Top Portfolio Rebalancing Methodologies In Canada

Are you willing to maximize your portfolio returns by taking the minimum risk? Are you looking for ways to change the weights assigned to each of your security? The next read is all about efficient portfolio rebalancing methods.

Source: Freepik

Investing needs a consistent effort where you need to keep assessing the worth of your portfolio.

So, let us help you maximize your overall portfolio returns through portfolio rebalancing.

What Do You Mean by The Term Portfolio?

There are still many who do not know about what a “portfolio” is. To simplify, it refers to a collection or a basket of several investment assets or asset classes typically spread across:

- Equity Instruments: Stocks of a company, Equity-based Mutual funds, Index-focused Exchange-Traded Funds, etc.

- Debt Instruments: Debentures, Bonds, Commercial Papers, Mezzanine Debt, etc.

- Liquid Assets: Government Securities, Treasury Bills, Gold, Liquid Mutual Funds, Certificates of Deposit, etc.

Usually, every investor first decides the investment goals and next divides the entire corpus across all the above categories to achieve those goals. Next comes rebalancing an existing portfolio.

What Is Portfolio Rebalancing?

If you are rebalancing your portfolio, you are simply changing the weights assigned to your investments. The overall size of the corpus remains the same. The primary intention of portfolio rebalancing is to re-achieve the optimal asset mix.

Investors usually do this by:

- Divesting (reducing the stake) in the assets that have crossed the threshold or targeted allocation percentage

- Investing (increasing the stake) in a specific asset that fallen short of the threshold, or the targeted allocation percentage

If you want to maximize the returns, keep the risk within your tolerance limit, and reap the benefits of diversification, then you must periodically rebalance your portfolio.

How Does Portfolio Rebalancing Practically Works?

Portfolio rebalancing can be a complicated concept for people who do not belong to a financial background. Hence, we have made things simpler for you by explaining this concept through a practical example:

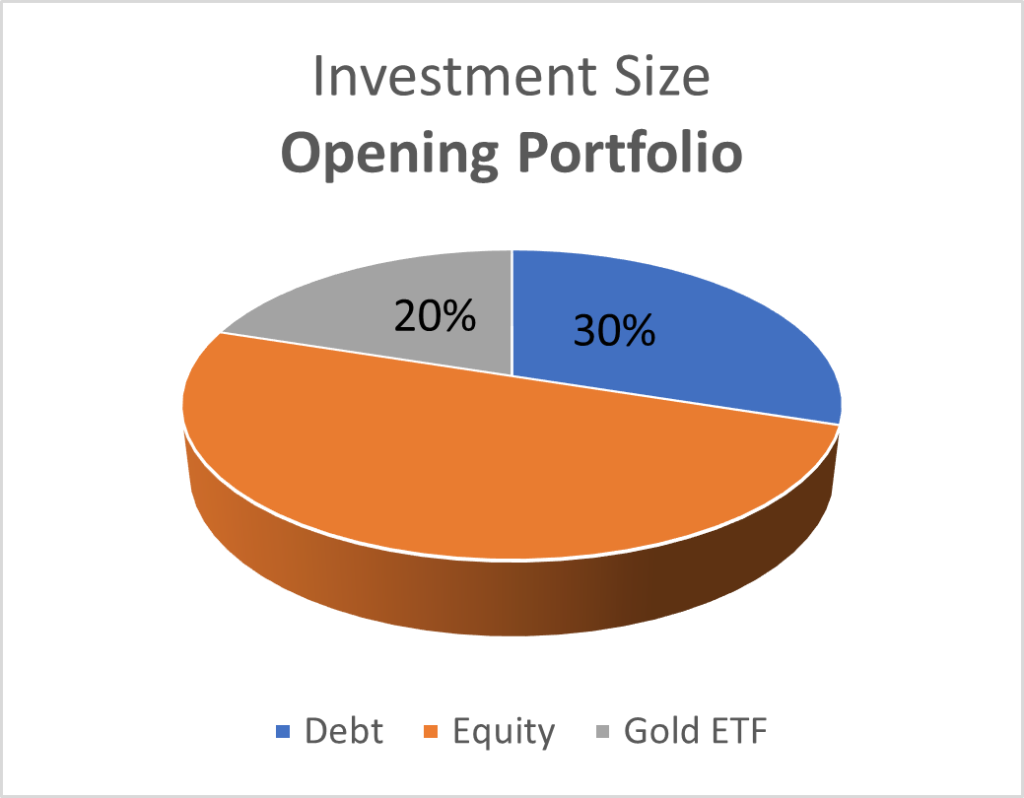

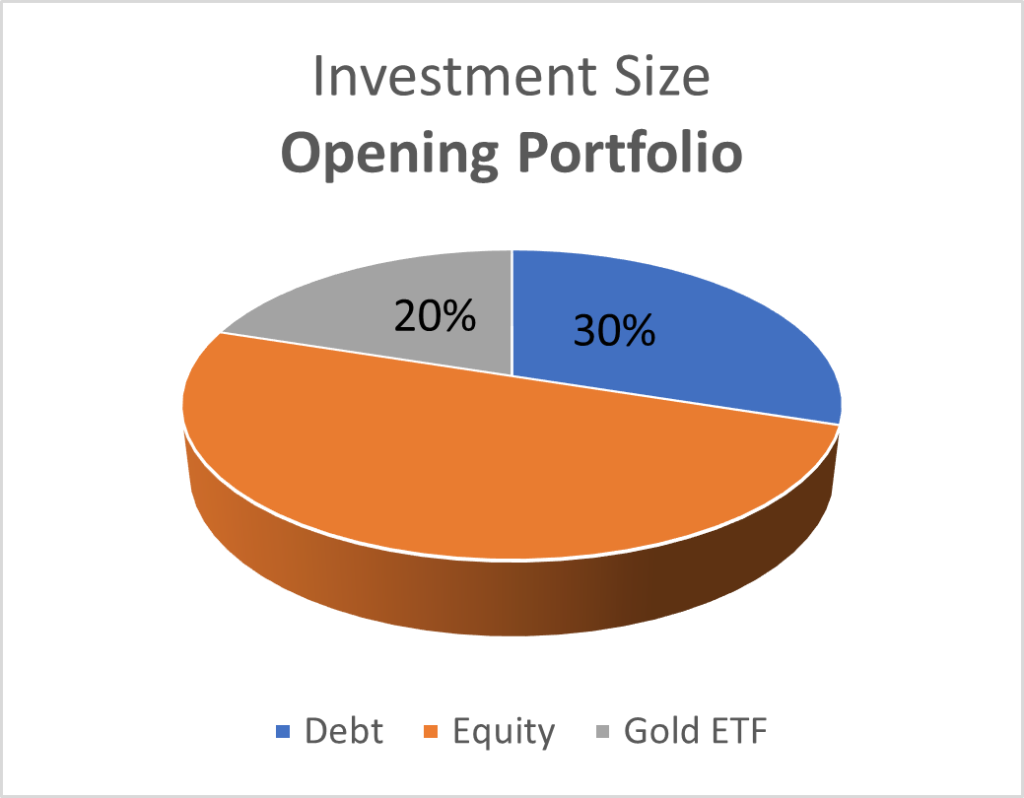

Willy is a young software developer working with a renowned multinational corporation in the Regional Municipality of Durham, the Greater Toronto Area. He has established a portfolio worth $900,000 via his savings and inheritance money. He has invested and spread his corpus in the different asset classes in the following manner.

Opening Balances of Willy’s Portfolio

| Asset Class | Name of the Asset | Percentage of Allocation | Investment Size |

| Asset A – Debt | Debentures of XYZ Manufacturing Corporation Inc. bearing a coupon rate of 5% per annum | 30% | $270,000 |

| Asset B – Equity | Stocks of YPO Financial Inc. | 50% | $450,000 |

| Asset C – Liquid | Gold Exchange Traded Fund (ETF) | 20% | $180,000 |

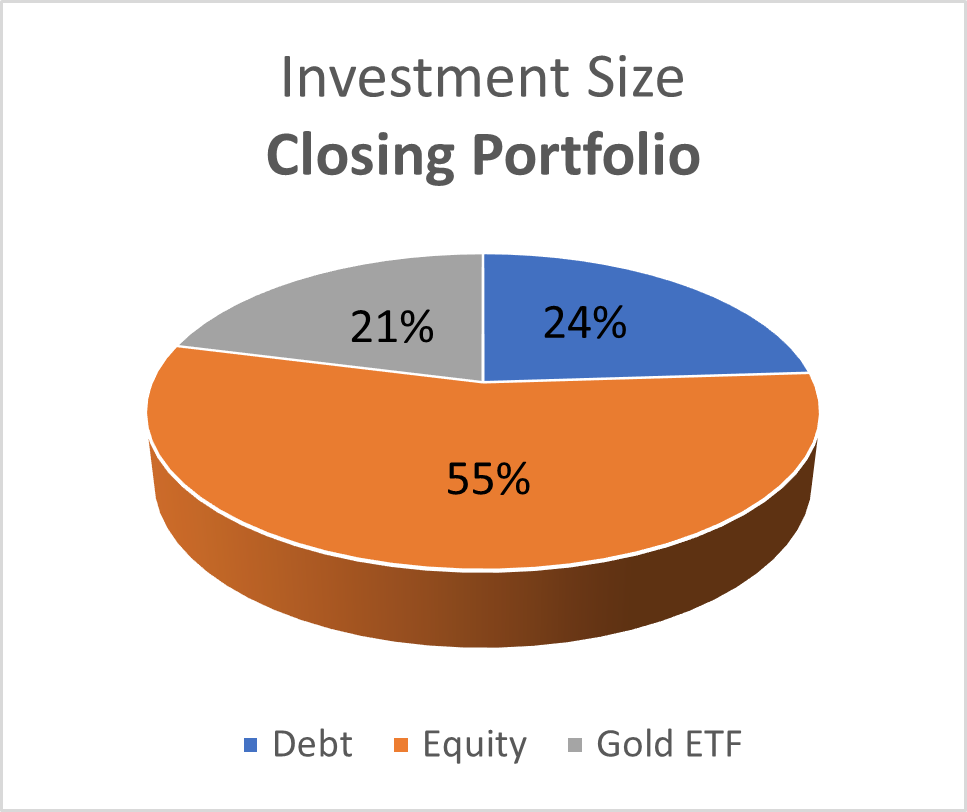

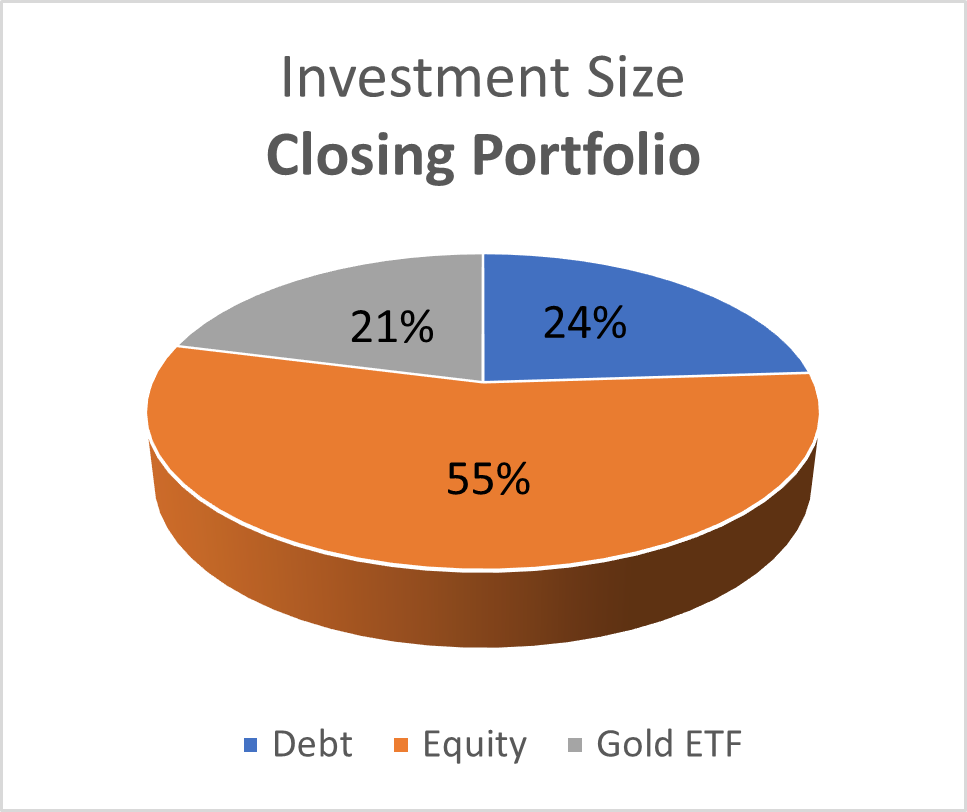

At the end of the year, Willy’s portfolio grew. Look at the following observations:

- YPO Financial Inc. generated stellar profit and beat the market expectations. It led to a substantial increase in the price of its stock.

- William gained thoroughly via this price rise, and his $450,000 investment increased to $522,500

- His investments in the Debentures of XYZ Manufacturing Corporation Inc. took the market-beating and got reduced from $270,000 to $228,000

- The gold prices largely remained stable throughout the year and generated a modest return. His investments in this segment grew from $180,000 to $199,500.

- Overall, his portfolio worth $900,000 grew to $950000, generating a return of 5.55% per annum

Let us now have a look at Willy’s portfolio after considering all the observations mentioned above:

Closing Balances of Willy’s Portfolio

| Asset Class | Name of the Asset | Percentage of Allocation | Investment Size |

| Asset A – Debt | Debentures of XYZ Manufacturing Corporation Inc. bearing a coupon rate of 5% per annum | 24% | $228,000 |

| Asset B – Equity | Stocks of YPO Financial Inc. | 55% | $522,500 |

| Asset C – Liquid | Gold Exchange Traded Fund (ETF) | 21% | $199,500 |

The original and grown portfolio illustrated through Pie Chart:

It is clear from the above data that the Equity segment (stocks of YPO Financial Inc.) has dominated the overall portfolio and has disturbed the original asset mix of 20:30:50.

Willy wants to stick to his original asset mix and has rebalanced his portfolio at the year-end by:

- Divesting from the Equity segment and investing the money into the Debt segment.

- Divesting from the Gold ETFs (liquid) and investing the money into the Debt segment.

What Are the Different Pros and Cons of Portfolio Rebalancing?

Portfolio rebalancing is a popular financial scheme preached by several financial advisors and successful investors. However, it also attracts mixed criticisms. Let us understand the pros and cons of portfolio rebalancing to help you understand its implications for your finances.

Pros

Maintains Your Target Allocation

One of the primary benefits of portfolio rebalancing is that it helps maintain your targeted asset allocation. If you want to invest your money (corpus) in a certain percentage or ratio, it certainly helps achieve it.

Maintains Your Risk Appetite

We can divide investors into different classes based on risk, with Aggressive, Conservative, and Moderate being the primary ones. Portfolio rebalancing helps every investor class by keeping the overall portfolio risk within the risk tolerance threshold.

Cons

Encourages Inferior Investment

Let us assume your equity investments have outperformed your investment returns in the liquid funds. Because of this, the weight of your investment in the equity segment will increase.

You will sell some equity stocks to invest in an underperforming liquid fund to rebalance the portfolio, because you want to stick to your allocation target. You have invested a part of your money into an inferior asset that is not generating optimal returns.

Enjoying Complete Profits

Every investment has its bull phase and a bear phase. There are chances that following the practice of portfolio rebalancing, you will sell an asset even before it has completed its bull phase, undermining your overall portfolio return.

Augments Transaction Costs

Let us assume that the percentage of your target asset allocation is 62:38. Now, just because it has slipped to 60:40, is it wise to rebalance your portfolio and bear the burden of transaction costs?–Well, obviously, No.

Hence, portfolio rebalancing is rudimentary, increases your transaction costs, and forces you to engage in unnecessary divestments and investments