Should You Buy A Travel Insurance in Canada? Everything You Must Know

Flying overseas for business or spending vacations requires extensive preparation for a successful departure. From toothpaste to earphones, we count on every little thing inside our backpacks but always forget to opt for travel insurance.

Do you have one?

Having travel insurance is undeniably crucial for a fruitful and safe journey. Travel insurance acts as a safety net that filters out unforeseen expenses, such as medical emergencies, luggage or passport loss, and accidental coverage (if you’re driving). Or anything which can spoil our trip, having travel insurance provides an additional safety net against unforeseen financial crises which may occur during traveling.

There are plethoras of travel insurance plans out there. This makes it tough to decide which one is best suitable for you. Don’t worry! We’ve got you covered.

To help you alleviate this stress, we have a go-to guide for your travel insurance plan for Canadians who are planning to fly overseas.

What is travel insurance?

Travel insurance is a personalized investment plan that provides additional protection layer against unforeseen financial expenses. Travel insurance covers the cost of accidental damage, cost of trip cancellation, luggage loss, medical expenses, and other losses. Reliable travel insurance plans are responsible to cover losses that occur during domestic or international trips. Travel insurance is an extremely beneficial plan for frequent flyers who travel abroad or domestically. Travel insurance covers the following losses:

- Trip delays or cancellation

- Hijack

- Loss of passport

- Loss of baggage/ loss of personal belongings

- Emergency evacuation

- Death of a person

- Disability of the insured person

- Hotel booking/Bounced airline

- Medical urgencies/ Accidents

Things to remember while applying for a travel insurance plan

There are hundreds or thousands of travel plans available in the market, and it’s essential to understand what your need is so that you can purchase the right kind of insurance plan.

- What kind of trip are you planning?

- How old are you? Are you young? Elderly?

- Are you traveling solo? With family or with a group?

- What exactly would you like to cover in your travel insurance?

- What will be your trip length- a few days or several months?

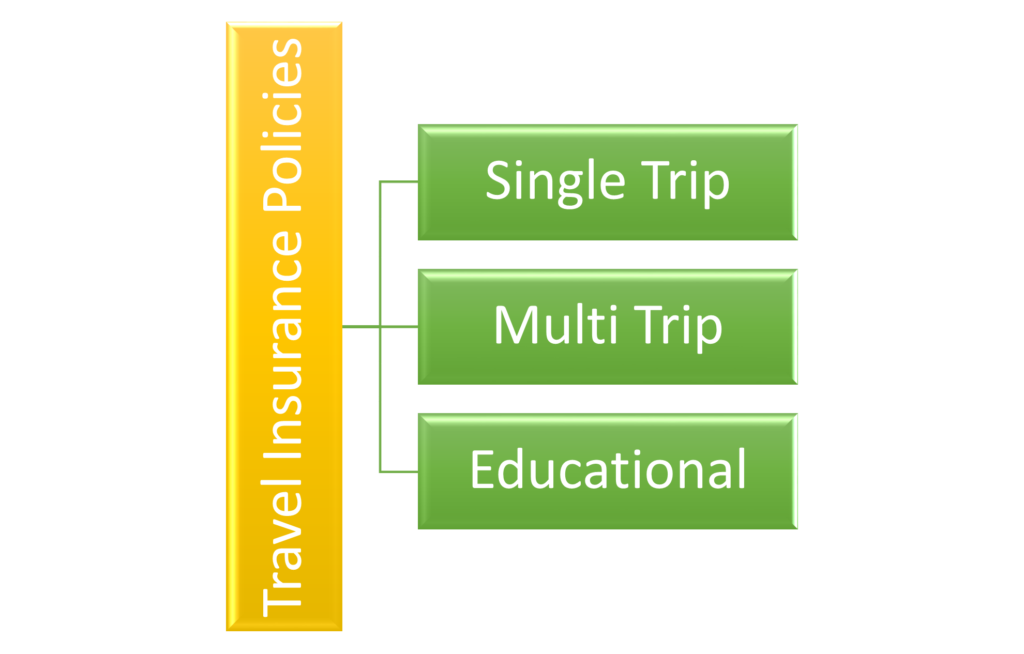

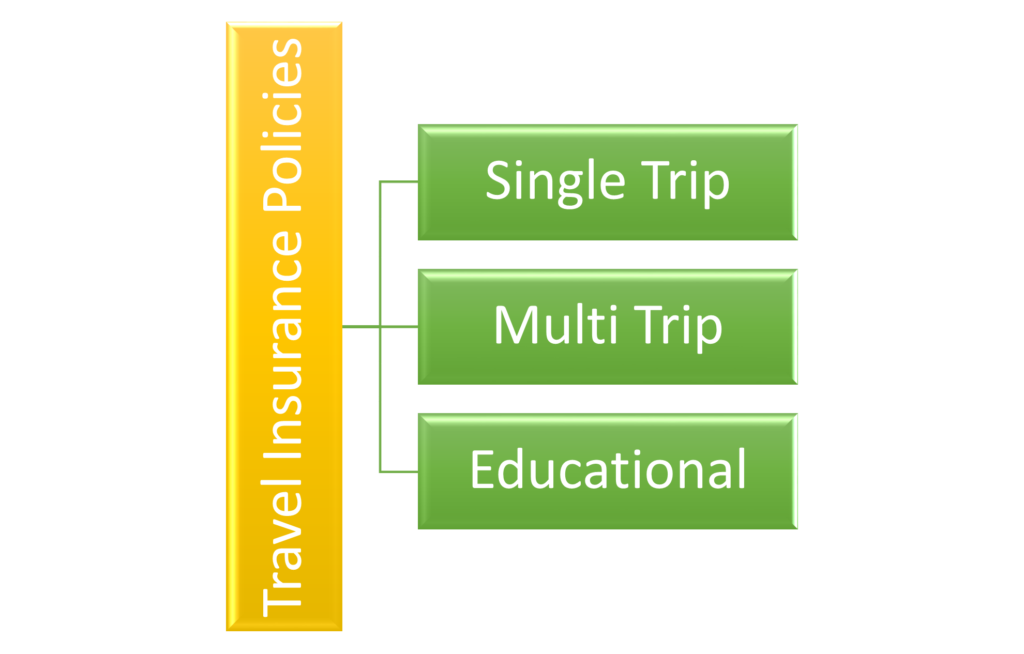

Types of travel insurance plans

Travel insurance can be broadly categorized into different spectrums, such as international travel insurance policy and domestic travel insurance policy. Particularly, an insurance policy provides coverage for a single trip.

But you can also opt for policies that cover multiple trips. Here we’ve listed types of travel insurance policies:

1. Single-trip travel insurance policy

The one-time travel insurance policy only covers one single trip.

2. Multi-trip policy

If you’re a frequent traveler, you should go for a multi-trip policy. It covers your multiple trips to different destinations for a long period, such as for an entire year. If you’re a businessman or a travel enthusiast, this one is for you.

3. Educational travel insurance policy

Students who fly overseas for educational purposes should opt for an educational travel insurance policy. You will get coverage for like 30 or 45 days.

Should I buy Travel insurance for Canada?

It’s recommended to travel shielded while flying overseas. Carrying travel insurance for Canada will cover you against unforeseen contingencies. Also, while applying for Canadian citizenship and immigration in Canada, you will be required to show proof of emergency Canada travel insurance for getting a visitor’s visa in Canada. Buying travel insurance in Canada will save you against unexpected medical emergencies, baggage loss, loss of passports, and loss of personal belongings.

What does travel insurance in Canada cover?

Here we have outlined all the things that come covered under Canada travel insurance-

- Emergency hospitalization

- Medical evacuation

- Accidental death

- Hijack

- Pre-existing diseases

- Loss of luggage

- Up-gradation to business class

What Canadian insurance plan does not cover?

It’s important to know what your travel plan covers, but it’s also important to know what your travel plan does not cover so you can plan things accordingly-

- If you’re flying for medical treatment that is needed to be taken outside the country.

- A medical emergency that occurred due to the influence of alcohol or drugs will not be covered.

Where can you get travel insurance?

You can buy your travel insurance through your:

- Credit card company

- Insurance broker

- Travel agent

- Employer’s insurance provider