Demystifying Credit Scores: How to Improve and Maintain a Healthy Credit Profile

A healthy Credit Profile is the most imperative factor that citizens of Canada must maintain in order to qualify for a better interest rate, mortgage, or any other loan.

Your credit score or credit rating is a three-digit number that is analyzed by the credit bureau when you take a loan from someone. After some time, the bureau receives these details:

- Whether you have paid your debt or not.

- If you have not paid your debt, how much money is still owed by you.

After carefully scrutinizing these details, the credit bureau evaluates your credit score, which ranges from 300 to 900. The lowermost 300 is bad credit, where you cannot opt for any loan as your profile states you are not trustworthy.

However, if your score ranges above 750, it is considered a good score, and you can get a better interest rate on any loan like:

- Home Loans

- Mortgage

- Any other loan.

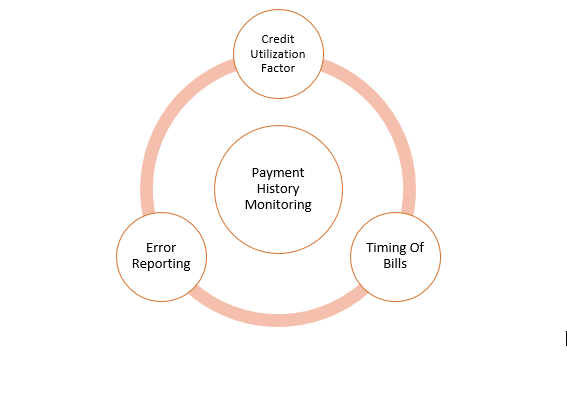

There are several factors to keep in mind to increase your credit score.

Credit Utilization Factor

Credit Utilization is the amount from your credit limit that you use. Depending on the usage, credit utilization can improve or decline your credit score.

Credit Score is inversely proportional to your credit utilization. If your credit utilization is less, your credit score shoots up, while the opposite happens if your credit utilization is more.

A simple example can make you understand much better.

For example, Amanda is a gym trainer that uses 15% of her credit limit, and Harry is a model that uses 25% of his credit limit in a month.

Amanda understands the concept of credit utilization very well, while Harry isn’t familiar with how credit utilization works.

When the credit bureau evaluates the credit report of Amanda and Harry, Amanda will get a much better score than Harry as she utilizes her credit more wisely than Harry.

Using your credit up to 35% at each billing cycle will get you a good credit score.

If you use all your credit each month but still pay all your dues every month, it will also hinder your credit score growth as you will appear riskier to lenders.

Minimizing credit utilization keeps you in a safe spot in increasing your credit score, and you will become more trustworthy towards lenders.

Payment History Monitoring

Your payment history is the first factor considered while evaluating your credit score.

If you have repaid your debts within the time frame, gradually your credit score surges.

If you struggle at repaying your debts within the time frame gradually your credit score diminishes.

You must closely monitor your payment history and try to pay all your debts within the time period of that debt.

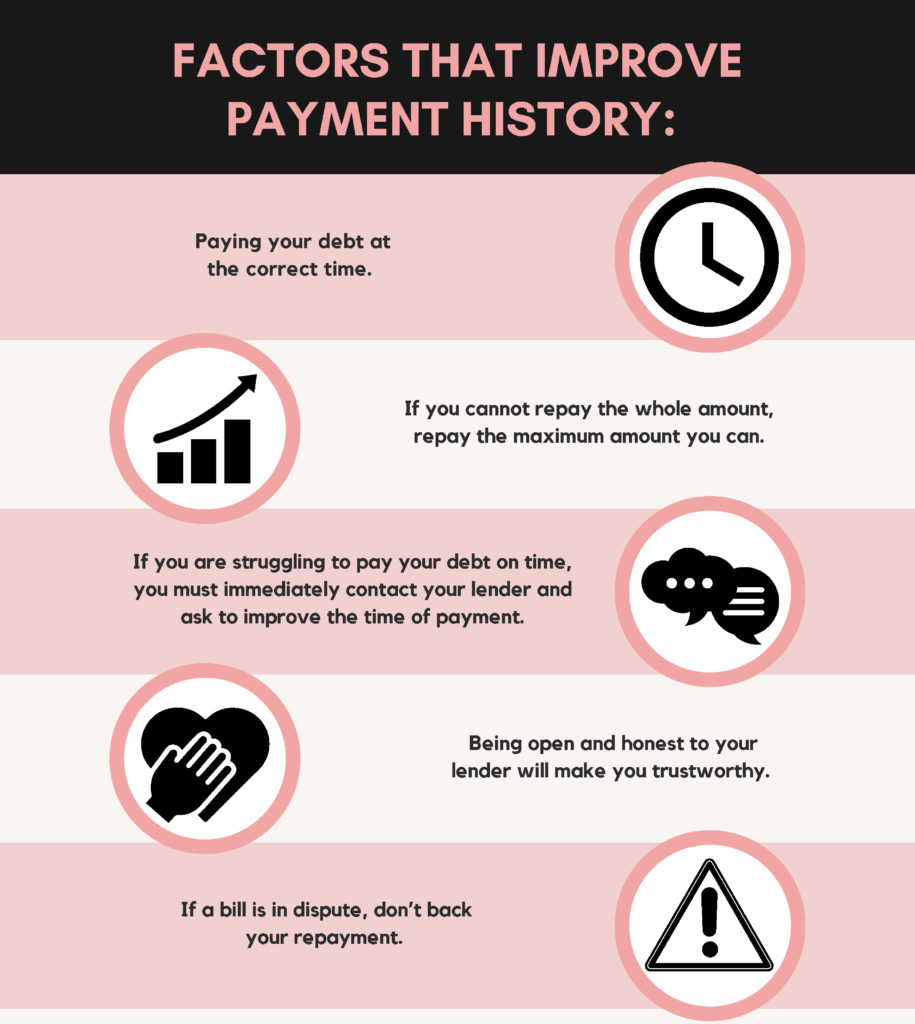

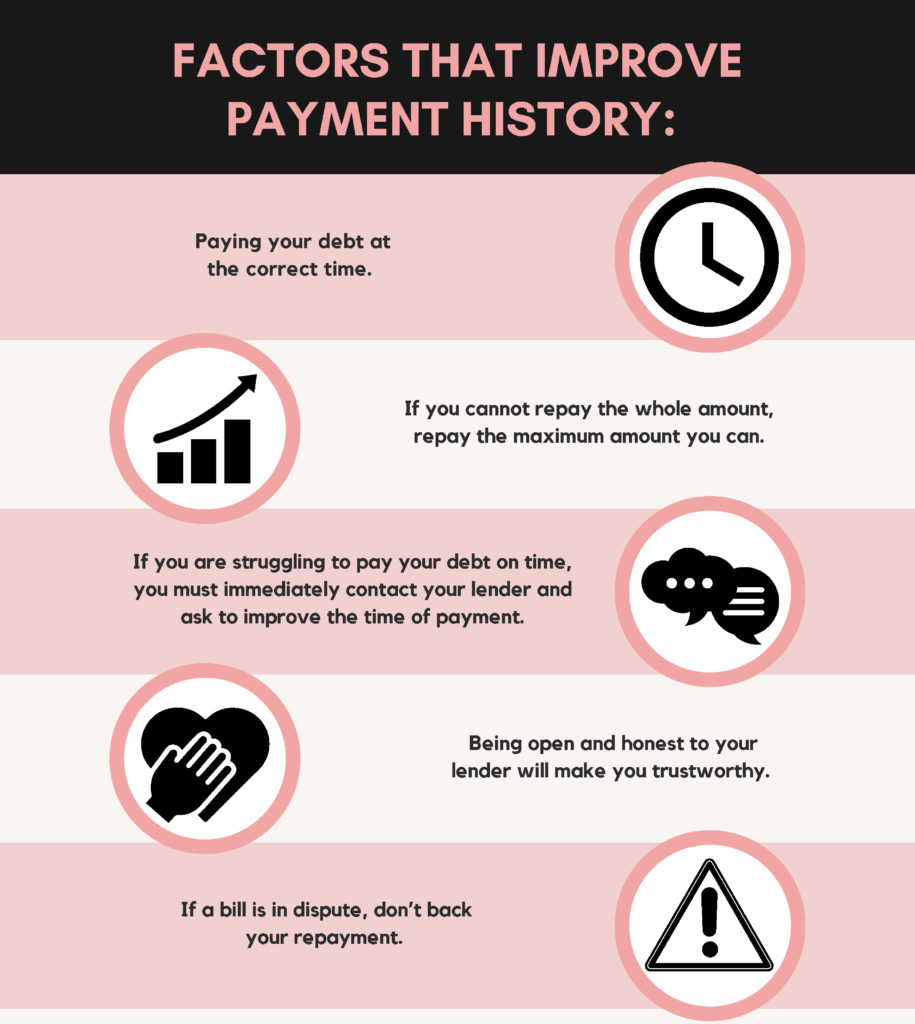

Other factors that improve payment history:

- Paying your debt at the correct time.

- If you cannot repay the whole amount, repay the maximum amount you can.

- If you are struggling to pay your debt on time, you must immediately contact your lender and ask to improve the time of payment. Being open and honest to your lender will make you trustworthy.

- If a bill is in dispute, don’t back your repayment.

Error Reporting

Any error that is prevalent in your report will doom your credit score and inhibit its growth toward a good number.

If there is any discrepancy or error in your credit report, you must contact the authorities and try to clear it as soon as possible.

Your credit score will also decline if you have repaid your loan on time, but your credit report shows the opposite.

You also have to report errors such as:

- Personal Information Error

- Mail Address Error

- If an account is listed that you have not opened.

You must try to avoid these errors at all costs, as these errors remain in your credit report even after many years.

Timing of Bills

Timing your bills is the simplest yet most effective step you can take in increasing your credit score.

Your payment history is checked by any financial institution or lender before they provide you with a loan.

If your payment history is good, you appear more trustworthy than the person whose payment history is flawed.

You can contact your lender and tell them beforehand that you will not be able to pay your debt on time if any mishappening occurs.

You can time your bills by following these simple steps:

- Pay your monthly bills in small amounts.

- A little saving goes a long way, save your money to pay your debt.

- Strategize your budget every month.

- Minimize overspending.

- Whenever you receive money, try to pay your debt.

Conclusion

Credit Score has a great impact on the lives of every Canadian. I have listed some tips and tricks to increase your credit score.