401(k) vs RRSP: Know Your Retirement Plans

When you enter the workforce, planning and knowing your options for the future are necessary. One of the most important things you should consider is a retirement plan. In the US, this is called a 401(k), while in Canada, it is called an RRSP.

These plans have similar purposes. They exist to provide a retirement fund for employees and exist in many forms, giving maximum power to the employee in choosing how to best make use of this account. However, they also have many differences.

Let us look at some of the features these two plans share and some that are different.

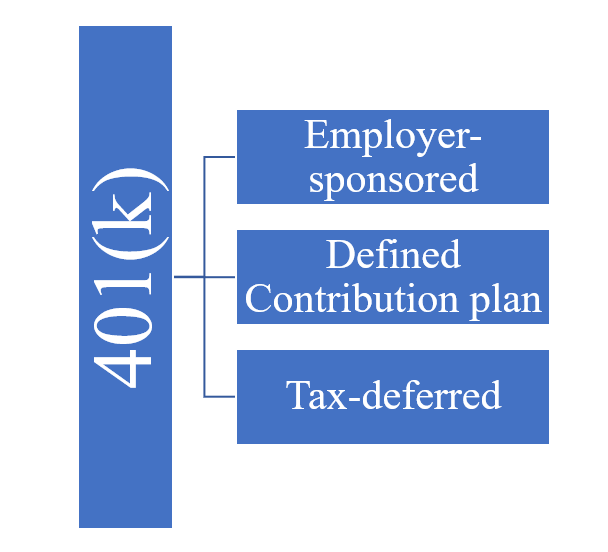

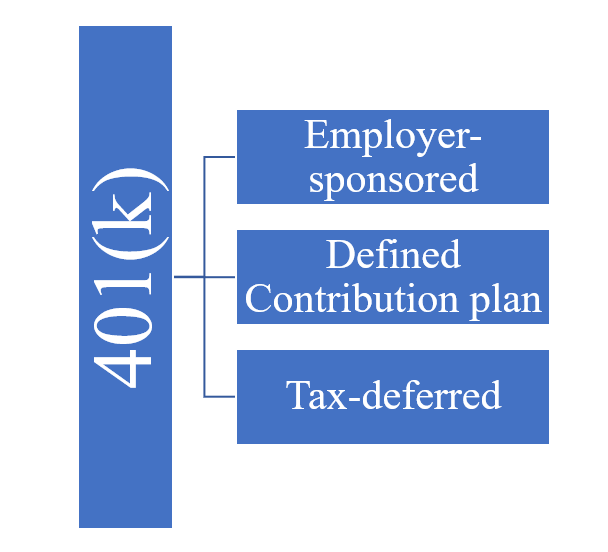

What is a 401(k)?

In the United States, a 401(k) plan is a retirement savings plan, offered by many employers to the people working under them. Named for a section of the US Internal Revenue Code, it has numerous tax benefits for the saver. It works by withholding a portion of the employer’s monthly salary and depositing it into the savings account instead. In most cases, the employer specifies the amount of money that can be deposited into the account- hence, it is also called a ‘defined contribution’ plan.

What Is An RRSP?

A Registered Retirement Savings Plan is the equivalent of a 401(k) plan in Canada and is included in the Canadian Income Tax Act. It is an investment account for employees and the self-employed. It is established by the employee, registered by the government, and can be contributed to by a spouse or common-law partner. In some cases, an employer can also set up an RRSP for the employees.

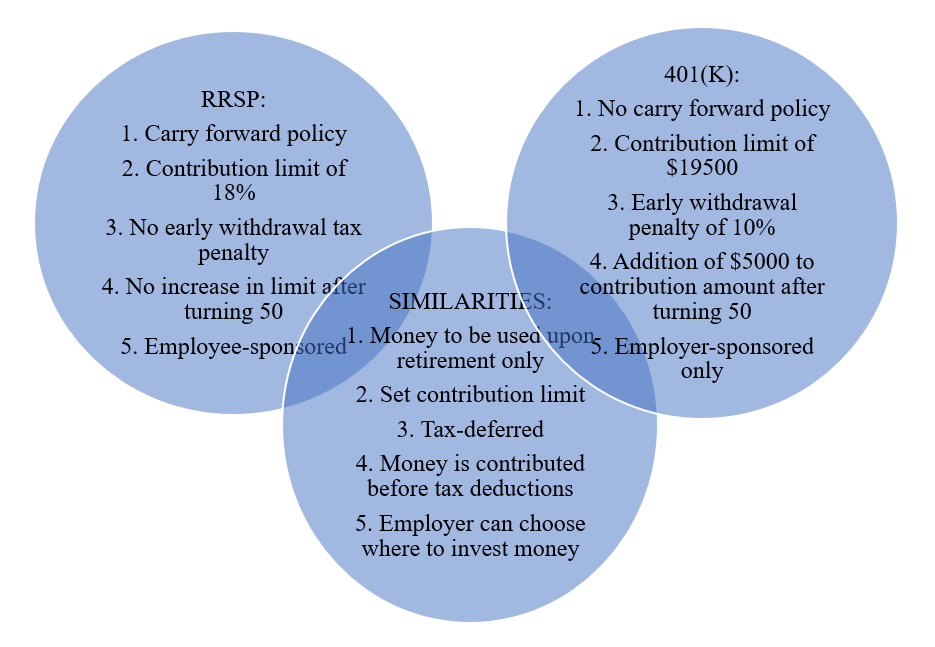

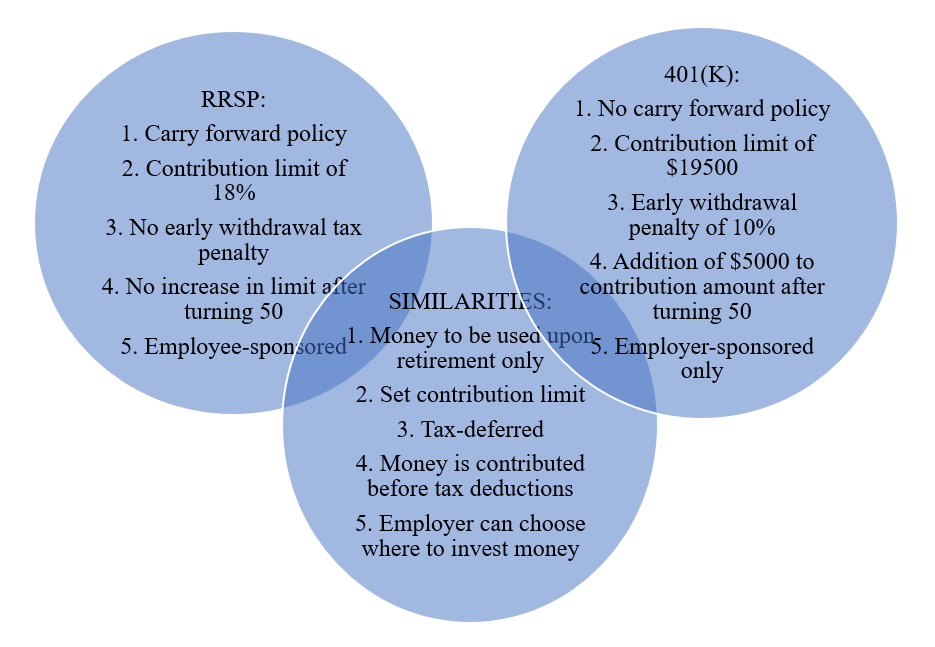

How Are They Similar?

- Both are meant to help you save up for your retirement. You are not meant to withdraw from these accounts until you have retired.

- Both RRSPs and 401(k)s have a set limit on how much you can deposit yearly.

- They are both tax-deferred- the money in these accounts is not liable to tax deductions until withdrawal.

- The deductions from your paycheck are taken before taxes are paid- this means that if you have chosen to contribute 10% of your paycheck to your 401(k) or RRSP, then that amount is deducted from the gross amount, not the amount written on your pay stub.

- Both plans come in numerous variations that allow you to choose where to invest your money- in mutual funds, stocks, etc.

How Are They Different?

- 401(k)s can only be set up by an employer, while any Canadian citizen can establish an RRSP. Therefore, an unemployed or self-employed American who wants to save for retirement must open a different account.

- In America, when an employee turns 50, they are allowed to add $5000 to their contribution amount to their 401(k)s. This is not an option in Canada.

- 401(k)s levy a 10% tax penalty for withdrawals before the employee reaches the age of 59 years. In Canada, the RRSP plan does not impose early withdrawal penalties.

- Though both plans have a contribution limit, it is different for each plan. In Canada, you can only contribute up to 18% of your paycheck to the RRSP account. However, the 401(k)-contribution limit in America is $19500, regardless of income.

- If you pay less than your set contribution amount to your RRSP, the remaining amount can be carried forward to be paid next year. This is not possible in America.