Know Your Net Worth for Better Future: Top Five Reasons Covered

Knowing your net worth isn’t just about seeing how and when your liabilities or debts can affect your financial health or make you feel stressed about your present financial condition.

Rather, calculating your net worth gives you an outline of your finances so you can undertake actions to combat your liabilities strategically at any point in time. If you measure your net worth, you’ll be able to map out the full results of how much you have earned and spent until now.

Getting the final numbers of your net worth can be shocking, and this means that you need to control your expenses and figure out how you can come back on track.

Alternatively, if you’re able to feed your debts, you’re doing well and can continue living the same way.

Calculating your net worth helps you determine where you stand financially and when you should control your expenses.

How are you doing? I mean, financially?

- Know your net worth

- It’s important to calculate your net worth timely, once a month

- It allows you to measure your progress toward your goals

- Knowing your net worth allow you to save and invest more in a right direction

- You can buy your home instead of paying high rent

- You get to see where you are spending your savings

- It allows you to track your cash flow

Understand the difference between your net worth and net income

Net worth and net income are the two important profitability metrics to understand. Net worth is the total amount by which your income exceeds your debts.

In simple terms, it’s what you have stored vs. what you need to pay off. On the other hand, net income is also known as the “take-home” amount you get after all the deductions for taxes, EMIs, and retirement contributions. Your net income should be greater than your expenditures.

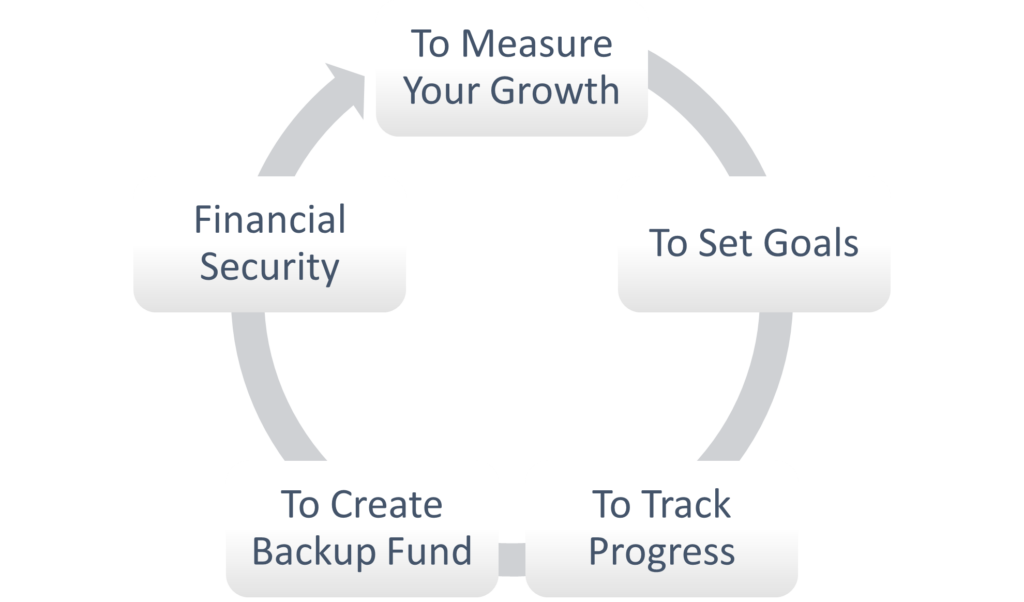

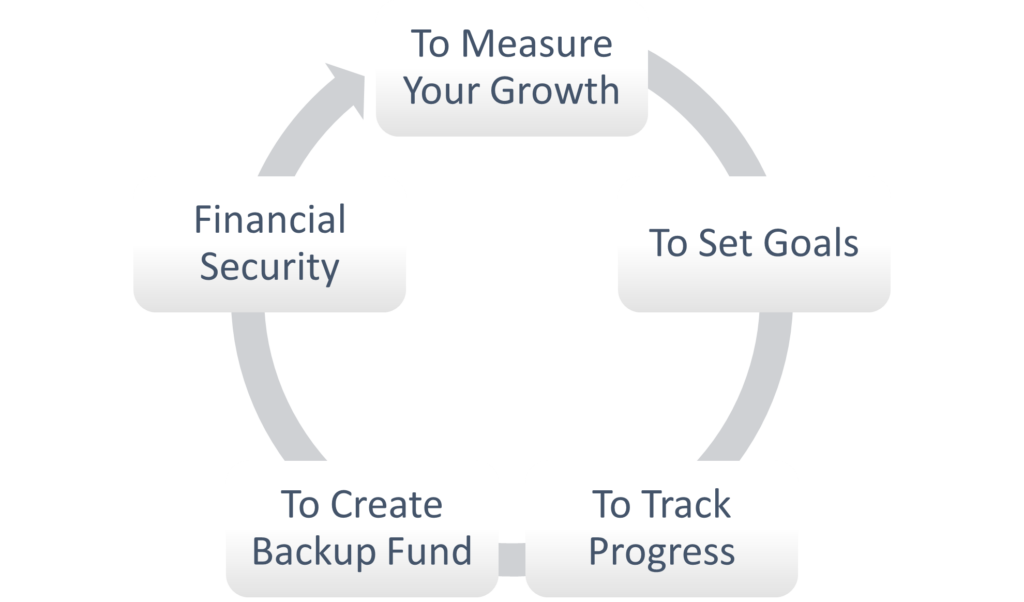

Reasons Why You Need to Know Your Net Worth

1. To Measure Your Growth

Calculating your net worth helps you measure your growth and your household’s successes.

2. To Set Goals

Knowing your net worth helps you to set your long-term and short-term goals. Your net income might be lower when you’re in the infancy of your career or when you start from the bottom at a lower level.

But it must rise later in life from the potential promotions, better salaries, and better jobs. Also, you should plan your budget if you want to live financially free.

3. To Track progress

Calculating your net worth helps you measure your progress and ensure that you’re doing well in managing your money correctly or not.

4. To Create Backup Fund

You should have cash or liquid assets to tackle the unpredictable or unexpected financial downfall that life throws at you. Back-up funds help you recover from hidden expenses or unexpected losses- job loss and business downfall.

5. Financial Security

Having financial security means not getting stressed about unexpected financial losses and living life comfortably with peace of mind. Calculating your net worth is the best solution to tackle financial curve balls strategically in life. It’s a convenient way to determine financial security at any point in your life. There are many apps, such as “personal capital” to help you easily calculate your net worth.

What Canadians Should Do To Increase Their Net Worth?

Canada is a big ocean! Different cities have different costs of living. This makes Canada one of the most expensive places in the world.

One study estimates that 20 to 40 Canadian households would require around $2 million for retirement.

According to this, if you start working at the age of 24 or 25, you’ll be able to save more assets and can nurture your net worth more aggressively.

Ideally, you should have the following net worth at the different walks of life:

| Age | Net Worth |

| 25 | $0 |

| 30 | $70,000 |

| 35 | $165,000 |

| 40 | $300,000 |

| 45 | $465,000 |

| 50 | $700,000 |

| 55 | $1,000,000 |

| 60 | $1,400,000 |

| 65 | $2,000,000 |