How to Creatively Use Life Insurance for Seniors? Explore Top 5 Plans in Canada!

Are you a senior in Canada worried about your financial security? Do you want to leave something behind your loved ones? Well, you’re not alone.

Many seniors face this challenge. But there’s a solution – Life Insurance for Seniors!

However, this special insurance isn’t just for after you’re gone—it can also help you reach your unique goals while you’re still alive. This post will show how seniors can uniquely use their life insurance policies. Plus, we’ll take a look at the top five plans available in Canada.

What’s Life Insurance for Seniors?

Life insurance for seniors is a special kind of insurance just for older people. If a senior has this insurance and passes away, their family gets money from the insurance company. This money helps pay for things like funeral costs, bills, or anything else the senior might have left behind.

Let’s say there’s a grandma named Mary. She’s worried about what might happen to her family if something happens to her. So, Mary decides to get the best term life insurance. She chooses a plan that will give her family money if she passes away.

Sadly, a few years later, Mary does pass away. But because she had life insurance, her family got some money from the insurance company. They used this money to pay for Mary’s funeral and to cover some bills she left behind. With this help, Mary’s family feels more secure during a tough time.

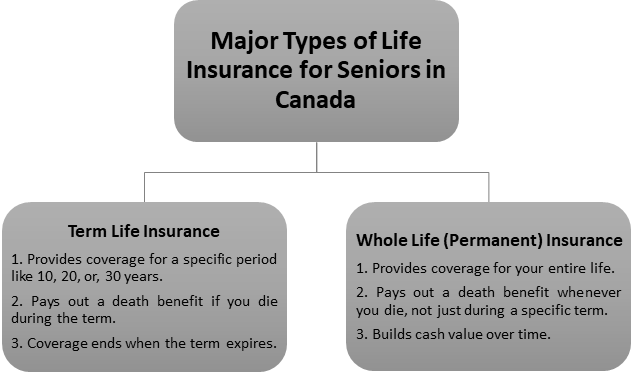

Types of Life Insurance for Seniors Available in Canada

In Canada, there are two main types of life insurance for seniors: term and whole (permanent) life insurance. Each has different features like cash value growth and investment opportunities. However, there are many sub-options available in the market. The best one for you depends on your needs and goals.

How Much is the Creative Potential of Life Insurance for Seniors?

From supplementing retirement income to covering unexpected expenses, here are the seven unique ways seniors can use their life insurance:

- As an Income Source for Retirement

Life insurance can be a smart way for seniors to supplement their retirement income. Seniors can build up a significant cash value by choosing certain policies like whole life insurance.

This cash value can then be accessed during retirement to provide additional income. It helps to cover everyday expenses or enjoy leisure activities.

- Paying Debts

Seniors in Canada may have outstanding debts like mortgages, loans, or credit card balances. Let’s take a look at some of the 2019 statistics from Statistics Canada!

| Assets and Debts Held by Economic Family Type in Canada | For the Age Group 55-64 Years | For the Age Group Above 65 Years |

| Average Value for Those Holding Debt | $80,600 | $49,900 |

| Percentage Holding Asset or Debt | 58.7% | 36.8% |

Overall, the above table indicates that, on average, economic families in both age groups hold almost similar amounts of debt. It also states that the debt percentage decreases as age increases but it does not vanish completely.

Life insurance for senior citizens can help ensure that these debts are taken care of even after they’re gone. For instance, the death benefit from any best term life insurance can be used by their beneficiaries to pay off these debts, relieving financial burdens on their loved ones.

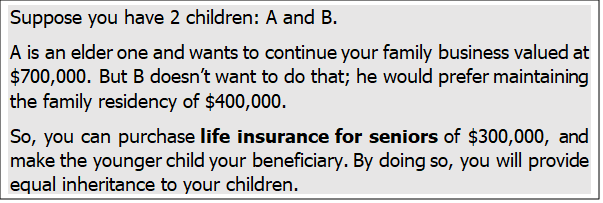

- Providing Equal Inheritance to Children

If you own property or a business and have children, you may want to leave an inheritance to each of them. However, if your children have different wishes, such as one wanting to continue the family business and the others not, it can be challenging to divide assets equally.

Senior citizens’ life insurance can help solve this problem by providing a source of funds to equalize inheritances. They can distribute the benefits from a life insurance policy to compensate children who may not receive certain assets, ensuring fairness and harmony among heirs.

Want to know how? Consider the example below!

- Covering Illnesses

The policies also offer options to add extra benefits in the form of riders by paying some additional amount. For example, critical illness riders and disability riders can be added to cover expenses in case of illnesses like cancer or heart disease.

This ensures that seniors don’t face financial hardship if they fall ill and need costly medical treatments or long-term care. So, whether you are calculating a whole life or term life insurance quote, keep in mind the price increase.

- Paying Income Taxes

Seniors can also choose a life insurance policy with enough coverage to offset expected estate taxes. This ensures that their property can be passed down without burdening their heirs with hefty tax bills. This approach safeguards family wealth and allows assets like a family cottage to remain in the family for future generations.

- Charitable Donations

They can make charitable organizations beneficiaries of their life insurance policies. This means that when the policyholder passes away, the money from the policy goes to the charity instead of family members or others. This is a simple way to support a cause and leave an impact even after you’re gone.

What’s the Top 5 Life Insurance for Seniors in Canada?

Here’s a simplified table outlining some popular life insurance for seniors in Canada!

| Name | Eligibility | Key Features |

| Canada Protection Plan | 18 – 80 Years | Up to $1,000,000 Coverage |

| TD Guaranteed Acceptance Life Insurance | 50 – 75 Years | Up to $25,000 Coverage |

| Desjardins’ 50+ Life Insurance | Over 50 Years | No Medical Exam and Waiting Period |

| BMO’s Term Life Insurance | 18 – 75 Years | Coverage for 10/15/20/25/30 Years |

| RBC’s Permanent Life Insurance | 0 – 85 Years | Coverage of $25,000 to $25,000,000 for Life |

The Bottom Lines

In conclusion, life insurance for seniors in Canada is a versatile tool with various creative applications. Whether it’s generating retirement income, paying off debts, or even managing taxes, the tool stands as a reliable ally.

So, let the curtains rise on this ode to creativity! With the top plans above and careful understanding, seniors in Canada can shape their legacy with strength and endless opportunities.

People Also Ask

Q. Can I use life insurance for seniors to fund my dream vacation?

A: While life insurance is mainly for financial security, some policies offer cash value that can be used for things like travel. However, it’s essential to consider your long-term financial goals before using life insurance for vacations.

Q. Will life insurance cover me if I decide to become a professional athlete?

A: Life insurance usually doesn’t cover high-risk activities like professional sports. If you plan to pursue a career as a professional athlete, it’s essential to discuss your insurance needs with an insurance advisor who can recommend suitable coverage options.

Q. Can I borrow money from my life insurance for seniors to buy a new phone?

A: You can borrow money against the cash value provided by whole life and universal life insurance policies. However, you cannot do so with your term life insurance.

Q. Is it possible to name my favorite teacher as the beneficiary of my life insurance?

A: Yes, you can name anyone you wish as the beneficiary of your life insurance policy, including your favorite teacher. Just make sure to discuss your decision with them beforehand and provide them with the necessary information to make a claim if needed.

Q. How is the calculation of the term life insurance quote carried out?

A: The quote is based on several factors like your health, age, lifestyle, the duration of the term you want, the coverage amount you want, and more.

Q. Can I add my pet as a beneficiary of my life insurance?

A: Unfortunately, you can’t do so. Life insurance is typically meant to benefit humans, like family members or charities.