Supplemental Health Insurance In The GTA: Bridging the Gaps in Coverage

The Greater Toronto Area (GTA) has a diversified population with many healthcare requirements. Adequate health insurance coverage is critical to ensuring that people and families access the healthcare services they demand. On the other hand, traditional health insurance policies sometimes include limits and gaps in coverage, leaving patients liable to excessive prices and inadequate benefits. Supplemental health insurance can help bridge these gaps by offering additional coverage to address particular needs and improve overall protection.

Understanding the Gaps in Coverage:

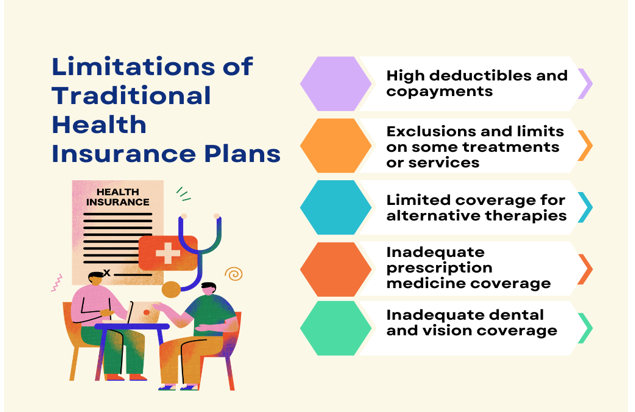

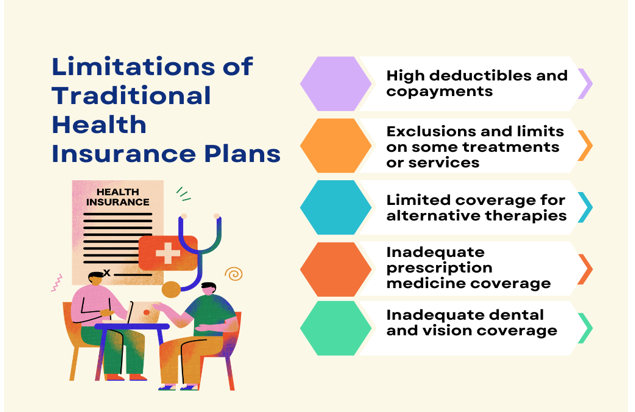

Limitations of Traditional Health Insurance Plans:

High deductibles and copayments:

- Traditional health insurance plans sometimes require patients to pay a substantial amount of their medical bills out of pocket before coverage begins.

- It may be costly, especially for people who require frequent medical attention.

Exclusions and limits on some treatments or services:

- Some treatments, therapies, or services may be excluded from traditional plans.

- Elective cosmetic procedures or experimental therapies, for example, may not be covered, leaving consumers responsible for the entire expense.

Limited coverage for alternative therapies or non-traditional treatments:

- Some people choose alternative or non-traditional therapies such as acupuncture, chiropractic care, or naturopathy.

- Traditional plans, on the other hand, may not provide appropriate coverage, or any, for such procedures.

Inadequate prescription medicine coverage:

- The escalating prices of prescription medications can be a considerable financial burden for people with chronic illnesses.

- Traditional plans may include restrictions on specific pharmaceuticals or omit coverage for costly medications.

Inadequate dental and vision coverage:

Dental and vision care are vital components of general health, but typical plans sometimes give limited coverage for simple check-ups, cleanings, orthodontics, vision examinations, and corrective operations.

Rising Healthcare Costs:

Increasing expenses of medical operations, drugs, and hospital stay: Healthcare costs in the GTA have been rising, making it difficult for persons without enough insurance coverage to pay for critical treatments, surgeries, and prescriptions.

Individual and family financial burden:

High healthcare expenditures can strain people and families, affecting their financial stability, and may even lead to medical debt.

Out-of-pocket charges:

- Even with typical health insurance, people may face out-of-pocket fees like deductibles, copayments, or costs that exceed coverage limitations.

- It might be difficult, especially for people with chronic illnesses or who require specialized care.

The Role of Supplemental Health Insurance:

What exactly is Supplemental Health Insurance?

Supplemental health insurance, often known as an add-on or extra coverage, is a type of insurance that operates in addition to regular health insurance plans. It covers special healthcare requirements that the regular insurance policy may not cover completely.

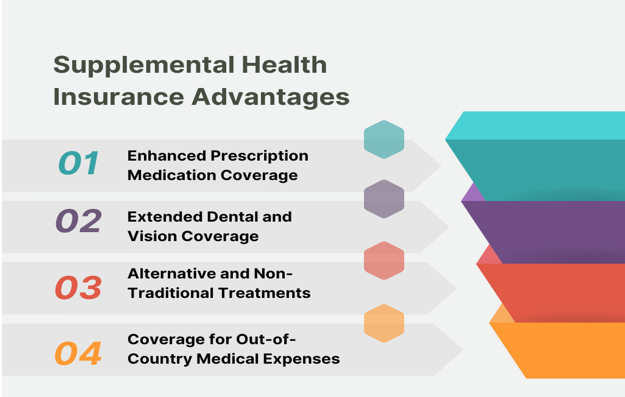

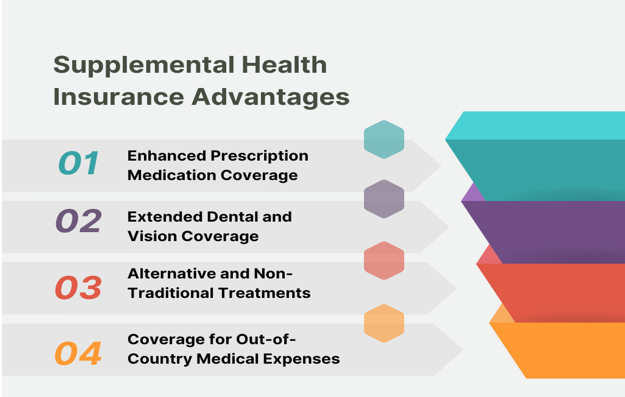

Supplemental Health Insurance Advantages:

Enhanced Prescription Medication Coverage:

- Supplemental plans frequently cover expensive prescriptions, including specialty pharmaceuticals or those not covered by regular policies.

- It allows people with chronic illnesses to obtain vital prescriptions without significant financial costs.

Extended Dental and Vision Coverage:

- Supplemental insurance covers normal dental and vision care, such as check-ups, cleanings, orthodontics, dentures, and major dental treatments.

- It also covers eye tests, glasses, contact lenses, and corrective operations, ensuring that people have access to vital oral and visual health care.

Alternative and Non-Traditional Treatments:

- Because complementary treatments such as acupuncture, chiropractic care, naturopathy, and homeopathy are essential, supplemental plans may include coverage for these.

- It enables patients to investigate alternative treatment choices and receive care tailored to their preferences and requirements.

Coverage for Out-of-Country Medical Expenses:

- Supplemental health insurance frequently covers emergency medical bills, hospitalization, and repatriation when persons travel outside Canada.

- This coverage gives peace of mind to regular travelers or persons with overseas ties by safeguarding them from potential financial problems in the case of a medical emergency abroad.

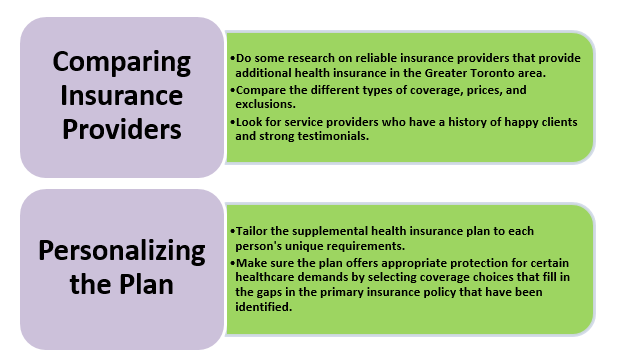

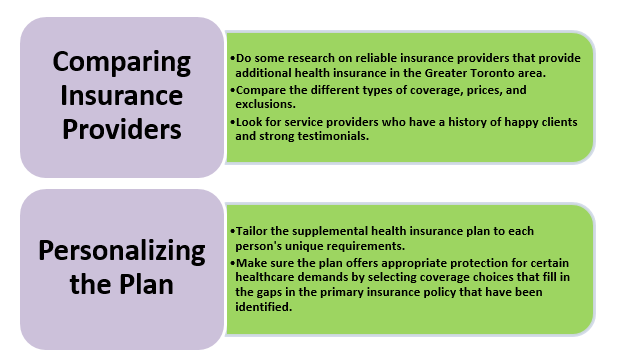

Choosing the Right Supplemental Health Insurance Plan:

Evaluating Individual Needs:

People should evaluate their unique healthcare needs to choose the best supplemental health insurance plan.

Things like current health issues, how often you require medical attention, if you need prescription drugs, whether you need dental or vision care, and whether you might travel abroad in the future.

Conclusion:

Supplemental health insurance plays a crucial role in bridging the gaps in coverage left by traditional health insurance plans in the GTA. With rising healthcare costs and limitations of traditional plans, individuals and families can benefit from enhanced coverage options provided by supplemental insurance. By understanding their healthcare needs, comparing insurance providers, and customizing their plans, individuals can ensure they have the right coverage to protect their health and finances. With supplemental health insurance, residents of the GTA can gain peace of mind, knowing they have comprehensive coverage for prescription medications, dental and vision care, alternative therapies, and out-of-country medical expenses.