5 Ways to Leave Money for Your Grandkids

Do you love your grandkids? Then, while planning your estate, you must look for the best ways to share some of your wealth with them. Well, leaving behind legacies is not a simple task. You can efficiently leave money for your grandkids. So, keep reading till the very end.

Source: Freepik

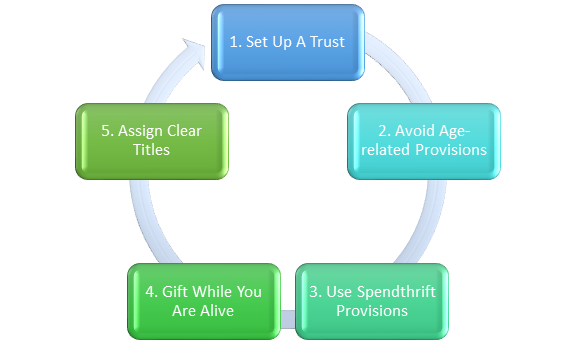

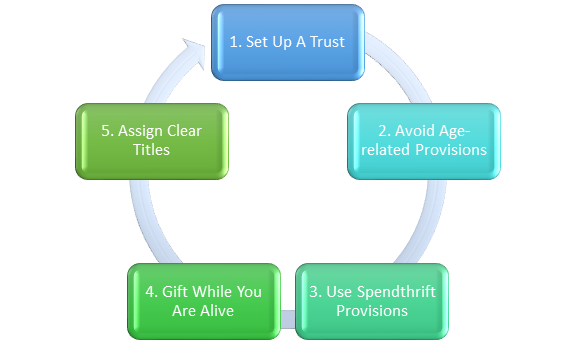

5 Best Ways to Leave Money for Your Grandkids

Probate fees, government taxes, and other charges are some issues you will face while leaving an inheritance. Nobody wants to pay the government more and tries to plan their estate to keep the liabilities minimum.

Below is a list of the 5 best ways using which you can leave an inheritance for your grandchildren:

1. Set up A Trust

Making “will” is common in Canada, and most seniors prefer this route. However, this mostly happens because most such people are not aware of the benefits of setting up a trust.

A trust is an individual entity in the law and holds your assets, such as real estate, bank accounts, precious metals, stocks, debentures, mutual fund units, etc.

A “revocable living trust” is the most common and preferred type of trust set up by seniors in estate planning. You can change or revoke the terms of such a trust multiple times until you are alive.

Trust acts in the same way as a will, but with some additional benefits, such as:

- Quicker Inheritance: Your grandkids will get your assets more quickly than would happen under the traditional route. Your legal heirs are not required to court to get the will probated.

- Cheap and Economical: When you set up a “trust fund” and transfer some or all your assets to it, you avoid probate fees. It is because such transferred assets do not form a part of your estate value.

- Escape Public Domain: Unlike a will, you are not required to go into the public domain and intimate via print media about the distribution of the assets. The trust has the sole ownership of all assets and will distribute them to the rightful owners (as designated by you) upon your demise.

2. Avoid Age-Related Provisions

You certainly want to be remembered by your grandkids. By leaving your estate, you not only develop a long-lasting connection with them but also create a legacy for ages.

Thus, in most cases, you will like your grandkids to receive the benefits instantly as soon as you pass. To do this, you must not define any age-related provisions while setting up your trust or writing your will.

Several Canadian provinces do not allow minors (below the age of 18 years) to inherit the property until attaining the age of the majority. There is usually an upper limit for such an inheritance, which is $15,000.

Hence, if you want even your underage grandkids to get their due share of the inheritance, you must avoid putting age provisions.

3. Use Spendthrift Provisions

You know your grandkids. You saw them taking their first breath and everything changed since then. If you feel your grandkids are not that financially mature and might not handle the windfall efficiently, you can use a “spendthrift provision” to your trust or will.

It helps to protect the value of your estate in the following two ways:

- Creditor Protection: One of the significant advantages of a spendthrift provision is that it protects the family assets from the creditors of beneficiaries. Your legal heirs cannot use the inherited assets to settle debts.

- Access Via a Designated Trustee: Your grandkids will have access to your family assets through a trustee designated by you. The trustee will make all the distribution decisions and assign the estate to the beneficiaries.

4. Gift When You Are Alive

Everything belongs to them. Be it today or after your demise. If you have faith in your grandkids and feel they will not misuse or squander their inherited wealth, you can gift your assets to them while you are alive.

You can freely transfer $15,000 annually to your grandkids as a gift without needing to report any such transaction. It helps you save probate fees as gifted assets do not come under the estate value.

5. Be Lucid and Assign Clear Titles

The last thing you want after your demise is to see your grandkids fighting amongst each other to get their due share of the estate.

To avoid such a gruesome situation, you must assign clear titles and mention “who will get what and in what percentage.” It leaves minimum room for confusion and ambiguity, as everyone would know their entitlements.

Further, it also avoids the occurrence of any situation wherein your relatives secure something out of your estate to whom you never wanted to give a single penny.

Hence, you can always take the help of established law firms that specialize in estate planning. The terms and conditions of your trust must be clear and use non-ambiguous words.

Wrapping It Up

You might not be there to see the joy on the face of your grandkids. But you will feel it no matter where you are.

The five tips mentioned above will help you maximize the potential of your estate division. Following them, your grandkids will pay much less in probate fees, and they will not squander your estate.