How does Anchor Investors Help Impact Funds Succeed?

How do we imagine investors? – Professional suits, matching boots, and maybe hats or tacos. They can be anyone from wealthy individuals to banks to venture capitalists. All they are vying for is “return on capital invested”. How will they do so? That’s by investing in different projects. One among them is impact projects, where investors do impact investing. Let us study it more and go deep.

Who Are Anchor Investors?

Let us imagine that you have a unique business concept. You are determined to make it a reality and want to start your own business. But the same old problem? – No capital, or in other words, you lack the initial funding.

What will you do? – You will try to raise money by pitching your business to some rich people with money. These are usually institutional investors, banks, venture capitalists, angel investors, and even friends & family members.

Your business was promising, and a few investors saw potential in it. You got the initial funding of $1 million from an institutional investor – ABC Capital Services Inc.

In such a case, ABC Capital Services Inc. is nothing but your anchor investor. Yes, this is the first organization, or we can say, an investor that showed faith in your concept and gave you the initial capital.

So, what can we infer? – Anchor investors are the first ones who give you money. They make you stand and help you in getting your business started. Sometimes, they make huge capital commitments when they see value, potential, and promise in your business.

What Are Impact Funds?

For a comprehensive understanding, we have divided this section into two parts, which are:

- Impact Investing

- Impact Funds

Impact Investing

Let us go back a few decades. In the era of industrialization, financial gain was the only motive driving investors. The higher the probability of earning a handsome return, the higher the number of investors flocking around.

However, times change, and in this space, they certainly changed with the deteriorating environment & the lack of social commitment from corporate giants.

It was in 2007 that the term “impact investing” was coined. It simply represents an investment strategy that is not limited to monetary gains. In addition to money, this strategy requires the deployment in such a way that it creates a positive social impact.

For example, a venture capital firm might prefer impact investing and invest in sustainable energy practices. Let’s say they invested money in the construction of a green building, which will rent out to corporates.

In this way, they will generate rental income, and at the same time, invest in an avenue that will create a positive environmental impact.

Impact Funds

What is your understanding of mutual funds? – They collect money from investors and prefer investing them in a specific area. For example, a blue-chip-focused mutual fund will invest money in the equity capital of blue-chip companies. It will not explore debt or commercial papers.

Similarly, an impact fund collects money from several investors, including anchor investors, and invests it in the avenues that will help achieve social/ environmental benefits.

It can be considered an extension of philanthropy – Not entirely free of profit-motive and not governed by it.

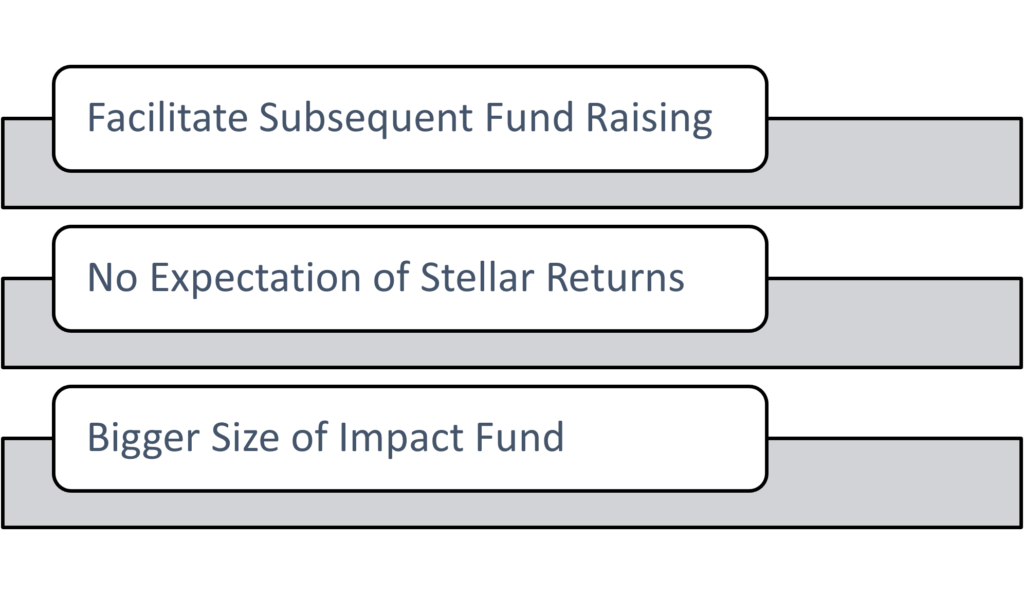

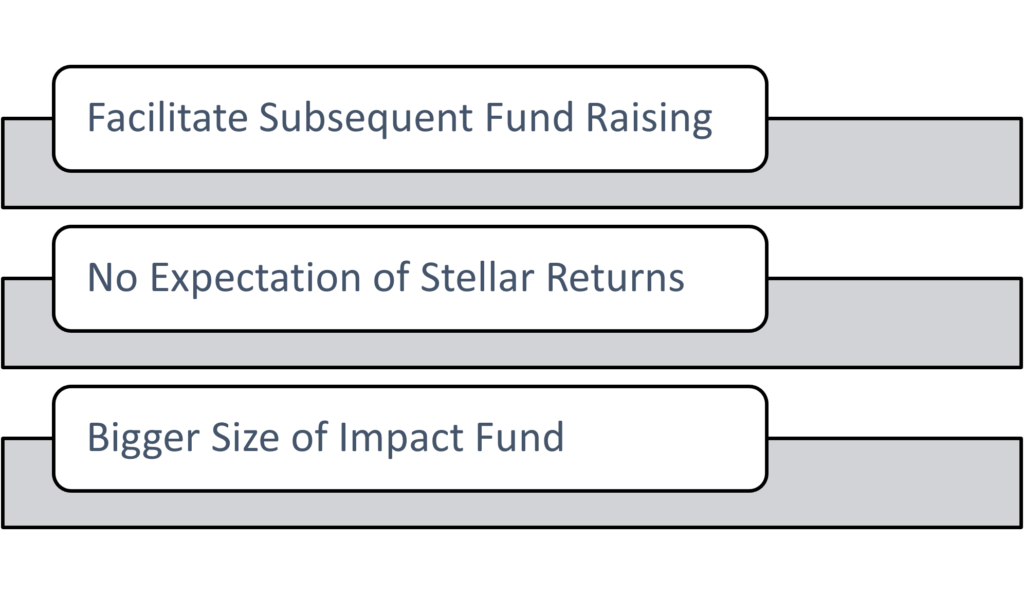

Three Reasons How Anchor Investors Help Impact Funds

It will impact funds, and anchor investors also have a huge role in the success of even the non-impact funds. They are the first investors and bring in the initial capital.

Sticking to the topic, the anchor investors help impact funds succeed in the following ways:

1. They Facilitate Subsequent Fund Raising

What do investors do? – They give money.

Now, what do anchor investors do? – They give money in the very beginning.

What difference can you spot? – The only difference is the timing. If the former invests in the later stages of business, the latter invests at the time of inception.

Is it easier to attract capital after the initial funding round? – Ask any entrepreneur, and the reason would be a big NO.

Then how do companies attract investors after the beginning? – The investors who put money in the later stages get attracted because of the anchor investors. The bigger the names, the higher the interest.

Let us assume that you run an impact fund. You got initial funding from a renowned anchor investor. In the later stages, the investors will turn up to you and invest money in your fund.

Why so? – Because you have got the back of a renowned anchor investor. They will feel confident and safe, almost assured of the safety of the principal and associated return.

2. Anchor Investors Don’t Expect Stellar Returns

Let us assume that you have surplus money and have three different investment options that are equally safe but differ in returns. Where will you invest? – Of course, the options that will fetch you the highest return.

But that is not the case with anchor investors that invest in impact funds. They want a return, but not as high as they might have gotten while investing in non-impact funds.

In 2020, an organization Global Impact Investing Network (GIIN), did a survey and found that about 67% of the anchor investors who invest in impact funds are looking for only market-rate returns. There is no intention to outperform the market.

It shaves much of the performance pressure off the managers of impact funds as the investors are not pushing them to generate high returns. Ultimately, this promotes quality investing and achieves true objectives – social benefits and a positive environmental impact.

3. Bigger Fund Size

As per the findings of a research paper developed by the Harvard Business School,

- the impact funds have anchor investors, are bigger, and have a large capital base. On average, they are USD 9 million larger than the impact funds without any anchor investor.

Your intention might be to earn a market rate of return but to earn it – you still need money to invest. That’s what anchor investors do. They help increase the size of the impact fund.