What Is The Guaranteed Income Supplement In Canada?

The Government of Canada offers a fixed monthly payment to its old-age citizens. Are you aware of the same? Do you wish to avail yourself of the benefits or your parents? If yes, this article will give you all the information you need about this scheme. So, keep reading till the very end.

Source: Freepik

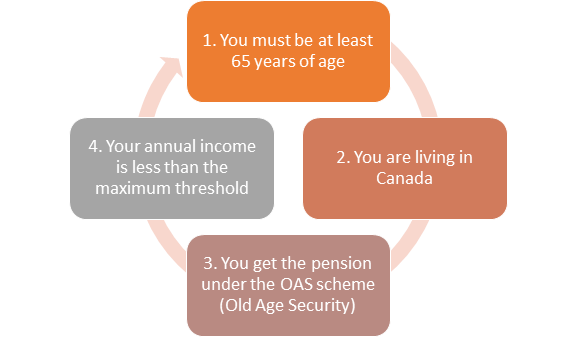

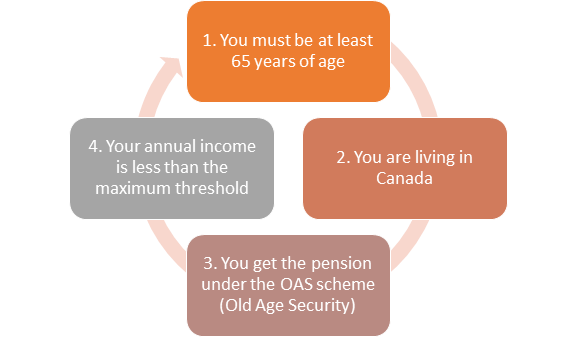

What Are the Conditions to Fulfil?

The Government of Canada pays a fixed monthly income to the eligible beneficiaries under the scheme of Guaranteed Income Supplement. To receive these benefits, you must satisfy all the conditions mentioned below:

What Are the Unique Features of This Scheme?

| S. No. | Features |

| 1. | The benefits received under this scheme vary and depend upon your income. |

| 2. | The monthly payments so received are exempt from tax. |

| 3. | • As soon as you turn 64, usually, the Government of Canada intimates you about this scheme within a month. • This intimation happens by way of sending you a letter. • In some cases, eligible beneficiaries are not intimated due to a lack of information. • In all such cases, you can apply voluntarily as well. |

| 4. | You will receive your first payment in the first month after you turn 65 |

| 5. | You will keep on receiving the monthly benefits until you remain compliant and file your income tax returns annually in a timely fashion |

| 6. | In case you have not received your payment for the month, you can contact the department via the following modes: • By Phone: Using the toll-free number 1-800-277-9914 • Online: Using My Service Canada Account • By Post: Send your documents to the nearest Service Canada Office • In Person: By visiting your nearest Service Canada Office |

What Amount Will You Receive Under GIS?

To get an amount under GIS, you need to be an active pensioner under the scheme of Old Age Security (OAS). Besides this, the calculation of the monthly amount payable entirely depends upon:

- Your situation (explained below),

and

- Your annual income

Let us now understand the different situations:

The situation I: You are Single, Widowed, or Divorced

In such a situation:

- You can get a maximum monthly payment of $968.86

IF

- Your annual income is less than $19,656

If your annual income is higher than this and sets the threshold, you are not eligible to receive any monthly benefit under GIS.

Situation II: You are living with a Spouse or a Common-law Partner

If you are living with a partner, there are three different sub-situations:

| Sub-Situations | Description | Maximum Amount Payable under GIS | The Combined Annual Income of You and Your Spouse or Common-Law Partner |

| I | If your spouse or common-law partner–Receives a Full OAS Pension | $583.20 | Less than $25,968 |

| II | If your spouse or common-law partner – Receives the Allowance | $583.20 | Less than $36,384 |

| III | If your spouse or common-law partner -Does not Receive any OAS Pension | $968.86 | Less than $47,136 |

What Are the Various Allowances Paid Under the GIS Scheme?

The monthly benefits paid under the GIS scheme cover you, your spouse, or your common-law partner can also receive these benefits. Further, besides receiving a monthly income under GIS, you can also get an allowance for the survivor.

Below are the two types of allowances paid under this scheme and their respective conditions:

| Conditions for receiving an allowance for your spouse or common-law partner | Conditions for receiving an allowance for the survivor |

| Your spouse or common-law partner: • Must be between 60 to 64 years of age (both limits inclusive) • Is either: a) A legal resident of Canada or b) A Canadian citizen • Is presently residing in Canada • Has resided in Canada for at least 10 years since the age of 18 | • You are between 60 and 64 years of age (both limits inclusive) • Your spouse or common-law partner has died and presently you are not in any sort of marriage or common-law relationship. |

| The combined annual income of you and your spouse/ common-law partner is within the set threshold. | Your annual income is less than the set threshold. |

| If your spouse or the common-law partner is receiving the benefits under GIS and the Full OAS pension: • You will get a Maximum Monthly Allowance of $1,231.87 IF • The combined annual income of you and your spouse or common-law partner is less than $36,384 | The maximum amount of monthly allowance that you can get is $1,468.47 IF your annual income is less than $26,496 |

What Do You Do While Receiving Benefits Under GIS?

- It is pertinent to note that whatever amount you receive under GIS will add to your Old Age Security (OAS) Pension and get directly credited as a single amount in your bank account.

- The benefits received under GIS are tax-free, and you are not required to include them in your total income for income tax purposes.

- However, you are still required to file your taxes by April 30 each year, or else there are chances that your payments might get disrupted.

- You are required to intimate the government if:

- Out of Canada for over six months. During these months, they will not pay you any amount under GIS.

- There is a change in your marital status.

- You are serving your sentence in federal prison.

- There is a change in your income level or the combined income. You need to give this intimation to the government by June 30.