Why Choose Term Life Insurance? Exploring Best Options in Canada!

Ever thought about what will happen to your family if something happens to you? It’s a big worry, but one who plans for the future wins the game.

That’s where term life insurance comes in.

However, according to Goose’s survey, over half of Canadians – 52.8% – don’t have this life insurance. Quite alarming, right? This means that a large portion of Canadians aren’t prepared for unexpected things that may happen in the future. The survey also found that lack of education was one of the primary drivers for the issue.

This urges our need to understand term life insurance deeply. So, in this post, we will not only navigate through its basics but also share some of the best choices you can find in Canada.

What’s Term Life Insurance?

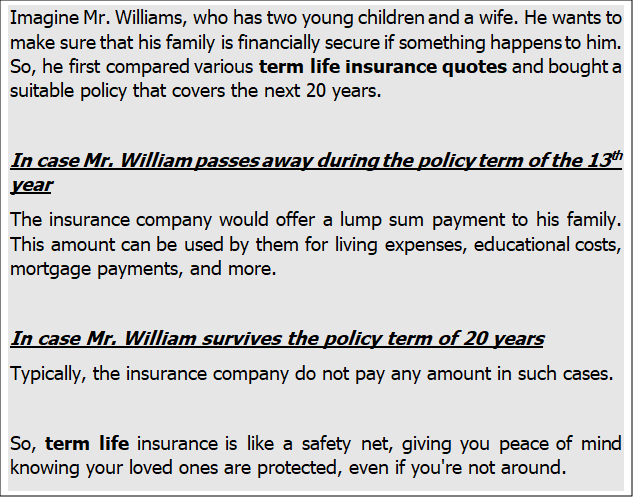

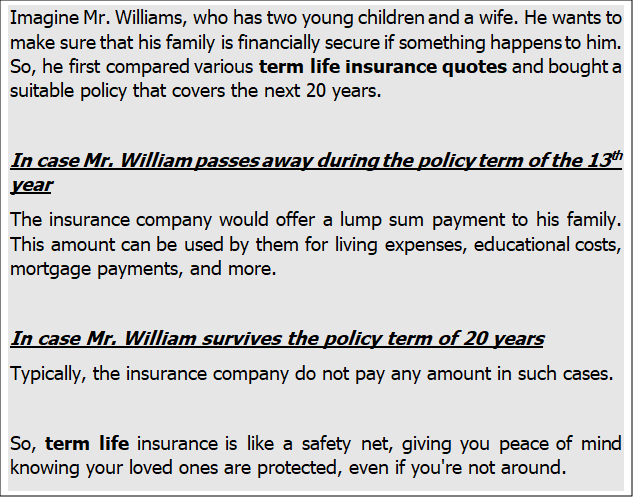

Term life insurance is a type of insurance that provides coverage for a specific period of time, usually ranging from 5 to 40 years in Canada. If the insured person passes away during the term of the policy, their beneficiaries receive a payout, known as the ‘death benefit’. However, the insurance does not offer any ‘maturity benefit’, which is the benefit received after the insured survives the policy term.

It’s also important to note that term life insurance quotes depend on how old you are and how healthy you are. If you are younger and healthier, the quote will usually be lower. If you are older or have health problems, the quote will be higher. Let’s understand its working with an example!

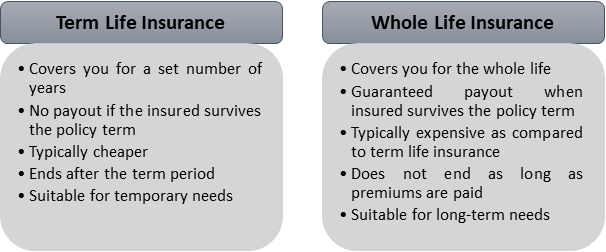

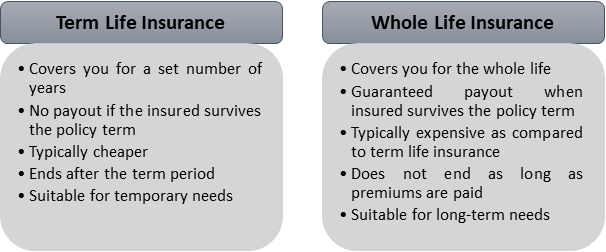

How is Term Life Insurance Different from Whole Life Insurance?

Here are some of the key differences between Term Life Insurance and Whole Life Insurance!

Why Should You Choose Term Life Insurance in Canada?

Though you can easily get term life insurance quotes online, choosing a suitable one can prove a wise decision for you. Here’s it how:

- Offers Financial Security to Dependents

You work hard to make sure there’s food on the table, the bills are paid, and everyone in your family has what they need. But if you pass away during the term of the policy, the insurance provider will pay a lump sum amount to beneficiaries.

Your family can use this money to pay for daily needs like groceries, rent, or mortgage payments. If you have loans, credit card bills, or other debts, the death benefit can help clear these, so your family doesn’t have to worry about them. It can also be used for future expenses like your children’s education or your spouse’s retirement, ensuring they have a secure financial future.

- Provides Higher Flexibility

Imagine you’re planning a road trip. You wouldn’t just hop in the car without thinking about how long you’ll be on the road, right? You’d plan your trip based on your destination and the stops along the way. Term life insurance works similarly, offering you the flexibility to choose the length of your “trip” to match your specific needs.

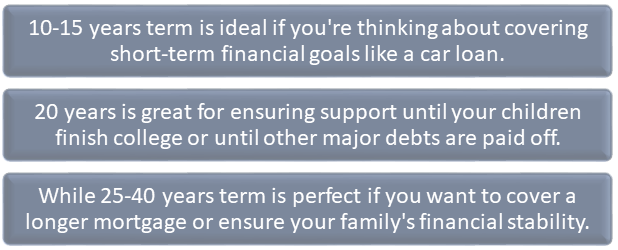

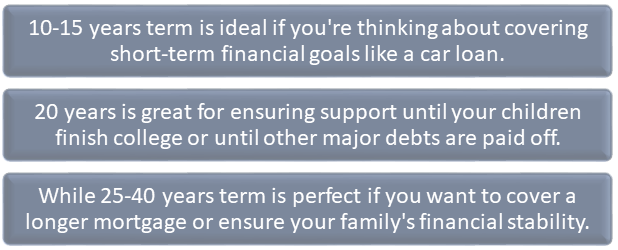

This simply means that while getting term life insurance quotes, you can pick a policy term that’s suitable for you.

As your life evolves, you can reassess and choose different terms for new policies if your needs change.

- Cost-Effective

The beauty of term life insurance lies in the fact that it doesn’t break your bank. If you compare the whole life insurance and term life insurance quotes, you’ll find that the latter one is available at a much lower price.

Now, what does this mean for Canadians? You can protect your family without having to cut back on other important expenses.

- No Investment Worries

You want to protect your loved ones, but you’re not keen on gambling with your money. Some other types of life insurance mix in investments, which can be like playing the stock market.

But not with term life insurance! Here, you pay for pure coverage, not for any investments. So, you don’t have to sweat over what’s happening in the stock market or worry about your investment tanking.

- Renewability and Convertibility

Some of these policies allow you to renew them at the end of the term without undergoing any medical exam. When you renew, you can find your upgraded term life insurance quote online. So, you can keep that safety net around you, even as the years tick by.

And then, there’s this nifty thing called convertibility. Many of these term policies come with this option. That means you can switch it up to a whole life insurance plan. It’s like having a built-in upgrade button for your insurance, ready to adapt as your life changes.

What are the Top Term Life Insurance Options in Canada?

Let’s take a look at the top term life insurance plans:

| Plan Name | Eligibility | Coverage Amount | Policy Term |

| RBC Term Life Insurance | 18 – 70 Years | $50K – $25M | 10 – 40 Years |

| TD Term Life Insurance | 18 – 69 Years (Varies According To Term) + You Must Be Canadian Resident | Up To $10,000,000 | 10/20/100 Years |

| CIBC Term Life Insurance | 18 – 65 Years (Varies According To Term) + You Must Be Canadian Resident | $50,000 To $5,000,000 | 10/20 Years |

| Scotia Term Life Insurance | 18 – 75 (Varies According To Term) | $10,000 Up To $20 Million | 10/15/20/25/30 Years |

| BMO Term Life Insurance | 18 – 65 Years | $100,000 To $30 Million | 10/15/20/25/30 Years |

How to Get the Best Term Life Insurance Quote in Canada?

Getting the best term life insurance quote in Canada is all about protection that fits just right. So, let’s explore how to snag the top deal!

- Identify Your Needs: First off, know what you need. Think about your life, your loved ones, and what you want to safeguard. Are you looking for coverage for a specific period, like until your kids are all grown up? Or maybe you want something more long-term?

- Compare, Don’t Stop: Always shop around like a pro. Don’t settle for the first term life insurance quote. Check out different insurance companies and compare their rates and coverage options.

- Check Your Budget: Once you’ve got a few quotes in hand, it’s time to crunch some numbers. Look closely at the best term life insurance premiums – that’s the money you’ll pay regularly for the coverage. Make sure it fits your budget without leaving you broken.

- Analyze Customer Service: When choosing term life insurance, it’s not all about the money. Customer service matters too! Check out reviews and ask around about how the company handles claims and supports its customers. You want someone who’s got your back when you need it most.

- Provide Accurate Details: And here’s a pro tip! Be honest about your health and lifestyle. The insurance company will want to know, and being upfront can help you get the most accurate quote.

Conclusion

In conclusion, term life insurance is like a shield for your family’s financial future. It ensures that they’re protected no matter what life throws their way.

So, why wait? Take charge of your family’s future today with the best term life insurance in Canada. Remember, “Every step you take today is a brick in the foundation of your future”.

People Also Ask Section

Q. What is a beneficiary in term life insurance?

A beneficiary is a person or entity you name in your policy to receive the death benefit if you die. You can choose anyone, like a spouse, child, or even a charity.

Q. What happens if I stop paying premiums?

If you stop paying, your coverage will lapse, and you won’t be protected.

Q. Why do term life insurance quotes vary between insurers?

Insurers use different underwriting criteria, risk assessments, and pricing models, which can lead to varying quotes.

Q. Is the payout from term life insurance tax-free?

Yes, in Canada, the death benefit is generally paid out tax-free to your beneficiaries.

Q. What information do I need to provide for a term life insurance quote?

You’ll need to provide your age, gender, health status, lifestyle habits, and the desired coverage amount and term length.