Swipe Smart: Picking The Perfect Business Credit Card

Of the different types of credit cards available, business credit cards are perhaps the most versatile and useful ones. They can do everything a personal credit card can do but also considerably more. Business credit cards can make purchases on behalf of your company, earn various rewards and cashback, and even help to manage your spending better.

How Is A Business Card Different From A Personal Credit Card?

Personal business cards have their own advantages. However, they are very different from business credit cards. Some of these are listed below:

- Business credit cards are issued to a business, not to the actual cardholder; this means that, instead of spending on personal items, business credit cards are for small purchases that are beneficial for the company. This applies to both online purchases and in stores.

- Keeping a separate credit card for your company helps to build a good credit history for the business- not for you, personally- consequently making it easier to apply for credit applications in the future.

- Business credit cards also help the cardholder to easily separate and manage their personal finances from the company’s.

- Business credit cards don’t offer cashbacks and rewards as extensively as personal credit cards- they do, however, come in handy for small perks for your employees.

- Business credit cards also allow you to set certain restrictions on the usage of the card, like spending limits, location-based constraints, etc.

It is also easier to keep track of your business’ finances with the credit card’s extensive reports.

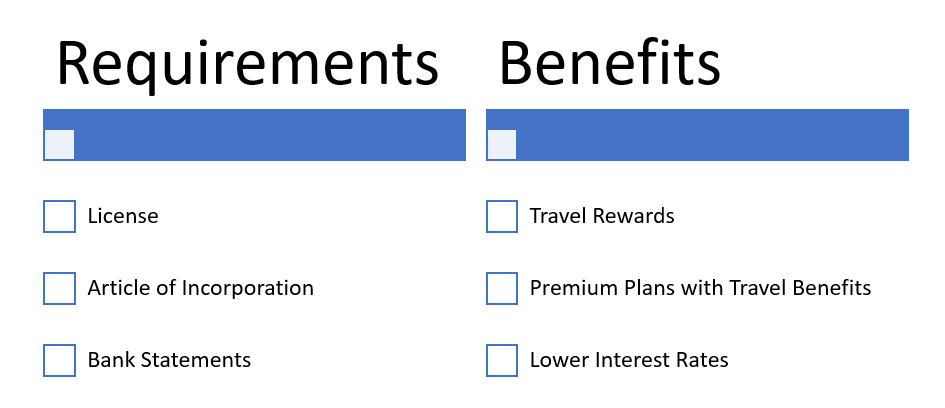

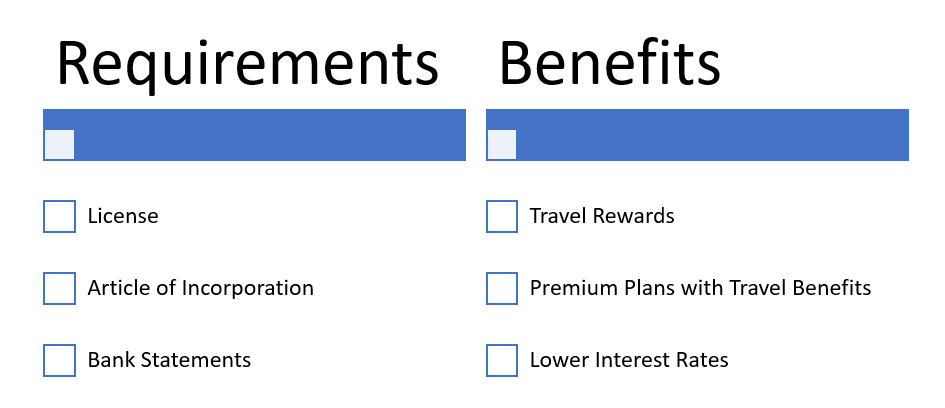

What Kind Of Rewards Can I Get From A Business Credit Card?

Rewards from a business credit card are not as extensive as those offered by a personal credit card. However, they do still come with many offers for the cardholder, such as the following:

- RBC, CIBC, and BMO all have business credit cards that provide popular travel rewards.

- BMO also has a premium plan that offers travel insurance coverage, Air Miles, and free access to airport lounges.

- Other business cards give cashback points on some purchase categories, lower interest rates, or little to no annual fees.

How Do I Get One?

A small home business, a sole proprietorship, or a large corporation- most businesses can apply for a credit card, as long as you can provide the following necessary documents, among others:

- A license

- Article of incorporation

- Bank statements

- Assessment notices

If you can present these documents, it is easy enough to apply for a obtain a business credit card.

Can I Keep My Personal And Business Credit Cards The Same?

A simple requirement of applying for a business credit card is that your company should meet the desired criteria; this is similar to the conditions one must meet while applying for a personal credit card. One of these criteria is that the business should have achieved a minimum income level for a certain period of years. The company should also be able to provide evidence of strong security funds.

This means that, in some cases, if your business doesn’t qualify for a credit card, you can still be issued one on your own merits. Thus, while the credit card can be used for business finances, it will now affect your personal credit as well; the biggest downside to this is that you will be responsible for making payments if the business is unable to do the same.

Although some small home business owners and young entrepreneurs might consider it redundant, it is actually recommended to own a separate credit card for your business, as it helps you keep better track of your investment into the business and the amount profited from it, without mixing it up with your personal finances.

What Are The Best Business Cards In Canada?

With personal finances, it is always considered best to avail different banks, each with a different set of advantages; the same holds for your business finances as well. Study the various benefits that each bank offers as well as the drawbacks that might come up while using their credits cards, before making a final choice.

Some of the best providers of business credit cards are listed below.

- American Express: As the foremost provider of corporate spending cards, they also have a variety of business credit cards for all sorts and sizes of corporations.

- RBC: They offer a business credit card with no annual fee and another option with strong travel insurance.

- CIBC: These offer very low-interest rates, travel rewards, and travel insurance.

- BMO: They have a large range of different business credit cards to choose from. Each offers a different type of reward, from cashbacks to Air Miles.

Before applying for a business credit card, be sure to conduct some research on various providers and the options they offer, and choose the credit card plan that is best suited to your business.