RBC Advantage Chequing Account vs. Alterna Savings Chequing Accounts

If you want to open your first bank account in Canada, you can choose a bank chequing account or a credit union chequing account in the Greater Toronto area.

Let us have a quick look at the various chequing account both financial institutions offer for the first-timer.

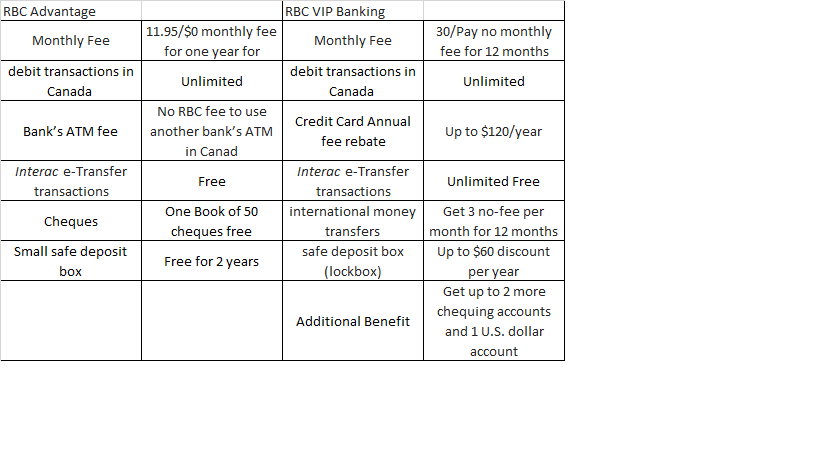

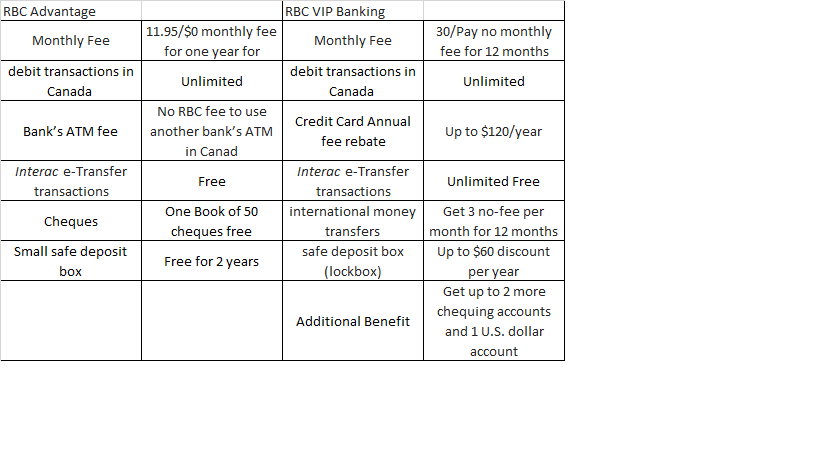

RBC Chequing accounts–most preferred

- RBC Advantage Chequing Account

- RBC VIP Banking

Alterna Savings Chequing Accounts

- Basic Chequing Account

- Value Chequing Account

- Unlimited Chequing Account

- Pay as you go Chequing Account

- Youth start Chequing Account

- Student Life Chequing Account

Let us look at a quick comparison based on the factors that matter to you most at the time of opening a chequing account in Canada.

RBC Chequing account

| Benefits | Basic | Value | Unlimited | Pay as you go | Youth start | Student Life |

| Best For | Medium volume user | Medium volume user | high-volume user | Occasional user/Senior user | Student User | Student User |

| Monthly fee | $4 | $10 | $14 | $0 | $0 | $0 |

| Monthly transactions | 20 | 35 | Unliimited | Pay per use | 30 | Unlimited |

| Senior Discount | 59+ $0 | 59+ $5 | 59+ $7 | NA | NA | NA |

| Monthly fee waived | Min. Balance $1000 |

Alterna Chequing Accounts Additional Benefits

Easy Access

- Cheques

- Bill payments (in-branch, online, mobile, and telephone)

- Debit card payments (point of sale)

- Alterna, ACCULINK®, and THE EXCHANGE® Network ATM withdrawals and transfers

- In-branch withdrawals

Safe & Secure

- Pre-authorized payments

- Interac e-Transfer® (send and receive payments)

- Transfers (in-branch, online, mobile, and telephone)

Overdraft Protection

- Repayment is as easy as depositing to your account

- Low monthly fee of $2.50

- The annual interest rate of 19.99%

- Covers draw on your chequing account (bill payments, cheques, point of sale, pre-authorized debits, etc.)

- Credit limits ranging from $500 to $5,000**

- Application is subject to credit approval

Expertbyarea comments If you want to save fees, Alterna is a logical choice between the two. Alterna offers many additional benefits at no cost or low cost. If you are a bank customer and prefer banking through a top Canadian bank, RBC fits the bill. But if banking is more important than the brand name, you may try Alterna credit union bank accounts if you are in the greater Toronto Area. Note that all costs & benefits listed here may differ when opening the bank account. We strongly recommend speaking to the branch or customer care before deciding.