How to Build Your Credit Score in Canada?

A credit score is particularly underestimated but it’s the main screw in your financial picture when you’re planning to immigrate to Canada. While you can transfer your assets and other savings to your Canadian bank, your credit score will lapse.

Don’t worry there are different ways to build your credit score as a newcomer in Canada.

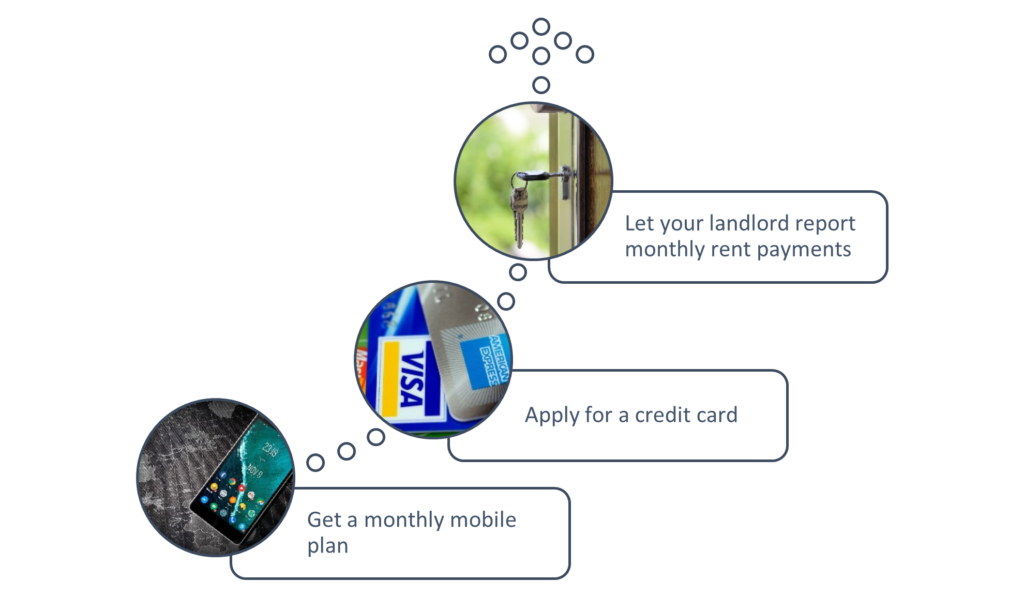

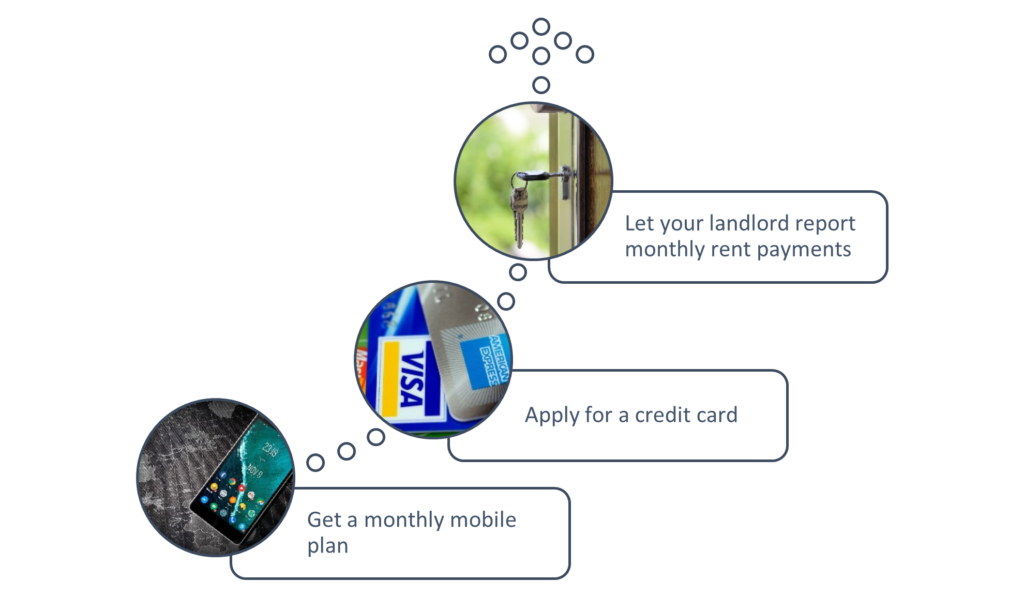

Here we’ve listed sure-shot ways to help you level up your credit score.

- You can get a monthly mobile plan for your budget

- You can apply for a credit card

- You can ask your landlord to report your monthly rent payment

But always remember to pay timely bills of whatever method you choose. Paying bills on time will improve your credit score. As a newcomer to Canada, you might cruise like a lost ship on the sea.

You might have a lot on your plate, such as finding a new job, a new home, or maybe updating your wardrobe, as winters in Canada can be cold. Your credit score can affect the financial square of your life.

For example– you might need a solid credit score if you want to buy a car to commute to or a new home to live in Canada.

What is a credit score?

A credit score is particularly a 3-digit number that depicts your creditworthiness. The higher your credit score, the better your chances of getting a loan or financial support from the banks. Credit scores allow lenders to determine the possibility that you will be able to repay loans timely. A credit score is a balance statement based on your financial statement, such as the total number of active accounts, repayment history, levels of debt, and other factors.

How is credit score calculated in Canada?

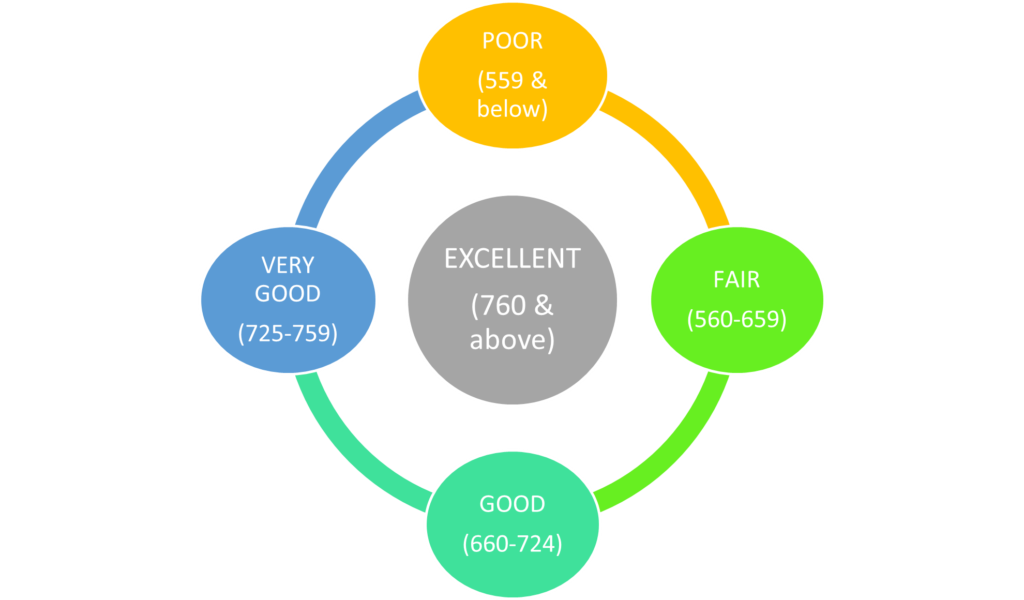

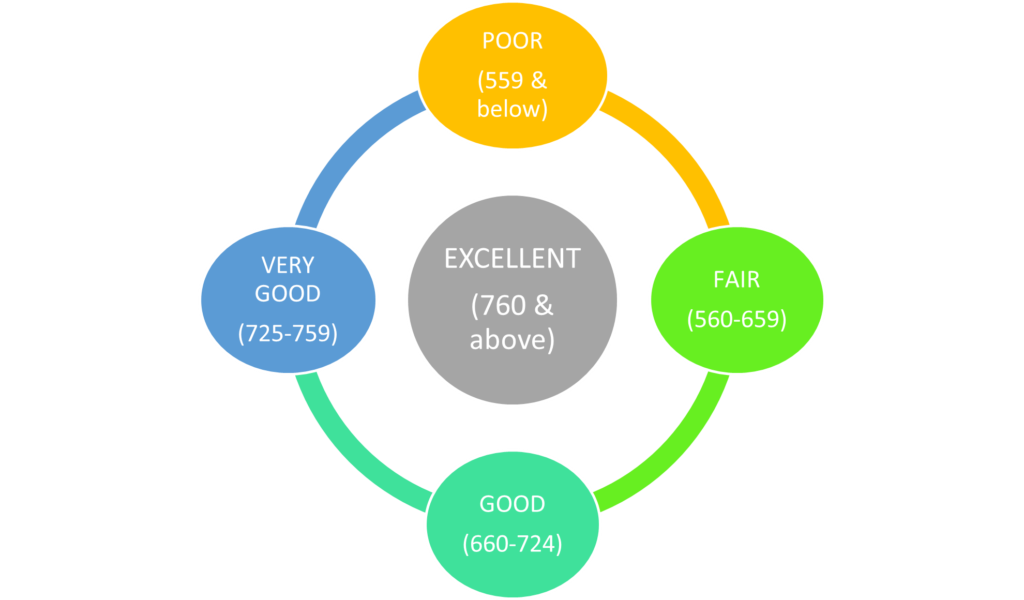

The below image will give an outline of how different credit scores and the category you will get in Canada-

The metrics for counting credit score in Canada is similar to some countries, such as Australia and the United States. Canadian credit score metric is based on your borrowing history and repaying debts.

The numerical ranking for Canadian credit scores ranges from 300 to 900. A higher score means you’re in the green zone and eligible to lend money from the bank.

- Here are other factors that you should consider

- Length of your borrowing history

- Previous history of bankruptcy

- Amount of credit available v/s how much credit you use

- How timely you’re paying your EMIs

Explained- How to build a solid credit score in Canada?

Building a positive credit score in Canada is not a one-night show. It will take time, and of course, timely pay bills to reach there.

1. Try credit building tool

Like you, thousands of immigrants come Canada and start from scratch. Paying bills for credit cards, mortgages, and loans are one legal way, but not everyone gets access to credit cards and loans. To counter this problem, you can try a credit-building tool that will allow you to build up your credit history for just a few dollars per month without taking on any loan or debt.

2. Get a monthly phone plan in your budget

Although phone plans are not counted as credit, many phone providers will give your monthly payment reports to credit bureaus. This will eventually increase your credit score. So, paying phone bills timely in Canada can help you in some way. Some cell companies won’t report your payment history to credit bureaus but can request them to do on your behalf.

3. Request your landlord to report your rent

The chances of a cell plan strategy succeeding are 50 percent. But you can request your landlord to report your payment history to your credit bureaus. But again, it’s essential to pay your rent timely, as missing a rent payment could affect your credit score.