5 Ways To Protect You From Inflation

Inflation refers to a rise in the general price level of goods and services. It can erode your wealth and can deplete your purchasing power. But do you know there are erudite ways to protect yourself from the adverse inflationary effects? We have tried to cover some of the best measures to help your cause.

Source: Freepik

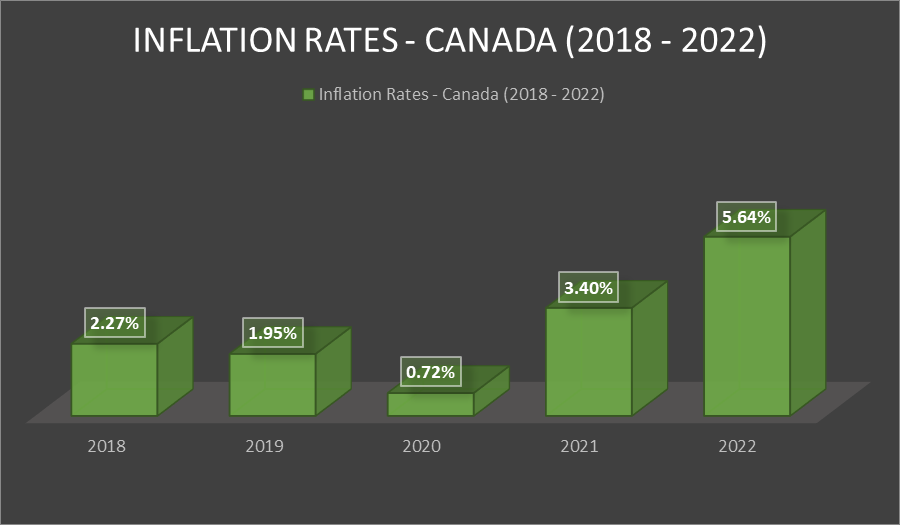

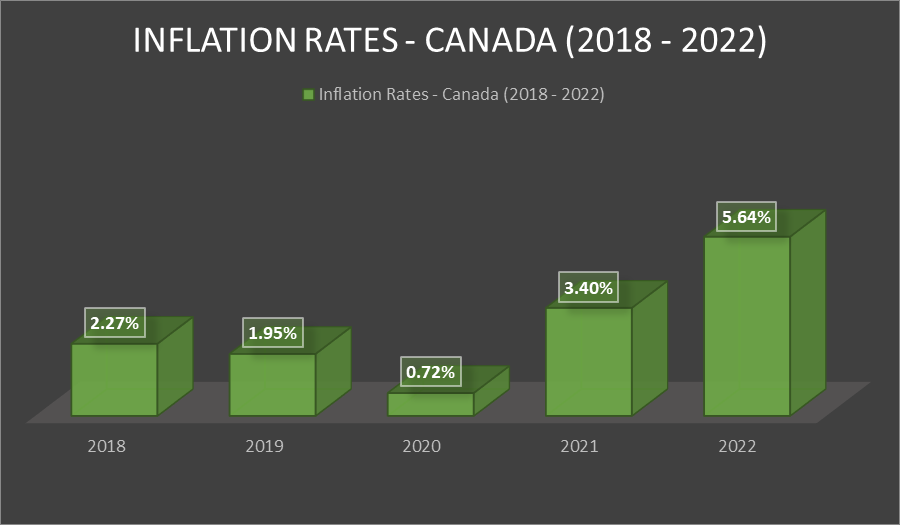

The Rising Inflation in Canada

As per a recent survey, the inflation rate calculated as per CPI (Consumer Price Index) was 6.7% in March 2022. It depicts if an item of consumer goods and services was worth $100 in March 2021, it becomes $106.7 ($100 * 106.7%) in March 2022.

It is worrying as Canada is witnessing its worst inflation rate. The booming housing market, tightening labor market, and even the Russia-Ukraine war have caused the inflation rate to rise beyond the Bank of Canada’s target inflation rate.

The chart below depicts a rising trend in the inflation rate:

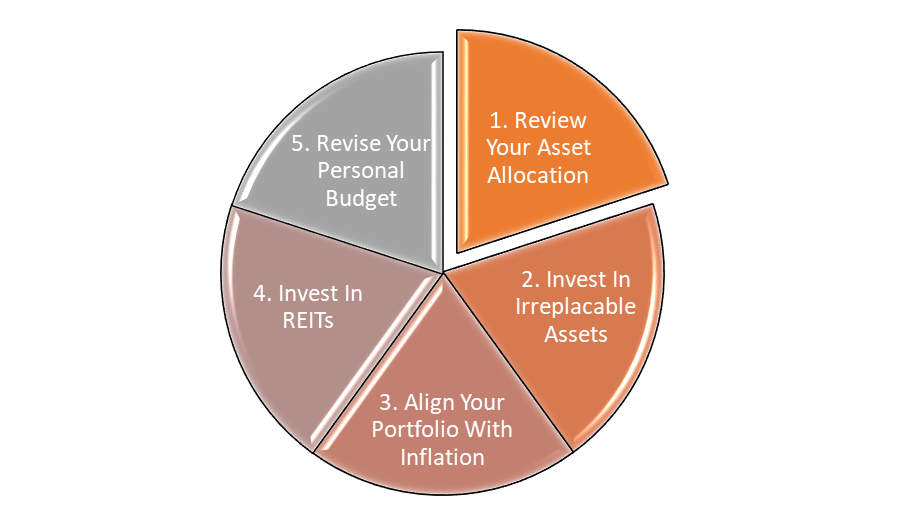

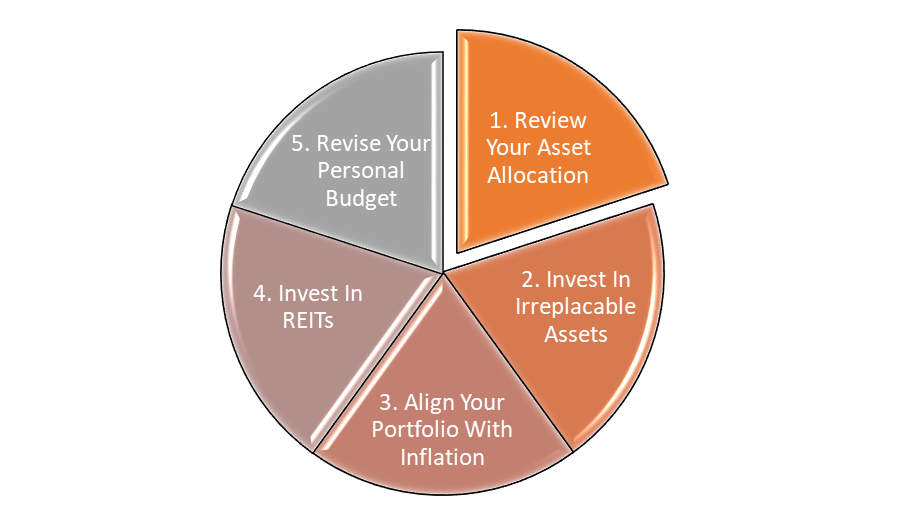

Five Best Ways to Get Protected from Inflation

1. Review Your Asset Allocation

One of the most visible inflation effects is the reduction in actual income and purchasing power. The revenue you generate from your investments is not enough to meet your expenditures. Thus, there is a greater need for you to review your portfolio and revise the asset allocations.

We always considered stocks a better and preferred investment option than bonds in inflationary situations. They can generate returns that can beat the rising inflation rate.

Thus, depending on your risk appetite and investment goals, you can prefer to give a higher allocation to equity and transfer some of your funds to it. You can follow the recommendations below based on your investor class:

| Classes of Investor (Based on Risk Tolerance) | Description | Recommendation (In Inflationary Times) |

| Conservative | • You are risk-averse • You don’t like volatility • You prefer liquid securities | Dividend-paying stocks |

| Moderate | • You prefer some risk • You invest most of your money in risk-less securities • You prefer to allocate some of your funds to volatile bonds and stocks | Growth stocks |

| Aggressive | • You have a good understanding of the stock market • You prefer to invest in highly volatile derivative contracts and other risky assets • You want to achieve maximum returns by taking maximum risk | Speculative stocks |

2. Always Invest in Irreplaceable Assets

During inflationary situations, the irreplaceable assets perform the best and generate super-returns. Land, real estate, and Antique items are some of the classic examples of irreplaceable assets you can own to beat inflation.

Such assets cannot be easily duplicated and are usually inflation-proof. A general rise in prices cannot erode their value. In testing times, the value of these assets increases tremendously, allowing you to pocket stellar returns.

3. Align Your Portfolio with inflation.

You invested in the debentures of a listed entity and are earning an annual 4% coupon rate. However, the inflation rate prevailing in the economy is 5.5%, and your rate of return on investment is in negative territory.

But what if your listed entity compensates you for the rising inflation and gives you an annual coupon rate of 5.5%? Well, this is not a dream.

You can align your portfolio’s assets with the inflation prevailing in the economy by investing in instruments aligned with the inflation. Some instruments:

- Treasury inflation-protected securities

- Floating-rate instruments such as

- Mortgage-backed securities

- Collateralized debt obligations, etc.

- Shorter-term bonds (you can keep a tap on the market and keep re-investing your money at the current interest rates)

The interest rate offered in such inflation-protected instruments is not fixed and keeps changing following the inflation rate (usually calculated per CPI). It causes changes in your interest income and can be a drawback if you prefer consistent returns.

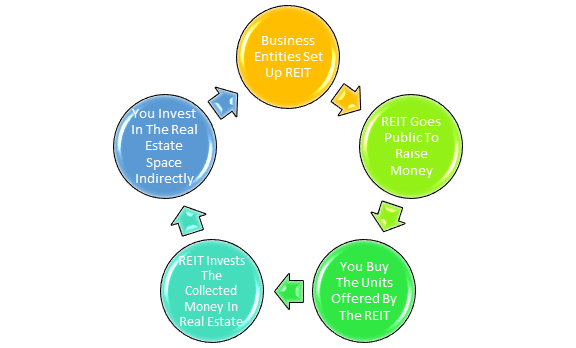

4. Prefer Real Estate Investment Trusts (REITs)

You need to innovate. If you move traditionally, you can never beat inflation. That is the general market mantra.

Inflation is nothing but a sticky rise in the prices of consumer goods and services. But we widely noticed that prices of the properties and the associated rental income also rise in an economy marred with inflation.

However, real estate is expensive, and if you are a mid-income investor, it might as well be out of your reach. Here, you can opt for an alternative real estate investment. You can buy out the units of the Real Estate Investment Trust (REIT) and indirectly invest in the real estate sector.

Let us quickly understand the functioning of REIT through the graphics below:

5. Revise Your Budget

“The prices are not the same. If I could buy ten items with $100 in the previous year, today I can buy only 7 of them with the same money. Inflation is persistently eating my savings and depleting my money’s worth,” said Timothy Wilson, a resident of the Greater Toronto Area.

It is indeed true. If the items are expensive, spend more money to buy the same quantity. Thus, we recommend you revise your budget and look for ways to reduce your overall cash outlay. You can do it in the following manner:

- You can retire your expensive debt by using proceeds from a cheaper source of finance

- Instead of saving and investing money, you can start reducing your debt liabilities

- You must keep looking for market opportunities and try to establish a passive/ supplemental source of income

- You can reduce your leisure expenditures and wait for this inflationary phase to pass

- Do not use any new financing, as lending rates are high during inflation

- You can use public transport more often and search for cheaper alternatives to general daily goods

Wrapping It Up

The central bank of every country tries to tame inflation through monetary policy. Even the Bank of Canada has raised the overnight interest rate by a whopping 50 basis points to control the inflation prevailing in the Canadian economy.

Thus, these testing times shall pass, but it is never a guarantee that they will not return. Hence, start following measures that will protect you from inflation. If there is something that we have missed, let us know.