What Is OAS (Old Age Security) In Canada?

Are you or your parents looking to avail the old-age monetary benefits from the Government of Canada? Do you wish to know the different provisions of the Old Age Security pension? Well, you have landed on the right page. This article will tell you everything that you need to know.

Source: Freepik

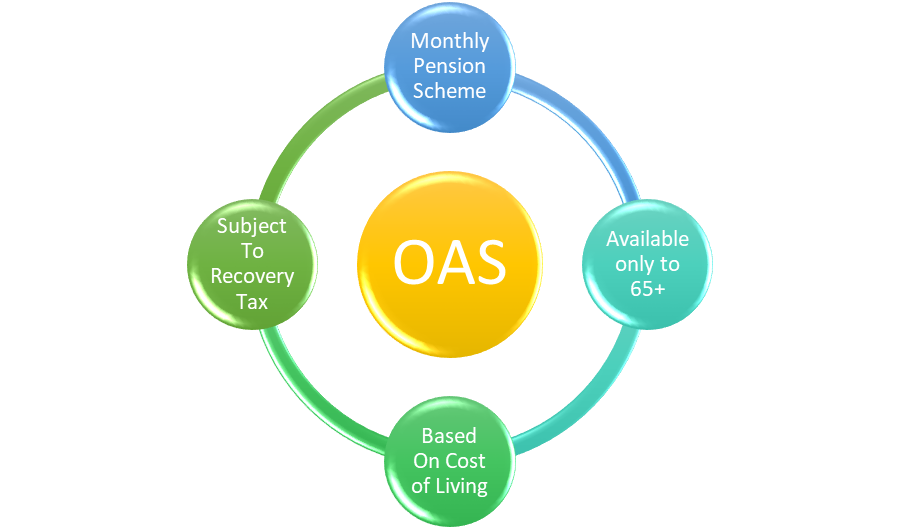

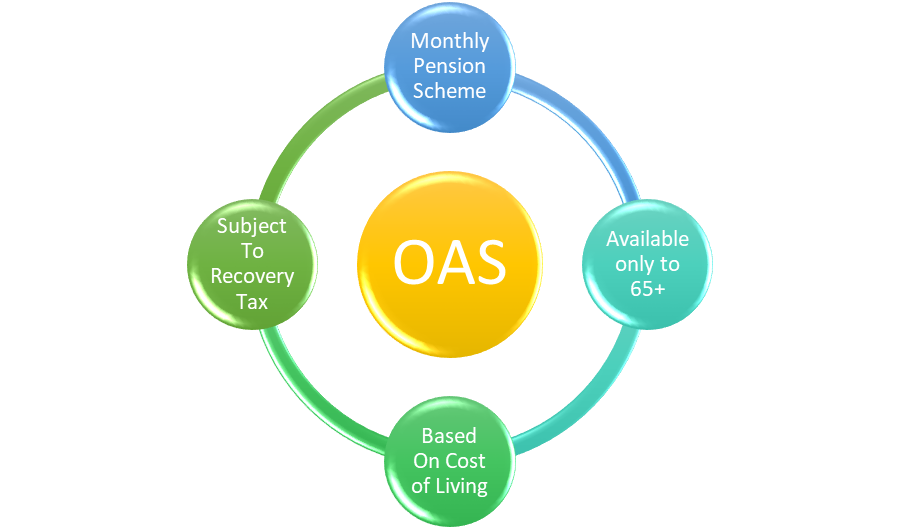

What is OAS?

OAS stands for Old Age Security. It is a pension scheme started by the Government of Canada wherein you get a pre-decided sum of money monthly. The payments under OAS begin from the first month after you attain the age of 65 years. Hence, you must be at least 65 years to receive the benefits under this scheme. Further, you must have lived at least 40 years in Canada after 18.

OAS is a supplementary scheme that supports the living expenses of seniors above 65 years. The general revenue of the Government of Canada funds it.

The offices of Service Canada will automatically enroll you in this scheme by sending you a letter. Sometimes, due to lack of information, you do not get the privilege of automatic enrolment, and you must apply yourself.

How Is OAS Pension Calculated?

The pension granted under OAS is not static and changes following the cost of living, which you can calculate and track by the Consumer Price Index (CPI).

The Government of Canada reviewed the payment rates four times a year in January, April, July, and October. These rates maintain a direct relationship with the cost of living, and your pension under OAS will increase if the cost of living measured by the CPI increases.

However, on the other hand, your pension under OAS will not decrease in case the cost of living measured by the CPI decreases. Thus, OAS also gives you a sense of stability and income protection as you will receive your current benefits in the future.

For example, from April to June 2022, the benefits paid under OAS increased by 1% because of the rising cost of living.

Further, there is a ceiling (frequently reviewed) over the maximum amount the government can pay under this scheme. For the quarter of April to June 2022, you will get the highest monthly OAS pension of $648.67 only if your annual income is less than $133,527.

What is the Taxability Status of OAS Pension?

The pension income received under OAS is taxable. You need to include it in your taxable income. Further, this pension is subject to the recovery of tax (also known as OAS Claw back) in case:

- Your net world income supersedes the limit set for the year. For example, in 2020, the threshold for the net world income is set at $79,054. If you crossed this limit and received the OAS pension, you will be subject to recovery tax.

- You are living in any country which taxes Canadian pensions at a rate of 25% or more.

The amount paid as a recovery tax you can calculate using the following formula:

Recovery Tax=(Your Net World Income-The Limit Set For The Year)*15%

Let us understand this concept with the help of a practical example:

- Amanda Wilson is a 65-year-old eligible OAS pensioner currently living in the Greater Toronto Area

- In the year 2022, she earned a net world income of $98,500

- In the year 2020, the threshold or limit set for recovery tax is $79,054

- Since she has crossed the threshold, then she needs to repay the amount received as an OAS pension

- She visited a taxation expert for this purpose, and he gave her the following presentation:

Statement Showing Calculation of Recovery Tax

| Particulars | Amount |

| Net world income for the year 2020 (A) | $98,500 |

| Threshold for the year 2020 (B) | $79,054 |

| Difference (A – B) ($98,500-$79,054) | $19,446 |

| Recovery Tax (15%*$19,446) | $2,916.9 |

What Are the Compliance Requirements?

To keep receiving the OAS pension from the Canada Revenue Agency, you need to remain compliant with the legal requirements.

Every year in January, you will receive the two forms (mentioned below), which you must fill in within the deadline. Failing to do so might lead to an interruption in the credit of your OAS pension scheme.

We have given a detailed description of these two forms below:

| Name of the Form | Description | Deadline |

| Old Age Security Return of Income (Direct Access Link: https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t1136/t1136-21e.pdf) | • This form comprises different headings, which are: a) Income b) Deductions c) Refund or Balance Owing • It also has an “Interest and Other Investment Income Worksheet” • While filling out this form, you are required to enter all the details indicated on the NR4 OAS Slip • Further, it is mandatory to enter the OAS repayment amount on line 23500 | April 30 |

| NR4 Old Age Security Information Slip (Direct Access Link: https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/nr4oas/nr4oas-21e.pdf ) | It shows the total amount credited to you as OAS pension in the previous year | April 30 |