Three Ways How Social Entrepreneurs Can Increase Their Investment Impact In 2023

Are you a social entrepreneur looking for ways to increase the impact of your investment? Check out the three best reasons following which you can effectively do impact investing.

Are You A Social Entrepreneur?

You might be, but you don’t know it. Yes, the term “social entrepreneur” is complicated, and most people don’t even know if they are one. Let us understand this comprehensively.

Before 1760, everything was hand-made. However, what followed was a period of the industrial revolution when human hands were replaced by industrial machines. Indeed, it did wonders for the economy, and there was increased production of goods. The standards of living also increased, and it paved the way for the capitalist economy.

But what suffered was our surroundings, human health, and the overall environment. The factories mercilessly polluted soil, water, and air. The effect of this ignorance can be seen widely in today’s modern world.

Furthermore, this rapid industrialization created a wider gap between the rich and the poor. It increased inflation and severely affected income distribution standards. Consequently, this led to several social issues such as poverty, hunger, food insecurity, lack of education, refugee crisis, etc.

It motivated a handful of individuals and prompted them to start their ventures or start-ups. Through these for-profit endeavors, they vowed to create a positive impact in their community, society, and the world.

These people are known as social entrepreneurs. Their businesses address environmental or social issues and are determined to bring positive change.

Besides this, it also covers all the business owners (who may or may not do social businesses) who prefer to invest or donate money to companies involved in bringing social change.

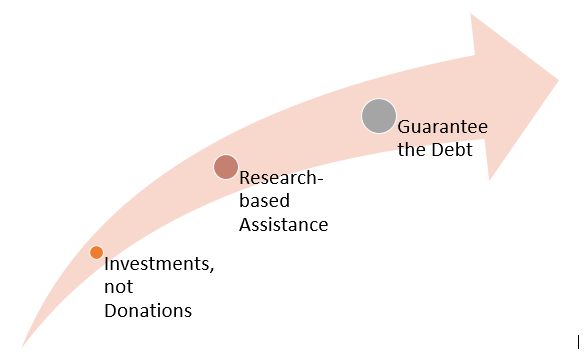

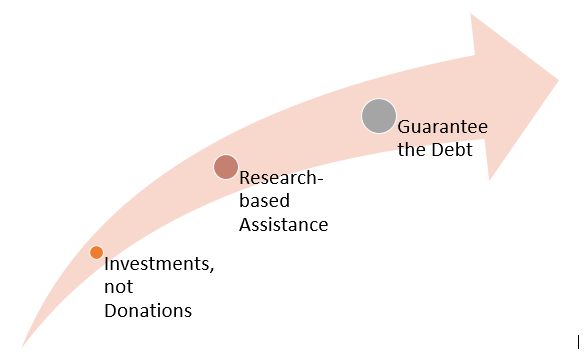

Three Ways for Impact Investing

Social entrepreneurs can practice impact investing by following these methods:

1. Make Investments and Not Donations

Undoubtedly, social entrepreneurs are a modern business class and differ from traditional philanthropies, which preferred to make donations. As per a recent survey, more than 41% of the large foundations give preference to investments over grants.

For example, The Bill and Melinda Gates Foundation makes investments through “program-related investments” in a bid to achieve its social and environmental goals.

A social entrepreneur can always enhance the impact of their investment by investing money in those companies that:

- Look promising and have multiple opportunities in hand

- Can increase their profit margins with minimal cost

- Have experienced management always looking for ways to exploit the profitable social opportunities

By doing so, you will not only satisfy your urge to contribute to society but also earn handsome returns on your investments. It will augment your overall investment impact.

2. Research-based Assistance

Social organizations are usually inadequately funded, and seldom are they able to afford research and development activities.

When it comes to problem-solving that is addressing both social and environmental issues, “innovation” plays an imperative role. A social enterprise that lacks an out-of-the-box approach is often outperformed by its competitors.

Social entrepreneurs can always address this problem and extend capital to social enterprises for conducting this research. It will help them stay ahead of the competition and develop social solutions that are novel.

For example,

- A company named “Roth” uses husk power (energy derived from rice husks and solar power) to cater to the energy needs of urban and rural communities.

- A social entrepreneur can always invest in such innovative companies and help them expand their research.

- It will help Roth become more efficient and improve its business processes, ultimately boosting its profit margins.

- The social investor can partake in the profits and earn a good return on its investments.

3. Guarantee the Debt

Traditional businesses are always in the money. They can use their balance sheet and different business plans to attract a wide variety of investors, such as – banks, private equity firms, venture capitalists, high-net-worth individuals, etc.

But when it comes to social enterprises, there is wider scrutiny, and most investors prefer avoiding such companies. Indeed, it is changing, and the overall outlook toward social enterprises is rapidly improving.

However, as of now, usually, the debt issued by social enterprises does not find many takers unless it is guaranteed by a major conventional business.

If you have faith in the financials, scope, and management of the social enterprise, you can guarantee their debt obligations.