Ins and Outs of Loss of Employment Insurance: What Canadians Need to Know?

Did you know that Canada’s unemployment rate has gone up to 6.1%?

Losing a job can feel like getting lost in a big, confusing maze. You might feel worried, stressed, or even scared about what’s going to happen next.

That’s where Loss of Employment Insurance steps in like a helpful guide. However, it can be a bit of a puzzle to understand this insurance well.

In this easy-to-follow guide, we’re going to break down everything you need to know about job loss protection insurance.

What’s Loss of Employment Insurance?

The loss of employment insurance, commonly known as Employment Insurance (EI), is a type of plan that gives you money when you don’t have a job. The loss of income can prove challenging for you to cover your daily expenses, bills, and debts.

If you have savings, they may quickly deplete as you rely on them to cover expenses while unemployed. In such cases, employment insurance works as a safety net to provide some source of income.

However, there are some rules to get it. If you quit your job for no good reason or get fired because of something you did wrong, you might not get EI.

Do You Qualify for Loss of Employment Insurance in Canada?

In this section, we will discuss the eligibility criteria for loss of employment insurance.

General Eligibility Criteria

To get EI Regular benefits, it’s important to prove that you:

- Had a job where you paid into EI or job loss protection insurance

- Lost your job for reasons beyond your control like flooding or fire

- Didn’t work or get paid for at least a week in the last 52 weeks

- Worked enough hours in the last 52 weeks

- Are ready and able to work each day

- Are actively hunting for a job (keep track of employers or companies you have contacted)

Eligibility Criteria for Specific Occupations

If you are related to jobs like farming, fishing, teaching, and more, you can find the eligibility information below:

- Farming

- Farmers working in insurable jobs may qualify for EI benefits.

- Self-employed farmers could access special EI benefits.

- Fishing

- Loss of employment insurance provides fishing benefits for self-employed fishers actively seeking work.

- Eligibility for EI fishing benefits depends on earnings, not insurable hours.

- Fishers may qualify for various benefits including regular fishing benefits, sickness, maternity, parental, compassionate care, and family caregiver benefits.

- Teaching

- Teachers with permanent contracts at some schools don’t get the usual benefits when they’re not teaching unless their contract finishes. They might still qualify for specific benefits like maternity or parental leave.

- Teachers at higher levels like universities or community colleges follow regular EI rules.

- Casual or substitute teachers can receive regular benefits during non-teaching periods.

- Self-Employed People

- If you own a business or control over 40% of a corporation’s voting shares, you can access special benefits after 12 months of registering.

- You could get financial support up to 55% of your earnings when you take time off to care for yourself, children, or family members, with a maximum of $668 per week in 2024.

- To qualify, you must meet the conditions of the loss of employment insurance benefit you’re applying for.

- You need to be a Canadian citizen or permanent resident.You must be registered in the self-employed program for at least 12 months.

- You should have reduced your business involvement by over 40% for at least one week.

- You must have earned a minimum amount of net self-employed earnings between January 1 and December 31 of the year before applying for benefits.

- Canadian Force Members

- Canadian Forces Members (regular or reservist) can get Employment Insurance Act benefits like regular, maternity, parental, sickness, compassionate care, and family caregiver benefits.

- Parental benefits last up to 52 weeks for standard benefits or 78 weeks for extended benefits, with up to 35 or 61 weeks respectively, plus extra weeks if shared with the other parent(s).

- Workers Outside Canada

- People who are living outside Canada, but previously resided in the US, can get EI benefits.

- Non-residents of Canada or the US with a valid Social Insurance Number can apply for specific benefits.

- Commuters crossing the Canada-US border regularly can also qualify for EI benefits.

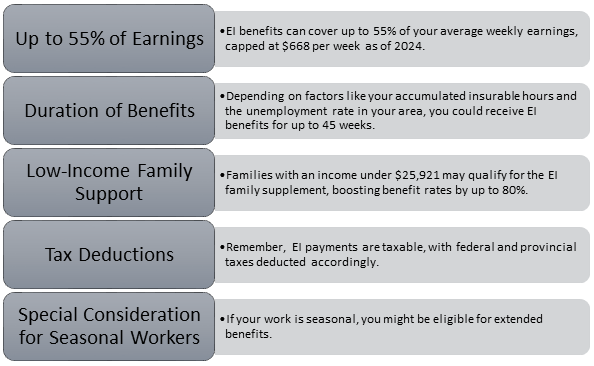

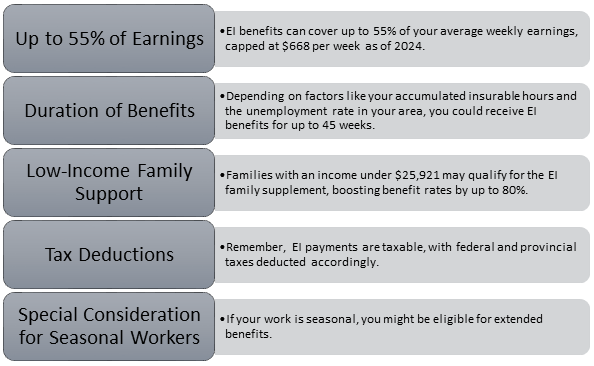

How Many Benefits You Could Receive through Loss of Employment Insurance?

If you have jobs like farming, fishing, teaching, and more, you can find the eligibility information below for your consideration.

Here’s a breakdown in simple terms:

How to Apply for Loss of Employment Insurance in Canada?

To apply for Employment Insurance (EI) benefits in Canada, follow these steps:

- Go to the official Government of Canada website and navigate to the Employment Insurance section.

- Fill out the online EI application form. Provide accurate information about your SIN (Social Insurance Number), employment history, reasons for unemployment, and personal details. Apply promptly to avoid losing benefits within 4 weeks of your last work day.

- Once you’ve completed the form, submit it online through the website. You may need to create an account or sign in to an existing one.

- After submitting your application, it will be processed by the government. You may be contacted for additional information if needed.

- You’ll then receive a decision regarding your EI application, typically within a few weeks. If approved, you’ll start receiving benefits according to the payment schedule.

- Keep track of any job search activities as you may be required to report them regularly to continue receiving benefits.

What are the Things to Consider in Loss of Employment Insurance?

When dealing with loss of employment insurance in Canada, there are several key factors to consider:

- It’s important to submit biweekly reports on time to maintain benefits eligibility.

- Report any work or earnings accurately to prevent overpayment.

- Inform “Service Canada” about any travel plans outside Canada.

- Benefits end when the entitlement period expires or upon request termination.

- Remember that EI benefits are taxable income and may affect your overall tax situation.

- You can receive various types of benefits within a benefit period.

- Deductions can be made from benefits for overpayments or advances.

- Understand your rights and responsibilities while receiving benefits. You have the right to file a claim, receive benefits, and appeal decisions.

- Consider the duration of EI benefits, which can vary depending on factors such as the unemployment rate in your region and the number of insurable hours accumulated.

- Know how EI benefits are calculated based on your earnings and the maximum amount you could receive per week.

The Bottom Lines

In summary, understanding the ins and outs of loss of employment insurance is crucial for Canadians facing job loss. By knowing the eligibility criteria, application process, and how to navigate benefits, individuals can access the support they need during challenging times. It’s like your trusty map in the maze of job loss.

People Also Ask

Q. When can I expect a decision on my EI application?

Generally, decisions are made within 28 days of filing your application.

Q. How can I avoid delays in processing my application?

Ensure all required documents and information are provided, check online for your records of employment, and submit your biweekly reports.

Q. How can I review the status of my application?

Sign in to My Service Canada Account (MSCA) to check your banking information, address, telephone number, claim status, and messages.

Q. What should I do if I disagree with the decision about my loss of employment insurance application?

If you disagree with the decision, you have 30 days from when you were told about it to ask Service Canada to take another look, and they can help you through the process.