Financial Wellness in the GTA: Strategies for Achieving Balance and Peace of Mind

Introduction:

Achieving financial wellness might seem a difficult task in the hustle and bustle of large cities like the Greater Toronto Area (GTA). People can feel overburdened and anxious due to the continual balancing of spending, future savings, and Debt management. However, with the right mindset and methods, it is feasible to accomplish financial balance and peace of mind.

In order to help readers who want to better their financial status, this article examines successful methods for financial health in the GTA.

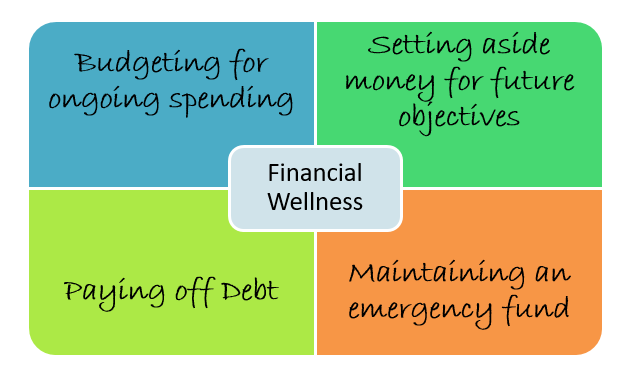

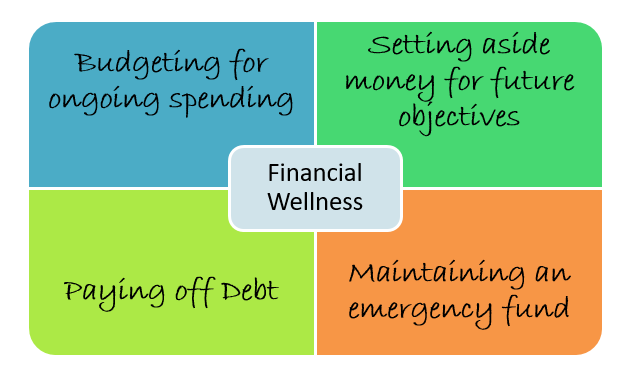

Understanding Financial Wellness:

When people have control over their present and future financial situations, they are said to be in a condition of financial stability.

- Achieving financial wellness is essential because it gives people a sense of stability but also lets them follow their goals and live fulfilled lives.

- An honest evaluation of your current financial condition is a necessary first step on the path to financial wellness.

- It entails assessing earnings, outlays, possessions, and liabilities.

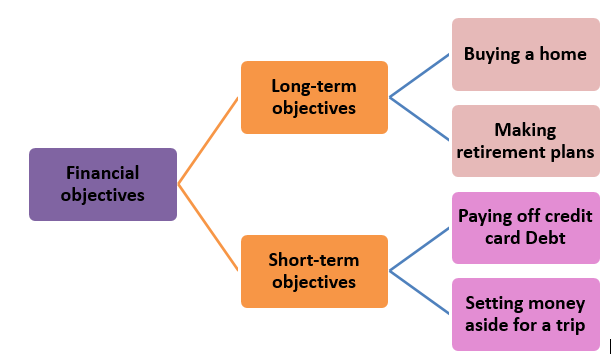

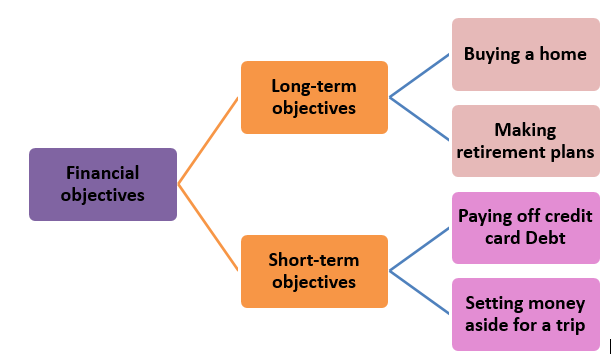

Setting Clear Financial Goals:

Setting definite and practical financial objectives is the next stage after being informed about your financial position. Establish both short-term and long-term goals first

- Rank your targets in order of significance and applicability to your life.

- By using the SMART technique for goal-setting, you may make your objectives precise, measurable, attainable, relevant, and time-bound.

- This framework offers direction and inspiration as you strive toward your financial goals.

Creating a Realistic Budget:

A budget is an essential tool for wise financial management.

- List all your revenue sources at the outset, along with any fixed costs you have, such as rent, electricity, and loan payments.

- After that, keep a record of your variable expenses, such as those for meals, entertainment, and transportation.

- Examine your spending habits to find areas where changes might be made to cut back on unneeded expenditures.

- Set up an emergency fund and set aside a part of your salary to put away for unforeseen emergencies.

Reducing Debt and Managing Credit:

Financial well-being can be seriously hindered by Debt. Consider your Debts, rank them according to interest rates and sums owed, and create a strategy for paying them off.

- Don’t forget about techniques like the Debt snowball approach, in which you prioritize paying off the lowest Debt first while making minimum payments on other Debts.

- The Debt avalanche approach, as an alternative, gives high-interest Debt precedence. Pick a strategy that works with your finances and inspires you to stop using Debit cards.

- Pay your payments on time, maintain a low credit utilization rate, and refrain from unauthorized purchases as further appropriate credit card usage guidelines.

Building an Emergency Fund:

Financial stability depends on having an emergency reserve. Unexpected costs might halt your financial progress since life is unpredictable.

- Spending between three and six months’ worth of spending in an emergency fund is a good idea. Set away a little part of your salary each month, to begin with, then steadily grow it over time.

- You could wish to automate your savings by setting up a regular transfer from your checking account to your emergency fund.

- In this approach, one might resist the need to spend the money on impulsive items.

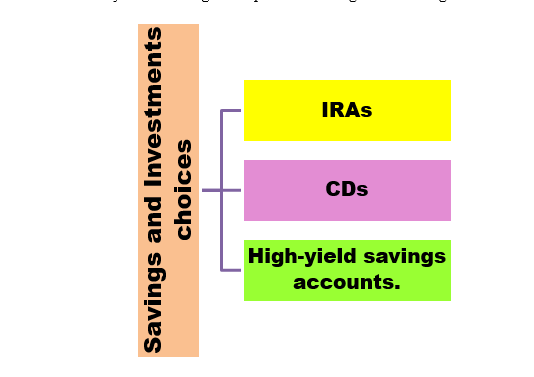

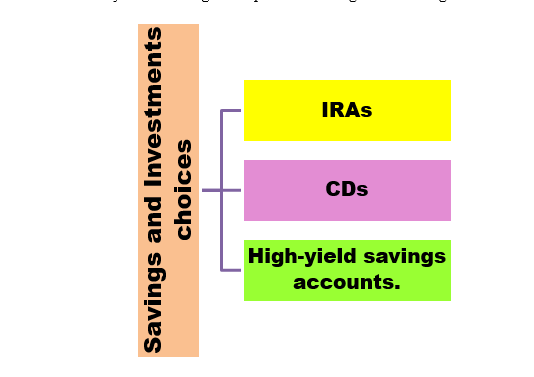

Maximizing Savings and Investments:

Financial stability over the long run depends on saving and investing.

- By diversifying your holdings, you may raise potential benefits and lower risks.

- If you require professional advice on investment strategies, think about speaking with a financial advisor.

- They can guide you through the maze of financial options and create a strategy that fits your objectives and risk tolerance.

Practicing Self-Care and Mindfulness:

The relationship between financial and mental health is complex. Your general quality of life may suffer as a result of the stress and worry brought on by financial difficulties.

- Include self-care activities in your regular routine to reduce stress and improve wellness. You may relax by engaging in enjoyable activities like exercise, meditation, or quality time with loved ones.

- When making financial decisions, be conscious of your choices. Keep your spending under control by taking the time to assess if a purchase fits your beliefs and financial goals.

Conclusion:

Financial wellness demands being proactive and observant in the GTA’s fast-paced climate. You may take charge of your finances and get peace of mind by comprehending your existing financial status, defining specific objectives, and putting into practice useful tactics like budgeting, debt management, and saving. Look for tools for financial education, use technology to handle your finances, and when necessary, think about seeing a professional. Keep in mind to take care of yourself and strike a good balance between your financial and psychological well-being. Although achieving financial wellness is a lifelong process, it is possible to create a stable and rewarding financial future in the thriving metropolis of the Greater Toronto Area with perseverance and commitment.