Skyrocketing Your Mortgage Approval Rate: Five Top Tips for a Smooth Approval Process

As per a recent survey performed by Scotiabank, more than 90% of Canadians aged between 18 and 34 believe that home prices are expected to go up for the next 12 months.

It is a fact that as the prices increase, mortgage affordability comes down, and obtaining a mortgage loan becomes tough. However, you can always use these five best tips to get your mortgage approved.

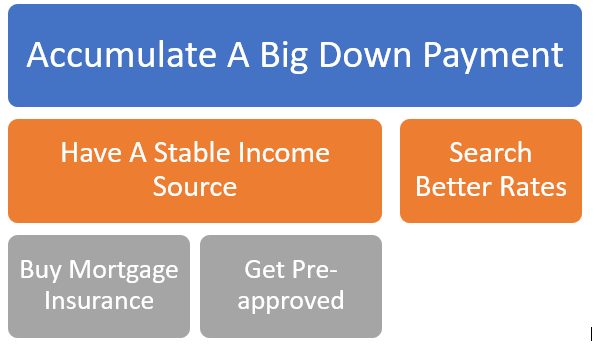

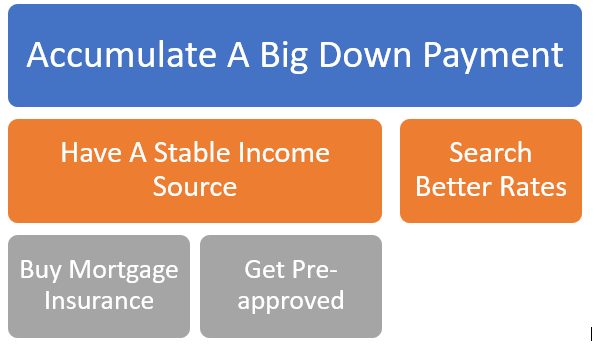

Five Best Tips

1. Accumulate A Big Down Payment

Credits: unsplash.com

You cannot get a mortgage loan for the entire purchase price of your house. Instead, you will be required to pay the minimum down payment. This percentage ranges between 5% to 20% and is based on the purchase price of your house.

Refer to the table and example below to get a clear idea:

| Purchase Price of House | Down Payment |

| Less than $500,000 | 5% |

| $500,000 to $999,999 | 10% |

| More than $1 million | 20% |

Example: You shortlisted a condominium in the Greater Toronto Area for $750,000. You wanted to avail a mortgage loan and were required by your mortgage lender to pay the minimum down payment. It was calculated in the following manner:

Minimum Down Payment:

Furthermore, it must also be understood that the higher you pay the down payment, the lower will be your overall cost of owning the house.

This happens because when you pay a higher down payment upfront, you usually assume a lower mortgage debt. Due to this, your overall interest payment reduces.

2. Have A Stable Source of Income

Credits: unsplash.com

Usually, most Canadians prefer to take mortgage loans for 20 years. What this means is that for the next 20 years or 240 months they will be required to regularly make their mortgage payments.

This is possible only when you have a stable source of income. A full-time job is the easiest as well as the best way to prove that you will not default and have the capacity to regularly meet mortgage payments.

Additionally, you can also prove to your mortgage lender about your other regular sources of income, such as rent, interest, etc. This will further push your case and make your application stronger.

3. Buy Mortgage Insurance

Credits: unsplash.com

If you are making less than 20% of the purchase price in down payment then you will be required to compulsorily purchase the CMHC mortgage insurance. However, in case you pay a higher down payment, you are not under any compulsion.

But to better your case and get your mortgage loan quickly approved, you must prefer to purchase a mortgage insurance policy.

This is because making monthly mortgage payments for longer tenures, say 20 years or maybe 30 years is usually considered to be challenging. With recent cases of Covid-19, the bouts of recession, mortgage defaults have been on the rising trend.

Thus, most mortgage lenders prefer to extend loans to applicants that are willing to purchase a mortgage insurance policy. This not only covers the mortgage lender but also your default risk.

4. Get Pre-approved for a Mortgage

Credits: unsplash.com

Several mortgage lenders, including the five major Canadian banks, pre-approve you for the mortgage loans, based on:

- Your financial situation

- The term of the mortgage loan

- The applicable mortgage rate

- The down payment you prefer to make

- Your credit score and debt-to-income ratio

- Your assets and liabilities, etc.

The pre-approvals are valid for 90 to 120 days. Within this time, you can always search for a house that suits your needs and fits your budget.

5. Search for Better Rates

Credits: unsplash.com

While it entirely depends upon your credit score, sources of income, and past credit history – if you have got all the bases covered, you must search for lenders that are offering cheaper mortgage rates.

When you are able to find lenders offering lower rates, the chances of your mortgage application getting accepted increase manifolds. This is because your monthly mortgage payments will be lower, and you will be able to service the loan easily.

Furthermore, this will also allow you to borrow a higher amount, as your mortgage affordability will increase.

6. Pay Existing Debts

Credits: unsplash.com

You might be having credit card balances, student loans, car loans, personal loans, etc. It is always better to apply for a mortgage loan after paying off all your existing debts. This improves your ability to regularly service the mortgage debt that you are willing to assume.

Further, it is not that your existing debts should be brought down to $0, instead, you should strive to bring them to a level that does not trigger your default chances. Having a lower overall debt also betters your credit score and makes your application look more attractive.