Meridian Limitless Chequing Account vs. Comtech Classic 25 Package – Get the best for you!

The Meridian Limitless Chequing Account is a youth account specifically meant for people between 18 and 29 years old. It has a zero monthly fee with unlimited free transactions. You can open this account here.

Comtech Fire Credit Union offers another similar chequing account–introduced in the market as the Classic 25 Package. It suits all moderate-volume users with limited banking needs.

Finding the best chequing accounts can be challenging. When you have a lot of variety, you need a detailed comparative analysis of these chequing accounts. Choose the best!

1. Meridian Limitless Chequing Account – By Meridian Credit Union

WELCOME OFFER

Presently Meridian Credit Union is not offering you any opening cash bonus or introductory benefits.

Eligibility

| You are a Canadian resident. |

| You are between 18 and 29 years. |

| You have any of your valid government-issued ID, like Passport, Driving license, etc. |

Interest Rate

- This chequing account does not offer any interest on balances maintained.

Minimum Balance

- There is no requirement for any minimum balance

Transactions

- Unlimited free transactions

- Four free Interac e-Transfer per month. Every additional transaction will cost you $1.25/transaction

- Unlimited and free Personal service transactions and bank cheque deposits

- Monthly Fees:

- There is no monthly fee

Additional Benefits

2. Classic 25 Package– By Comtech Fire Credit Union

WELCOME OFFER

Comtech Fire CU is not offering you the benefit of any introductory offer or an opening cash bonus.

FEATURES

- Eligibility

| You are a Canadian resident. |

| You have attained the age of majority as set by your province. |

| You have a valid government-issued ID, like a Driving License, passport, etc. |

Interest Rate

- You do not get any interest in this chequing account

Minimum Balance

- There is no requirement for any minimum balance.

Transactions

- You get 25 free day-to-day transactions every month

The “day-to-day” transactions include:

- Cheque clearing

- Debit card payments (point of sale)

- In-branch withdrawals

- Me-to-me Transfers

- Pre-authorized payments

- Bill payments (In-branch, Online, Mobile, and Call Centre)

- Transfers (In-branch, Online, Mobile, and Call Centre)

- CFCU, ACCULINK®, and THE EXCHANGE® Network ATM withdrawals and transfers

Monthly Fees

- There is a monthly fee of $10

- However, if you are 59 years or above, you will pay $5

- However, you can waive your monthly fee by maintaining a minimum monthly balance of $3,000

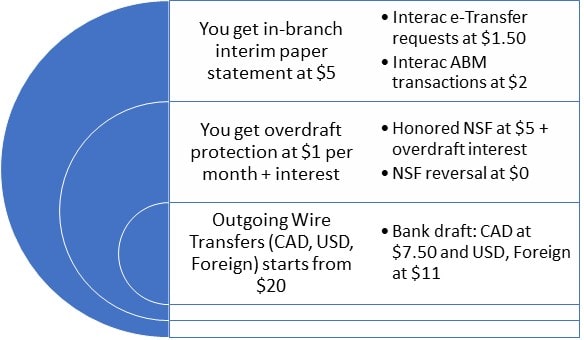

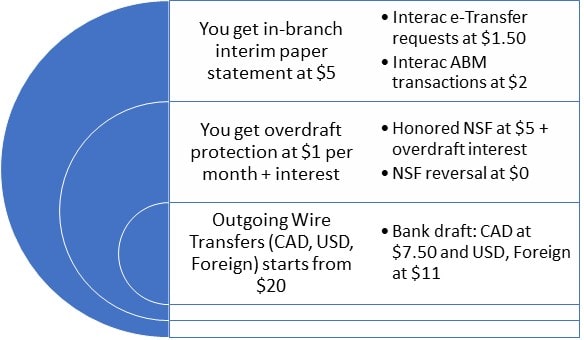

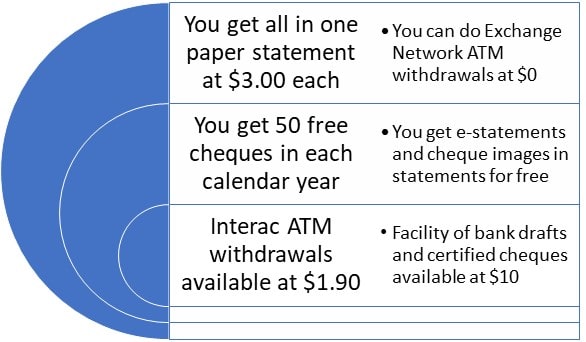

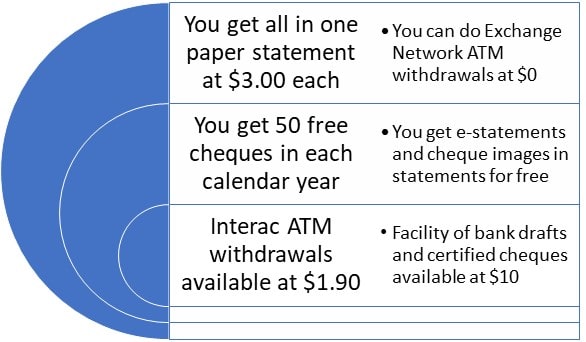

Additional Benefits

COMPARATIVE ANALYSIS

We compare the features of the accounts through a table.

| Parameters | Meridian Limitless Chequing Account– By Meridian Credit Union | Classic 25 Package– By Comtech Fire Credit Union |

| Monthly Fees | $0 | $10 |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | $3,000, if you want to waive the monthly fee |

| Free Debit Transactions | Unlimited and Free | Combined limit of 25 |

| Free Interac e-Transfer | Four every month | Combined limit of 25 |

Among the five parameters mentioned above, Meridian Limitless Chequing Account scores are high in four. There is a tie in one parameter.

OPINION of ExpertByArea.Money

Being the second largest credit union in Canada, Meridian offers superior financial products and comprehensively beats the Comtech Classic 25 Package.

Highly affordable ($0 monthly fee), limitless banking (unlimited transactions), and Zero requirement of any minimum balance make Meridian Limitless Chequing Account comparatively better.

The Classic 25 Package limits your banking transactions to 25 and even charges a $10 monthly fee. If you wish to avoid it, maintain a minimum monthly balance of $3,000. It is simply asking too much from the youth!

Evaluate your requirements. Choose the best account that better serves your needs.