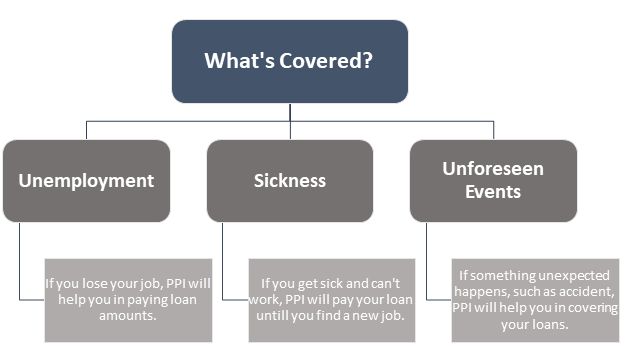

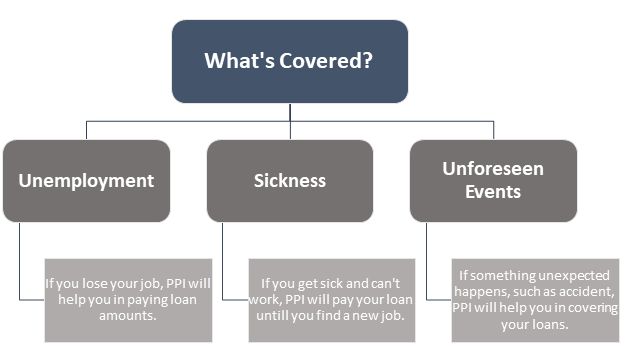

PPI, or Payment Protection Insurance, helps you pay your loans if you can’t work due to sickness, losing your job, or other unexpected events. It’s like a safety net that keeps you from missing payments when things go wrong.

Eligibility Criteria

To get PPI insurance for loan in Canada, you usually need to:

- Have a job or be self-employed.

- Be between 18 and 65 years old.

- Have a loan or credit agreement.

How Financial Stress is Related to Mental Health Status in Canada?

Mental health is a growing concern in Canada and Payment Protection Insurance can play a major role in preventing the issue.

The 2023 Financial Stress Index from the FP Standards Council shows that money has been the top stressor for Canadians for the sixth year in a row. The index reports that 48% of Canadians lose sleep over finances. Additionally, 36% have faced mental health challenges like anxiety and depression because of financial problems.

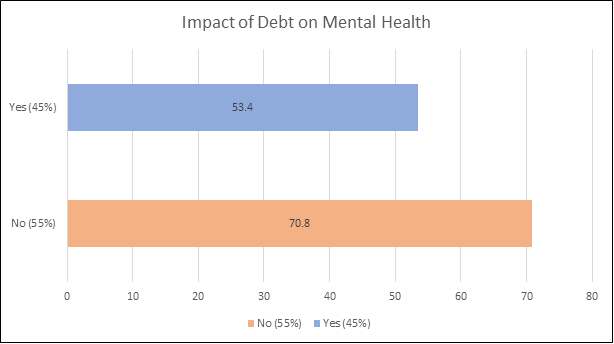

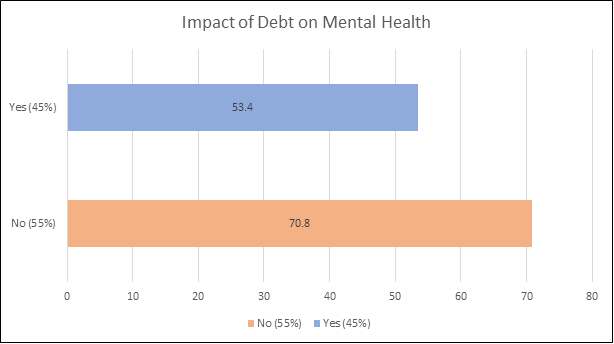

Moreover, a recent survey by Telus Health analyzed the mental health of people who have felt overwhelmed by debt compared to those who haven’t. The results are showcased in the graph below.

Where 0-49 is Distressed; 50-79 is Strained; and 80-100 is Optimal; For more information, please click here!

The survey concluded two important points:

- People Overwhelmed by Debt: 45% of respondents reported feeling overwhelmed by debt at some point. Their average mental health score was 53.4.

- People Not Overwhelmed by Debt: Those who hadn’t experienced this had a much higher average mental health score of 70.8.

The above statistics come as no surprise as they show a clear link between financial stress and mental health issues. That’s why, improving financial stability is key to better mental health in Canada.

How does PPI Insurance Promote Mental Health in Canada?

Now that we have had a glance at mental health status in Canada, let’s understand how Payment Protection Insurance can prove helpful:

- Dodges Your Debt

PPI Insurance is like a superhero when it comes to preventing debt. Imagine you lose your job or get sick unexpectedly. Bills keep piling up, and it feels like drowning in an ocean of debt.

But you have PPI! It acts as a shield to keep debts away while you get back on your feet. It starts covering your loan payments so that you can breathe easier and focus on finding a new job or getting better.

- Money Matters Made Easier

Juggling with bills and daily life expenses can be scary and risky. The thought of choosing between paying bills and putting food on the table may make your head spin.

But with PPI insurance for loan, money problems are easily solved. When tough times hit, the tool steps up to cover your payments. So, you don’t have to stress about stretching your budget or skipping meals.

- Helps You in Regaining Confidence

Losing a job or facing financial difficulties can take a toll on your self-esteem. It’s like someone pulled the rug out from under you, leaving you feeling shaken and insecure. But with Payment Protection Insurance by your side, you’re not just protected from the monetary fallout of unexpected setbacks; you’re also safeguarding your self-esteem.

Knowing that you have a safety net to catch you if you fall can do wonders for your confidence. Instead of wallowing in feelings of failure, you stand tall, knowing that you’re not alone in this fight.

- Access to Support Services

PPI isn’t just about money—it’s about support too!

In Canada, the insurance often comes with access to support services. These aren’t just any services; they’re like an important kit of help and guidance.

Picture financial counseling to help you budget better or job placement assistance to get you back on your feet faster. So, with PPI insurance, you’re not alone in facing life’s challenges. You have a whole team of experts ready to lend a hand in your tough times.

- Promotes Long-Term Planning

It also frees you from the shackles of immediate financial crises. This allows you to start planning for the future you’ve always dreamed of.

Instead of worrying about how to scrape together enough money to cover this month’s bills, you can start thinking about retirement savings or putting money aside for your children’s education.

However, it’s not just about the numbers on a balance sheet. It’s also about the sense of empowerment that comes from taking control of your financial destiny.

The Conclusion Points

In a country where financial stress ranks high, PPI insurance emerges as a beacon of hope. By preventing debt accumulation, easing financial burdens, and fostering confidence, it’s a game-changer.

So, let PPI take the weight off your shoulders so that you can enjoy the sweet sound of financial peace!

People Also Ask

Q. Does Payment Protection Insurance work for everyone?

PPI is helpful for many people, but it’s important to check if it’s the right fit for your situation and needs.

Q. What if I’m already feeling stressed due to my debt?

PPI insurance can still help! It acts as a shield against more debt, giving you breathing room to work on getting back on track.

Q. How do I know if PPI insurance for loan is right for me?

You can talk to a financial advisor or read more about PPI insurance to see if it fits your needs and situation.

Q. Does the insurance cost a lot in Canada?

The cost of PPI insurance varies, but it’s often worth it for the peace of mind and financial security it provides.

Q. Does it cover all types of loans?

PPI can cover various types of loans, including personal loans, mortgages, auto loans, and credit cards. However, coverage may vary depending on the provider and the terms of your policy.

Q. Is PPI insurance the same as mortgage insurance?

No, PPI (Payment Protection Insurance) and mortgage insurance are different. PPI covers your loan or credit payments in case you can’t work due to sickness, injury, or job loss, while mortgage insurance protects the lender in case you fail on your mortgage payments.

Q. Does it cover the entire loan or credit balance?

PPI typically covers your loan or credit payments for a specific period, up to a certain limit. It’s essential to review the terms of your policy to understand the coverage limits and exclusions.

Q. Can I get PPI insurance if I’m self-employed?

Yes, many PPI policies offer coverage for self-employed individuals. You’ll need to meet the eligibility criteria and provide documentation of your income and employment status.