Understanding GICs In Canada

Are you looking for ways to augment your fixed income? Do you feel that mutual funds, exchange-traded funds (ETFs), and the stock market do not suit you? Well, you have landed on the right page as we will tell you everything about GICs (General Investment Certificates) and their diverse types. So, keep reading and make yourself financially literate.

Source: Freepik

What Do You Mean GIC In Simple Language?

GIC stands for General Investment Certificate. These are several investors who are highly conservative and possess a low-risk appetite. Even an afterthought of losing the principal amount and accumulated interest sends chills down their spines.

A highly safe, predictable, and guaranteed investment product, known as the GIC, controls such a market of investors. Several financial institutions and lenders issue it for you to earn a fixed income on your principal investment.

Owing to the changes in people’s perception and the ever-growing investment market, GICs have also grown and are available in diverse types. Let us now discuss and read about them.

What Are the Different GICs based on Interest Rate?

GICs typically comprise two elements: –The Interest Rate and the Tenure or The Period of investment.

To stand out and offer something new to the investors, most financial institutions have created several GICs by altering the interest rate.

Some of the GICs are:

1. Fixed-Rate GIC

The most common and popular type of GIC that has a fixed tenure and an interest rate. For example, if a 2-year GIC is available at an interest rate of 2% per annum and you have invested $50,000 in it, then you will get the following returns:

- Interest amount, which is equal to $1,000 ($50,000 * 2% per annum)

- Maturity amount, which is equal to $51,000 [$50,000 (Principal)+$1,000 (Interest)]

No matter how long the tenure, the interest rate of a fixed-rate GIC remains constant and will fetch you a similar interest every year. The return generated by a fixed-rate GIC we can always express as a flat line on a graph:

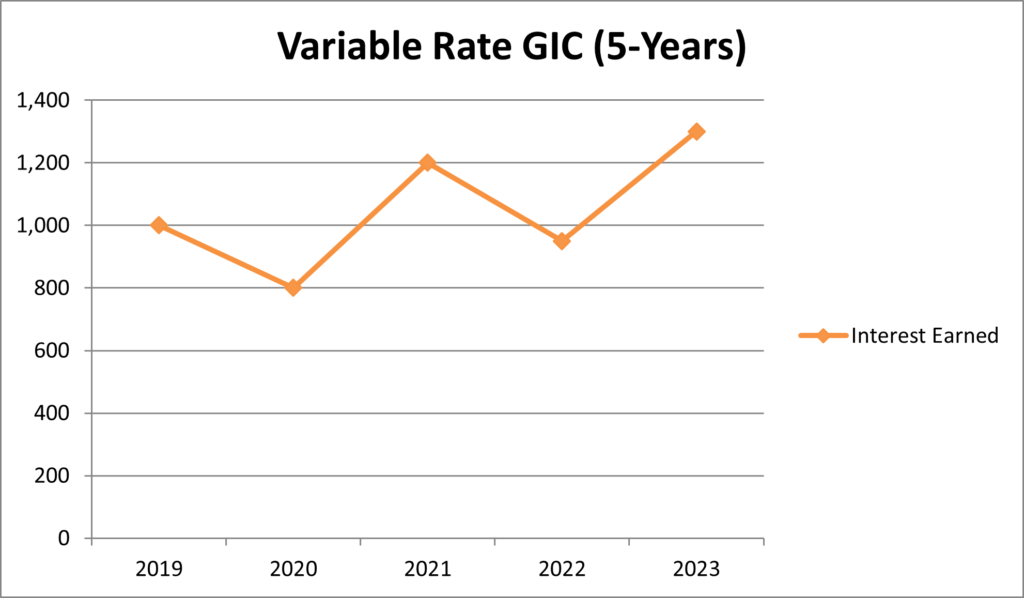

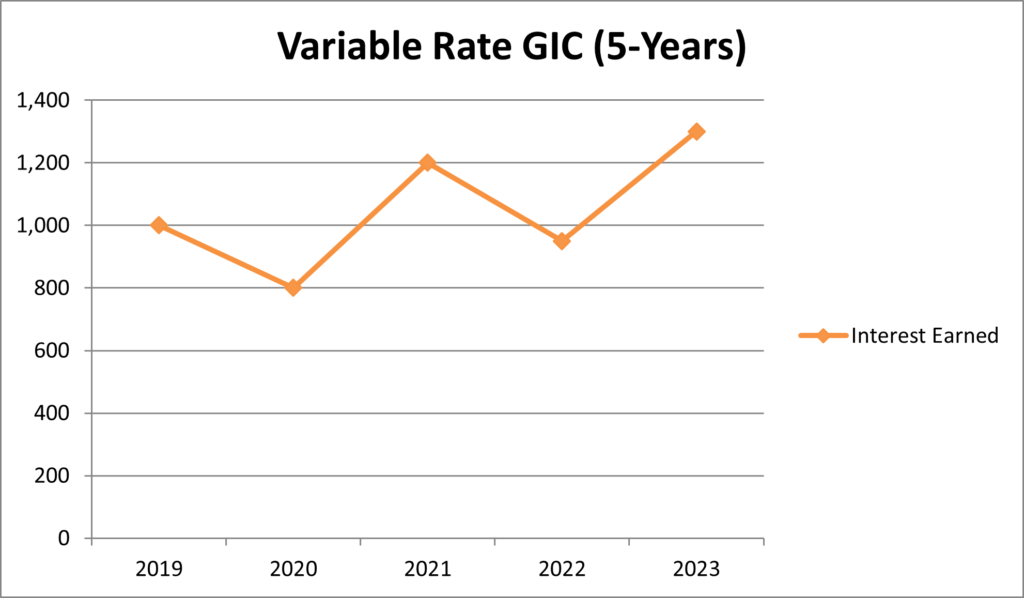

2. Variable-Rate GIC

As the name suggests, in a variable rate GIC, the interest rate varies and changes following the prime rate of a financial institution.

| Prime Rate of a Financial Institution | Interest Rate offered by a Variable Rate GIC | Effect on the Investors |

| Increase | Increase | Favourable, as the investors will earn a higher interest |

| Decrease | Decrease | Adverse, as the investors will earn a lower interest |

Owing to the fluctuations in the interest rate, the interest income earned by such investors of GIC changes periodically. Thus, we can exhibit the returns offered on a graph through a zigzag line:

3. Step-Rate GIC

If you are a conservative investor and cannot resist the sight of earning lesser than before, a step rate GIC can surely help you gain an increasing interest income every year.

Unlike variable-rate GIC, in which the interest rate can decrease as well, in a Step rate GIC, your interest rate will increase yearly. This investment product allows you to earn a constant increase in interest income throughout the tenure of such a GIC.

On a graph, the returns generated by a Step rate GIC look like this:

4. Market-Linked or Equity-Linked GICs

Because of the limited options earlier, the GIC was an investment product meant only for ultra-conservative investors. However, to make it more attractive and appealing to even the investors with a moderate risk appetite, they developed an Equity-linked GIC.

The performance of such a GIC depends on the assets/ stocks it has invested. They often tie the return available to a GIC investor to the market.

In periods when the market performs poorly, you will see the returns of your GIC falling. Conversely, when the market performs exceptionally well, your overall GIC return can beat the returns offered by the other GICs.

The graph of an Equity-linked GIC is like a Variable-rate GIC. But it shows a considerable variation as it considers the rapid market fluctuations.

What Are the Different GICs based on Registration?

Apart from the different interest rates offered by the various GICs, these can also be differentiated based on their registration criteria. Some common types of such GICs are:

1. Registered GIC

- These GICs are an eligible investment in the RRSPs, RRIFs, and TFSAs, which are government-registered savings accounts typically a part of the retirement planning.

- You need to contribute a sum of money annually into these accounts you have invested per your directions.

- You can directly invest your annual contributions into these accounts in the Registered GICs.

- The income earned from such GIC investments is tax-free, and as a result, you gain a higher return.

2. Non-Registered GICs

- These GICs are not an eligible investment for the contributions made in the RRSP, RRIF, and TFSA.

- The interest income earned from such GICs is taxable and is not tax-sheltered

3. Foreign Exchange GICs

- It represents all the GICs that are:

- Held in any currency other than the Canadian Dollar and

- Held by Canadian Financial Institutions

- One of the most popular Foreign Exchange GICs is a U. S Dollar GIC.

- These GICs will let you earn interest in the foreign currency. For example, a US Dollar GIC will let you receive interest in the US Dollars.

- Foreign Exchange GICs have minimal capital risk, as the Canada Deposit Insurance Corporation insures these (CDIC) for up to $100,000 per beneficiary.

At A Glance

| S. No. | Types of GICs | Major Feature |

| 1. | Fixed-Rate GIC | The interest rate remains fixed throughout the tenure. |

| 2. | Variable-Rate GIC | The interest rate fluctuates following the Prime rate of the issuer. |

| 3. | Step-Rate GIC | The interest rate increases every year. |

| 4. | Market/ Equity-Linked GIC | The interest rate fluctuates following the market performance. |

| 5. | Registered GIC | The interest income is tax-sheltered, and you can invest your contributions to RRSP, RRIF, and TFSA in the Registered GICs. |

| 6. | Non-registered GIC | The interest income earned is taxable |

| 7. | Foreign Exchange GIC | It earned interest in foreign currency. |