What Is A Special Purpose Acquisition Company (SPAC) And Its Purpose?

A special purpose acquisition company (SPAC) is a publicly traded company formed to acquire or merge with some other business. Read this blog to find out more.

Source: Pexels

A special purpose acquisitions company is a legal entity, which is created for a specified purpose, such as:

- To buy out the existing businesses

- To raise funds via several methods, such as

- Issue of equity shares

- Issue of debt instruments

- External commercial borrowings, etc.

- To absorb or merge with any existing company.

A SPAC does not perform any business operation and is not engaged directly with the customers. It may or may not have permanent employees that further depends upon the need and the purpose of its creation.

What is the Need for A Special Purpose Acquisition Company?

A SPAC is a valid legal entity and set up to perform a specific function. Let us understand the circumstances that lead to the development of such special purpose vehicles.

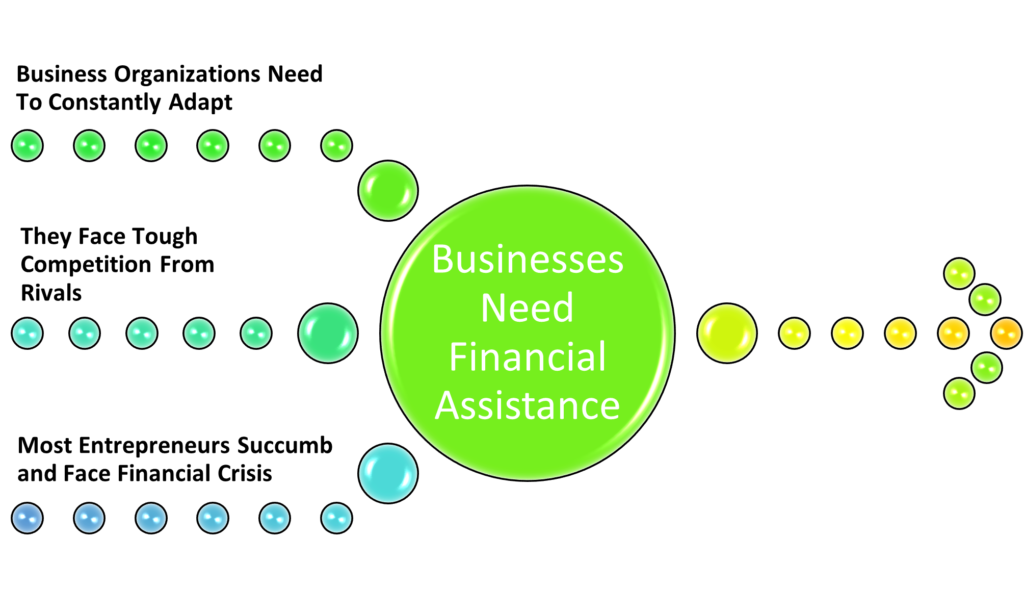

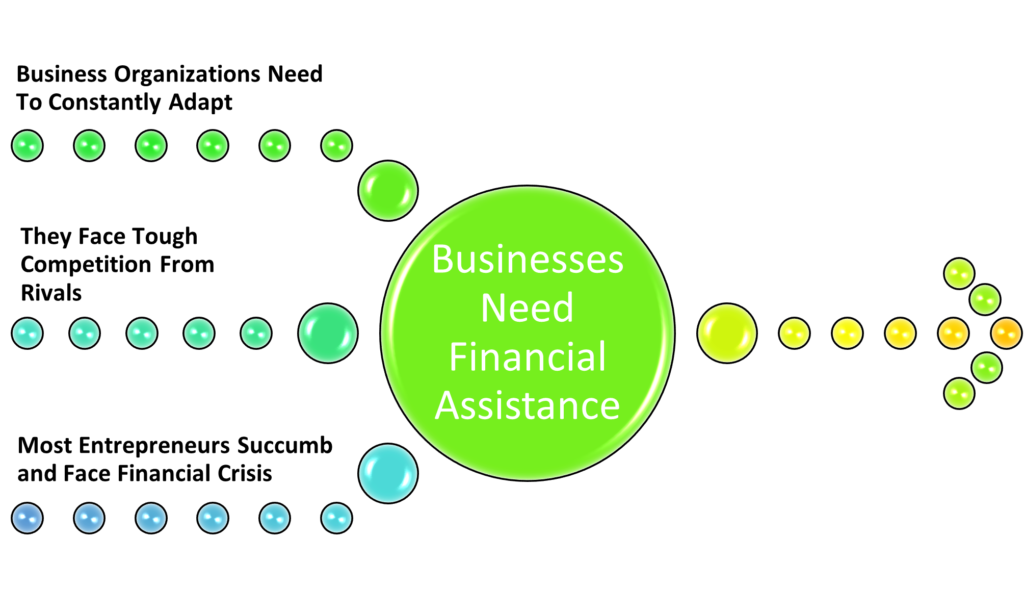

Market Situation That Leads to the Development of SPAC

Business organizations operate in a dynamic and fast-changing world. They not only face competition from rival companies but also need to adapt constantly to the changing business environment in terms of legal, political, and social factors.

It is a fact that operating in such a challenging business environment does not suit every entrepreneur, and a few succumb to absorbing this pressure.

Such organizations usually face financial distress if they cannot find funding on time. According to a recent survey conducted by the Government of Canada, 99,244 insolvency requests filed in 2020 alone with the Office of Superintendent of Bankruptcy (OSB).

It certainly presents a gory situation as the closure of businesses disturbs the overall robustness of the economy and augments the unemployment rates. Further, the tax collection targets of the governments also take a hit and affect their development plans.

Hence, there is a greater need to prevent businesses from falling by leveraging SPACs.

The Solution

A solution to the problem is provided fittingly by setting up SPACs.

A SPAC is a company that will support the economy by extending financial help to troubled and sick business ventures.

What is a SPAC In a Simple Language?

SPACs are also known as Blank Check Companies and have been in existence since time immemorial. As per a recent survey, more than 247 SPACs created in 2020 with an approximate cumulative investment of $80 billion.

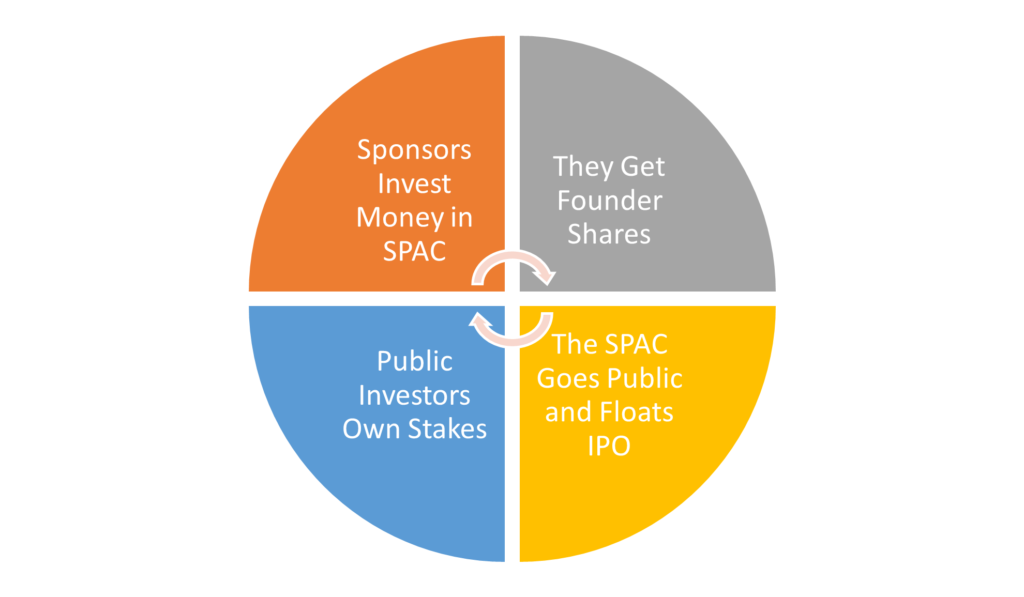

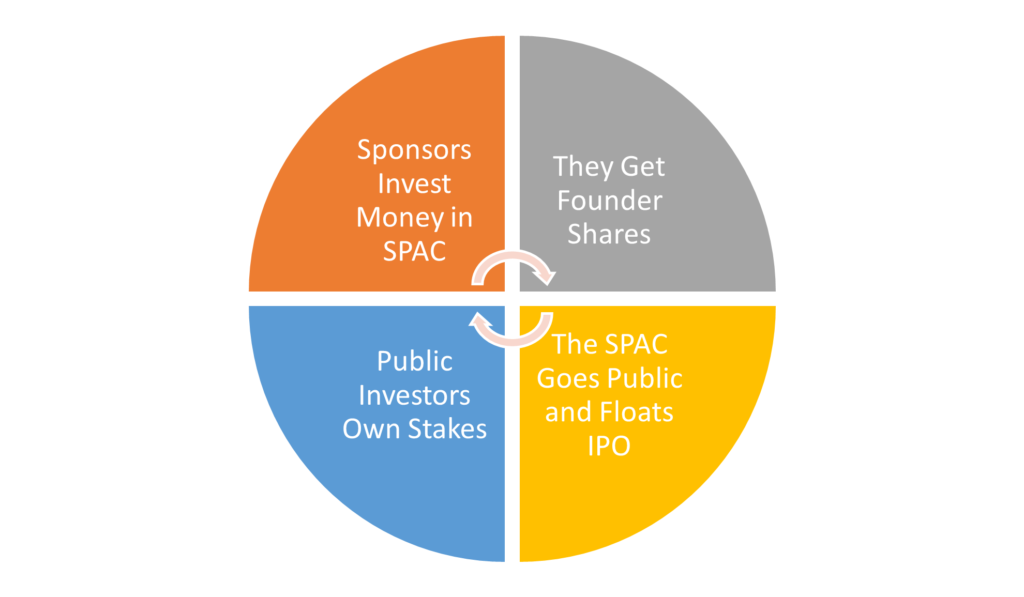

It certainly displays optimism regarding the setting up of SPACs. A typical SPAC created in the following manner:

- A management team (also known as sponsors) identifies market opportunities and invests nominal capital in the SPAC.

- As a result of the investment, the SPAC allows founder shares to the sponsors besides a minority stake

- Post this, most of such companies go public and raise funds through the Initial Public Offer (IPO) route

- The investors invest and subscribe to the equity share capital of the SPAC in question.

It generates interest from the public and extends to the high-net-worth individuals, established investment houses, institutional investors, and renowned private-equity firms.

Keeping Money Raised in an Escrow/ Trust Account

The funds raised by a SPAC kept in an escrow or trust account. The utilization of this fund earmarked for the purposes for which the company floated.

If an SPAC cannot perform the duties or execute the purpose of its creation, it gets liquidated through a set procedure. Investors get their money back.

Structure of a SPAC

As mentioned earlier, SPAC is a specific purpose vehicle set up by selling private equity shares to investors. A typical SPAC usually has the following hierarchical structure:

- Top-level management usually comprises sponsors, promoters, primary investors, and stakeholders.

- Middle-level management usually comprises business analysts, equity researchers, and investment bankers who keep on exploring the market to identify lucrative opportunities.

- Lower-level management usually comprises clerical staff supporting the top and middle-level management performing their duties.

Since a SPAC is required to achieve its acquisition targets within two years of establishment, they usually hire most of its employees contractually.

How does SPAC Work?

A management team with insights from several potential target companies usually forms a SPAC. These sponsors require negotiating the deals within 18 months to 24 months. Typically, a SPAC merges/ absorbs a target company with itself.

Upon successful acquisition, the investors of the SPAC invest into the resultant entity. This entity is formed with the amalgamation of the SPV and the Target company.

How SPAC Helps Start-ups and Mid-Sized Firms?

Most SPACs indeed acquire sick units that are in financial distress. However, situations are not always that bad, and a SPAC also invests in the start-ups and mid-sized corporates that are unlisted and need funds.

While raising money via the IPO route is long, stressful, and arduous. Such unlisted organizations prefer to deal with the SPACs for their funding requirements. A SPAC purchases their equity shareholding and acquires a minority stake. This stake could be less than 50% of the total equity shareholding.