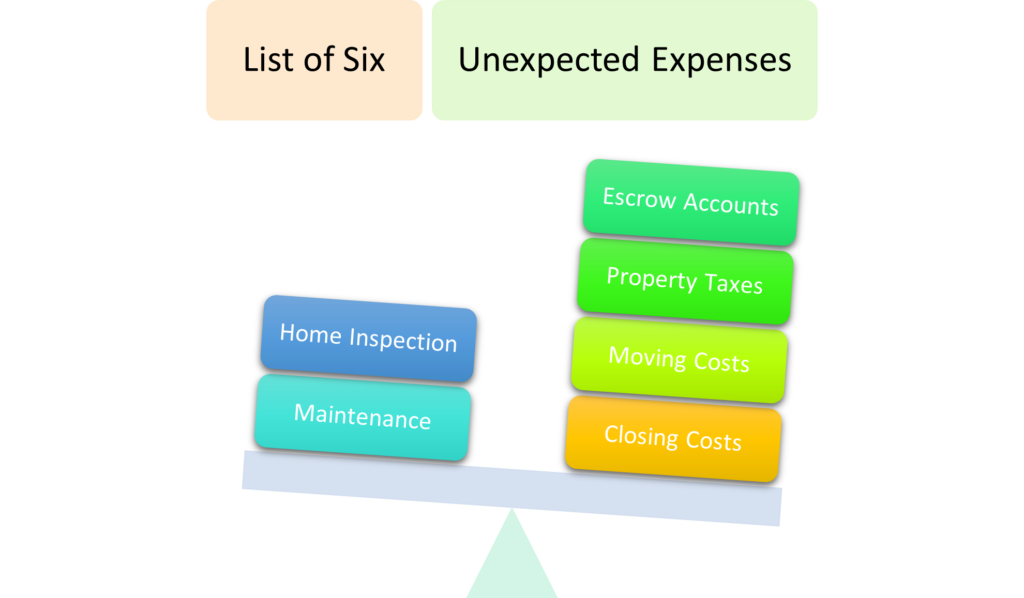

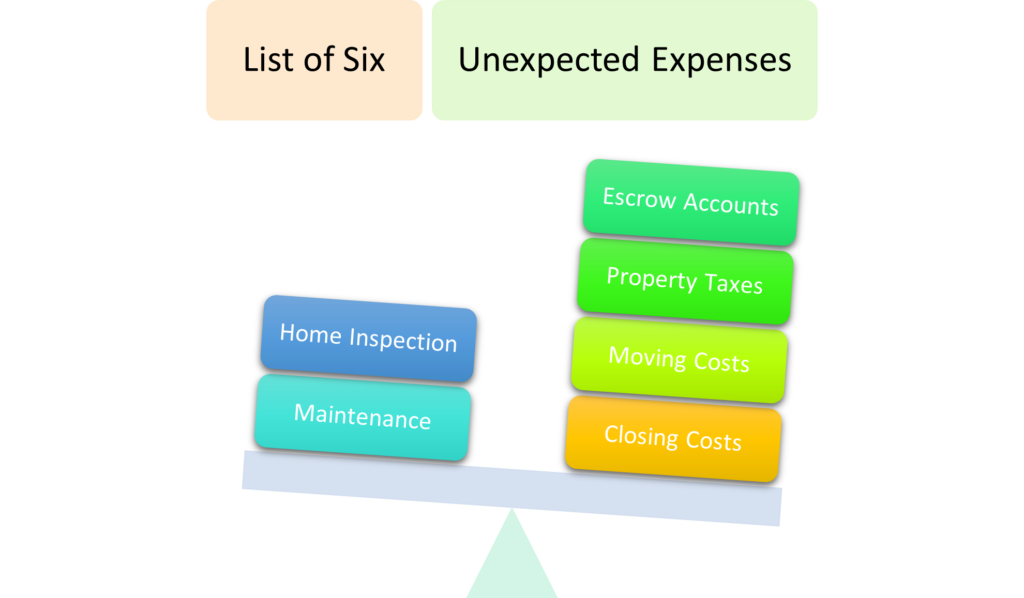

Are You A First-Time Homebuyer? Six Unexpected Expenses Waiting For You

Image Source: Pixabay

Owning your own home is a big deal, even if it is just a starter home you plan to buy. It is a huge step that will influence your life.

It is even more important to consider the financial impact of owning a home. You can be hammered hard by several unforeseen charges. This blog looks at some of the main costs you might have to handle.

Six Expenses That Wait for You

1. Closing Costs

While purchasing your first home may feel like a dream come true. But the total cost of homeownership may come as a surprise. First-Time homebuyers need to consider closing costs as well as other expenses.

It can be tricky learning how to calculate closing costs and grasp the various costs of purchasing a house. The biggest issue is, you do not know how much your closing costs are until you find a home and get your offer approved.

2. Home Inspection

After putting down the offer, you need to hire an inspector. Finding the right home inspector is essential to avoid the many problems that can exist in a house. A home inspection can help to make your home purchase decision easier.

3. Maintenance

Home maintenance is one of the most unexpected costs related to the house. Cosmetic repairs might seem insignificant to the average person. But as a homeowner, you want your house as perfect as possible. It might seem like a minor cost, but it adds up over time. Your best wager is to negotiate with the real estate agent to get the best price for the cosmetic expenses.

4. Escrow Accounts

Escrow accounts are required by certain lenders when you are purchasing a property. This ensures that the lender has money when they need it. Some most frequent expenses include property taxes, property and flood insurance, and property fees.

5. Property Taxes

Property taxes are one of the biggest outgoings of owning a property and are also one of the biggest headaches. Taxes on property change from state to state. They can also be raised or reduced depending on the value of the land and the property itself. If you think of buying a property, you should find out what the property taxes are and how much you can expect to pay.

6. Moving Costs

Everything is ready, and it is time to pack and move into the house. However, there are more extra costs associated with moving all your belongings. Expenses for household cleaners, moving supplies, and transporting your belongings must all be factored in. You get quotes from various moving companies well in advance. This way, you’ll be ready on time.

We hope that with this information you can better prepare yourself for homeownership. The reality is that a lot of expenses come with owning a home, but it doesn’t have to be overwhelming!

If you’ve been thinking about buying a home, now would be a great time to start saving for a down payment and budgeting for all of the expenses you’ll need to pay.