How to Use Mortgage Calculators to Save Money on Your Home Loan in Canada? [Updated 2023]

In Canada, there are several mortgage calculators in existence. Read about them all through this interactive blog.

Undoubtedly, mortgages are complicated. You have to deal with mortgage rates, mortgage insurance policies, and also down payment. Post that, you will be required to make regular mortgage payments monthly without any default. Or else, your house can be foreclosed.

Thus, to ease out the entire process of mortgage, which could otherwise be cumbersome, several financial institutions have developed mortgage calculators.

We will discuss three different mortgage calculators in this blog, which serve different purposes. Also, we will be telling you how mortgage interest rates are calculated in Canada. So, keep reading and become mortgage-savvy.

The Three Mortgage Calculators

1. Mortgage Payment Calculator

Do you wish to know about your monthly mortgage payments? A mortgage payment calculator does the same. It lets you calculate, eventually what you will be paying every month. This calculation is dependent upon several factors. These are:

| Factors | Explanation |

| Mortgage Loan | a) To finance your residential accommodation, you might be willing to obtain a mortgage loan b) The higher the quantum of this loan, the higher will be your monthly mortgage payments |

| Mortgage Rate | a) The mortgage companies, banks, and every other lender charges the mortgage rate based on your credit score, payment history, and other parameters. b) The higher the mortgage rate, the higher will be your monthly mortgage payments |

| Down Payment | a) It refers to the amount that you pay in the very beginning out of your funds – savings, monetary help from relatives, friends, etc. b) You cannot obtain a loan to finance your down payment c) The down payment reduces the overall quantum of the mortgage loan that you wish to obtain d) In effect, the higher your down payment, the lower will be your monthly mortgage payments |

| Mortgage Term | a) You need to keep paying the monthly mortgage payments for a specified period, which is known as Mortgage Term b) The longer your mortgage term, the lower will be your monthly mortgage payments c) This is because your mortgage repayments will be divided by more number of months/ years |

| Cost of Insurance Policy | a) If you have gathered less than 20% of the purchase price of the house property, you will be under a compulsion to buy a “default mortgage insurance policy”, primarily offered by CMHC. b) Usually, most homebuyers prefer to get finance for the cost of this insurance policy c) In this case, the cost is added to the purchase price and a composite mortgage loan is offered d) In effect, since your mortgage loan gets inflated due to the addition of the cost of an insurance policy, you end up paying a higher monthly mortgage payment. |

The five factors mentioned above are pillars that decide how much you will be paying every month. While using a mortgage calculator, you will be required to enter all these details. The calculator, in return, will provide you with your monthly mortgage payment.

In some cases, a few calculators give you an option to add the value of all the associated costs, for which you’re getting finance from your lender. These include a few closing costs, property tax, cost of default insurance (as mentioned above), and cost of other insurance policies, which you might prefer to avail.

2. Mortgage Affordability Calculator

You might be wishing to buy a penthouse or maybe a beach-side villa. But, all you can afford is a condominium. How do you determine this? – A mortgage affordability calculator comes to your rescue.

It tells you whether or not you can afford the house that you are buying. In other words, it tells you if you will be able to meet those monthly mortgage payments without default for the entire length of the mortgage term.

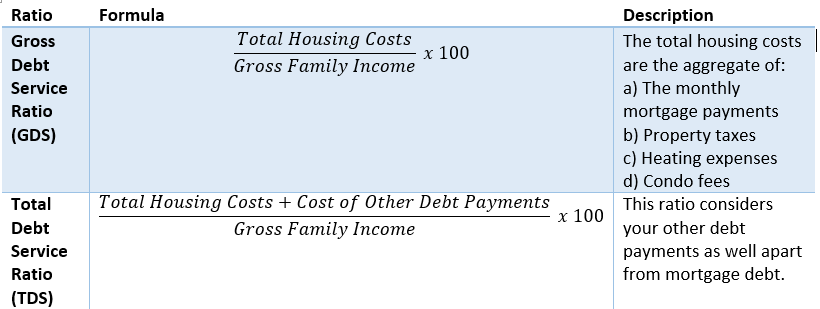

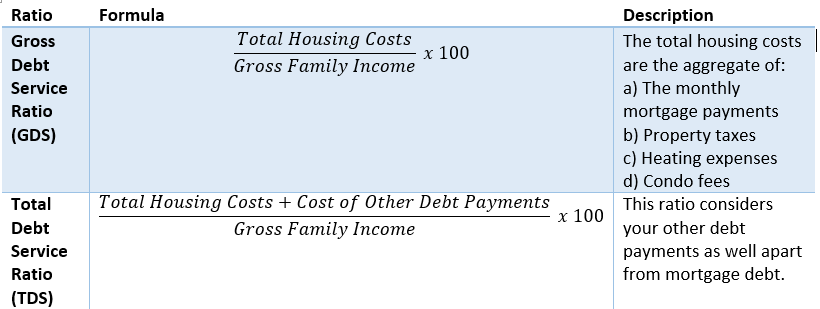

The mortgage affordability calculator uses two different ratios for exactly telling where you stand. These are:

Let us understand both GDS and TDS with a practical example.

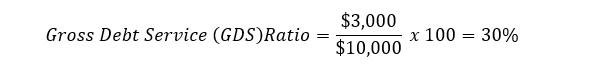

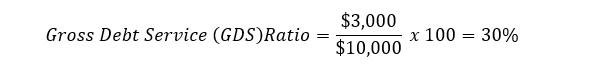

Your monthly household income (before taxes) is $10,000. And your monthly mortgage payments are $3,000. Besides this, you are also paying $800 in credit card loans and $1,500 towards the personal loan every month.

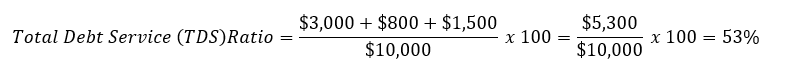

In such a case, your GDS ratio will be:

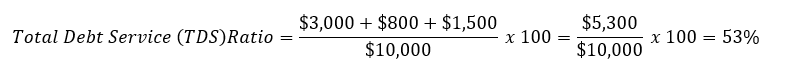

Your TDS ratio will be:

To understand the relevance of the GDS and TDS in a better way, we present to you the recommendations of the CMHC. These are mentioned hereunder:

| Mortgage Affordability Ratio | Ideal Percentage |

| GDS (Gross Debt Service) Ratio | Must be less than 39% |

| TDS (Total Debt Service) Ratio | Must be less than 44% |

Hence, if your GDS and TDS are more than 39% and 44% respectively, you are advised to improve these scores and search for alternative residential properties that have a lower purchase price.

3. Mortgage Term Calculators

Whatever your mortgage term is, 10 years, 20 years, or maybe 30 years, you will be required to pay mortgage payments every month up to the entire length of these tenures, provided, you are not making extra payments.

A mortgage term calculator tells you what is the best tenure that you should opt for. The calculation is based on:

- The mortgage loan, which you will be assuming

- The interest rates, which are offered to you by your lender for the different tenures

- The years after which you plan to retire

These calculators tell you an ideal mortgage term, which you should go for. Some extended versions of these calculators might also require you to share information regarding:

- Your current level of savings

- Your monthly budget and

- Your risk appetite, in other words, how much risk you can tolerate

Furthermore, the length of the mortgage term has a deep impact on your finances. Learn this through the relationship between:

- The length of the Mortgage Term,

- The monthly Mortgage Payments and

- The Mortgage Interest you will be paying through the entire life of mortgage loan

| Mortgage Term | Monthly Mortgage Payments | Overall Mortgage Interest |

| Longer | Lesser | Higher |

| Shorter | Higher | Lesser |