Boost Your Credit Score in Canada: 4 Simple Habits for a Healthier Financial Future

It is a necessity. Yes, Canadians have always been progressive individuals and love to live life at a higher standard. They wish to own a house, a car, want to educate their children, and whatnot. All of this can happen only with finance. With a better credit score, you can tap the best loan facilities from recognized institutions, and that too at an affordable interest rate.

Do you wish to improve your credit score? Let us find out more.

What are Credit Scores?

It is a score or a measure. Yes, you must have given exams in your academic life where you used to get evaluated against some set parameters. A credit score works in the same way, and credit rating agencies consider several pre-defined criteria, such as:

- How often have you defaulted?

- Do you pay your bills on time?

- What is your credit history?

- How many times was your credit application rejected?

What Does It Do?

A higher credit score shows you are financially sound, and if you take a loan from any financial institution, you are capable enough of repaying it. It allows you to avail yourself of finance from the best banks and mortgage companies at the most competitive rates.

What Is the Average Credit Score in Canada?

In Canada, the credit scores lie between 300 and 900. Both the extremities represent your creditworthiness. The higher your credit score, the better your chances of getting a loan on favorable terms. In Canada, the credit scores usually lie between 660 and 724.

Besides,

- If you have a credit score of over 725, it falls into the category of “Very Good.”

- If you have a credit score of over 760, it falls into the category of “Excellent.”

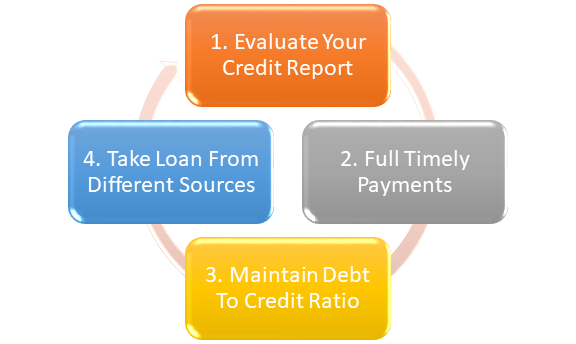

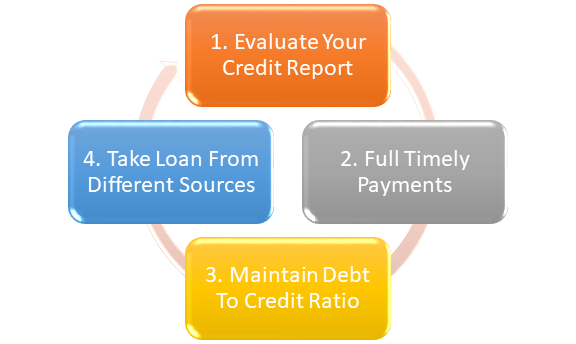

Best Habits to Improve Credit Score

“Financial well-being is a necessity. When I was young, I was utterly ignorant and often defaulted on several payments. It severely affected my credit score. And now I am in my 50s, no matter what I do, I cannot improve it. I hope somebody taught me about some good credit habits at my early age.”

said Philips Kotler, a resident of the Greater Toronto Area Well.

Philips certainly made mistakes, but you must not.

Start following these habits and revamp your depleted credit score.

1. Get Your Credit Report and Evaluate

One of the first steps toward improving your credit score is to get access to your credit report and deeply evaluate it. Yes, your journey will start with knowing what is wrong. You can determine how to correct it.

For this, you can get a credit report at zero cost from two of the credit bureaus of Canada, Equifax, and Transunion. All you need to do is send them an email.

You can send mail to both the bureaus and can get two separate reports. But note that your credit scores will differ as both use different parameters and algorithms.

2. Full Payment on Time

Timely payment leaves no balance. This is the mantra that you must adopt in your life. Most lenders need to share your payment history with the credit bureaus used to calculate your credit scores.

Hence, when you never miss a date and pay fully, you build a positive payment history that allows the bureaus to assign you a perfect credit score.

However, if not intentionally, you might default in making a complete payment when you are low on finance. In all such cases, at least ensure you pay the minimum amount.

3. Try Maintaining Your Debt to Credit Ratio

We also know it as the credit utilization ratio. It represents the amount of revolving credit that you are using. Revolving credit refers to the cash available via credit cards, lines of credit, and other similar sources.

A higher debt-to-credit ratio significantly affects your credit score and shows that:

- You are highly indebted

- There are high chances that you can default, eventually

- Much of your income goes away to meeting your principal and interest payments

Ideally, if you can maintain a debt-to-credit ratio of about 30%, you can certainly be on the side of credit bureaus, as this percentage is acceptable.

For example, if you have a revolving credit facility to the tune of $50,000, you can use $15,000 or less to maintain a good credit score.

4. Diversify Your Credit Sources

It is a fact that credit bureaus give you a good credit score if you avail yourself of finance from various sources, such as credit cards, student loans, personal loans, car loans, mortgage loans, etc. Instead of relying on any lone source.

Hence, never remain dependent upon any sole source of finance and try to diversify by obtaining credit from various sources.

However, making timely payments, preferably in full, remains the key to revamping your credit score.