Understanding Mortgage-Backed Securities (MBS) And Their Benefits

Want to understand what Mortgage Backed Securities (MBS) are and how they work? Read this blog to find out.

Source: Pexels

Here are some alternative forms of investment. Become an indirect mortgage lender. The investment market is growing, and you are too.

MBS has a connection with the mortgage loans and your new homes.

The investment market has ballooned. You can find the market presently flooded with a variety of investment products. Be it a simple investment in an equity stock of a company or a complex one as units in a real estate investment trust (REIT), you, as an investor, must analyze them all.

“Mortgage-backed securities” are the most popular investment products, especially suitable for conservative investors. Let us delve deeper and know everything about this investment opportunity.

What Are Mortgage-Backed Securities?

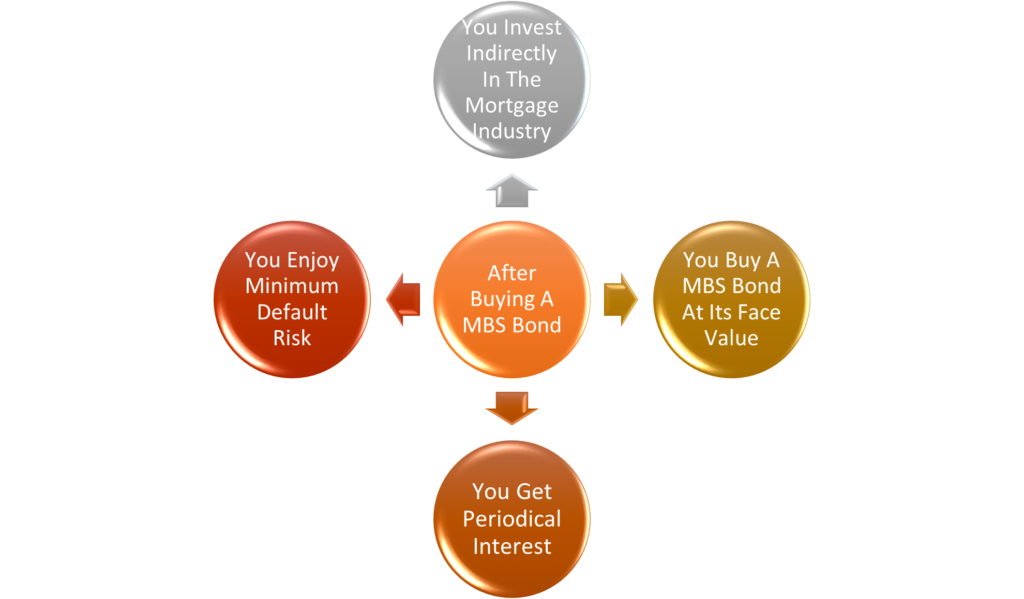

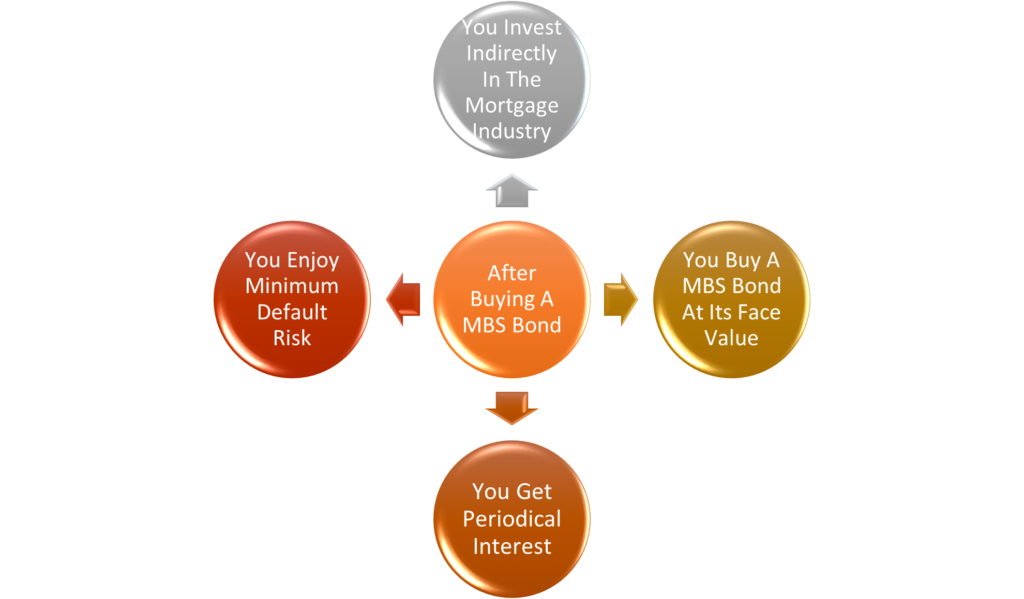

Mortgage-backed securities are available to investors as bonds.

- They are like debentures and like every other debt instrument you have bought.

- These MBS bonds offer you periodic returns, which are calculated based on a coupon rate

- These bonds have a face value, and you need to pay it upfront to invest in these bonds

How Mortgage-Backed Securities Bonds (MBS Bonds) are Safe?

It is a fact that the mortgage industry or the home loan industry is the safest in terms of default risk. No homebuyer wants the banks to foreclose their houses because of the non-payment of mortgages.

Further, even if you as a borrower cannot pay off your mortgage debt, the lender can always sell the house to realize its outstanding amount.

Hence, you can safely assume that the investments made in the MBS bonds carry a lower risk of principal and interest. These are suitable for conservative investors who want to earn a modest return by taking a minimal capital risk.

How Are Mortgage-Backed Securities Created or How Do They Come into Existence?

Are you aware of the bank branch working closest to you? It might be a branch of the Scotiabank or the Royal Bank of Canada. All the lenders and financial institutions engage in issuing mortgage-backed securities for funds.

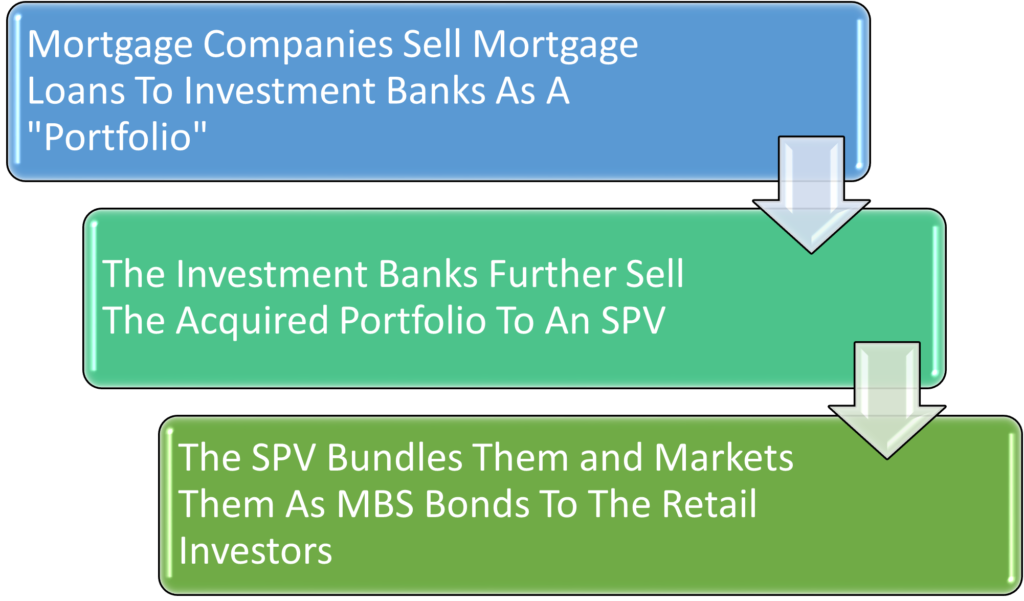

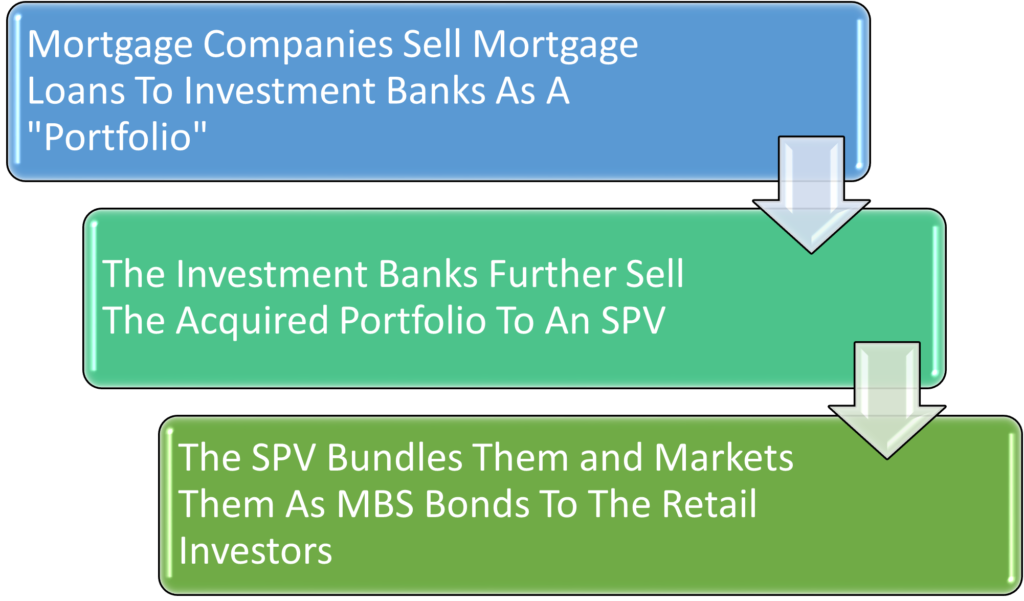

It is a type of debt financing in which a bank or a mortgage company sells its mortgage loans by aggregating them or making a bundle of them to an investment bank.

The creation of mortgage-backed securities is a complex process and primarily involves four major parties, which are:

- A mortgage company/ retail-focused bank

- An investment banks

- A purpose vehicle and

- An MBS Investor

Let us understand the process of mortgage-backed securities through this practical example.

I. The Role of Mortgage Company

- ABC Mortgage Company is a private lender currently working in the Greater Toronto Area

- It has a large pool of customers and disburses mortgage loans worth millions every month

- It accumulates or aggregates all the mortgage loans, makes a portfolio of them, and sells them to an investment bank

- The investment bank buys the portfolio of mortgage-backed securities and pays money to the ABC Mortgage Company

- The ABC Mortgage company uses the sales proceeds from this transaction to extend fresh loans to its customers

II. The Role of an investment bank is:

- The investment bank, which has bought the mortgage-backed securities, combines these

- Newly acquired mortgage loans with

- Its existing mortgage loans

- Based on mortgage interest rate

- For example, all mortgage loans with a mortgage rate between 3% and 3.5% per annum are clubbed together.

- Transfer these bundles of mortgage loans to a special purpose vehicle (SPV). It is a company formed to serve a special purpose.

III. The Role of Special Purpose Vehicle (SPV)

- A Special purpose vehicle acquires all the bundles and then markets them to the investors as bonds.

- If you are buying a bond of the MBS, then it simply means you are investing your money in the mortgage-backed loans without needing to generate, close or manage any home loan.

IV. The Role of Investors of MBS

- We sell the MBS bonds to the investors through a special purpose vehicle

- Investors like you buy these bonds on offer that are like debt instruments by paying an upfront amount

- The investors get regular returns till the time they are holding the bond

What Are the Different Benefits of Mortgage-Backed Securities?

The creation, sale, and overall existence of mortgage-backed securities have several benefits for all the associated parties. Let us look at all of them through the table below.

Benefits of Mortgage-Backed Securities

| The Mortgage Company | Investment Bank and Special Purpose Vehicle | The MBS Investor |

| Gets ready funds from the sale of mortgage loans | Develops a sophisticated yet safe investment product, which they sell to the investors for a profit | Invest in the mortgage industry without needing to extend loans to homebuyers |

| The money generated upon the sale of mortgage-backed securities are used by the mortgage company for extending new loans | Create a regular stream of income as mortgage loan repayments | Diversified portfolios as MBS portfolios are an alternative form of investment |

| Enhanced profit due to increased capacity of disbursement and new inflow of customers | Gets the ability to foreclose the houses | Reduces the overall portfolio risk, as MBS bonds are considered a safe investment |

| Lower default risk as the mortgage company sells its mortgage loan in the initial stage | Creates a system where they can retain some mortgage payments for their expenses and pass on the balance to the MBS investors | Enables the investors to generate regular interest income until the time they are holding the bond |