Business Insurance: Vital Investment for Growth and Legal Protection

In life’s intricate tapestry, insurance stands as the guardian of value, the shield against adversity.

Life Insurance: A beacon of financial security for your cherished ones when you’re no longer present.

Car Insurance: A safety net against road mishaps, mending your car’s wounds without emptying your wallet.

Business Insurance: A fortress for visionary entrepreneurs, repelling legal challenges that customers might wield.

In Canada, no legal decree mandates business insurance, yet its armor proves invaluable when tides turn.

Business Insurance

Credits: pexels

All the business owners and entrepreneurs in Canada must have thought at the initial point of starting their business whether they should get their business insured or not.

- However, business experts have advised you to get your business insured as it will protect you from potential risks associated with a business pursuit.

- It is likely that the insurance premiums when you are starting your business will be a burden as you have a lot of other expenses to take care of, but having business insurance is worth it.

Every business, whether small or big, has the risk of customers making allegations about your product or your service, and it will land you in big trouble.

However, if you have business insurance, you are protected from such allegations and all the legal risks associated with them.

- Business insurance might seem unnecessary at first, but it can help you from legal troubles if you decide to navigate your business options more.

What is business insurance?

Credits: pexels

All businesses bear the risk of getting legal allegations. Business insurance protects you from such legal allegations.

Different types of business insurance provide coverage for various aspects of your business.

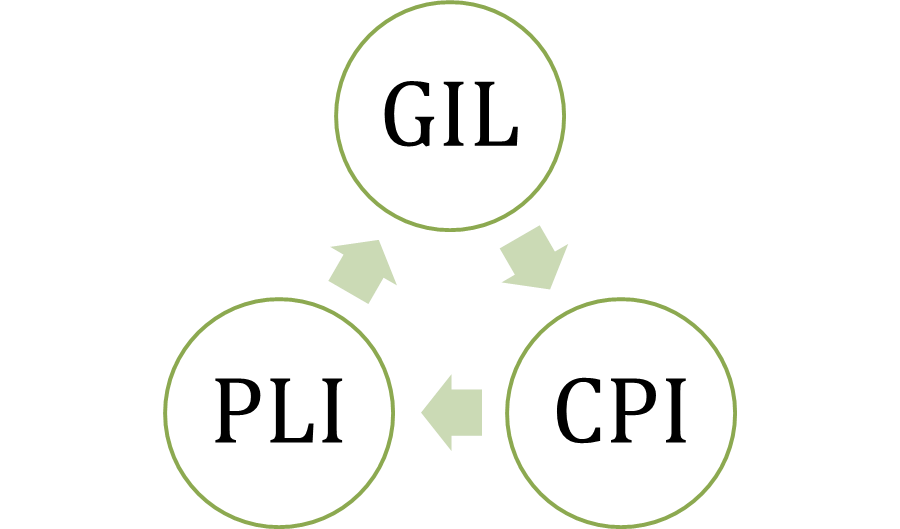

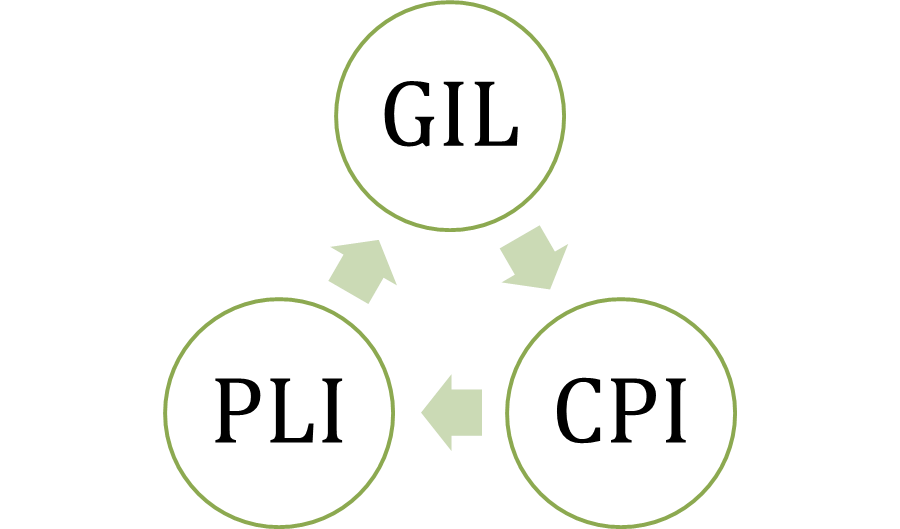

1. General Liability Insurance

A GLI or General Liability Insurance protects you against property damage or bodily injuries caused by your services or products.

2. Commercial Property Insurance

A CPI or Commercial Property Insurance secures your property premises from any damages.

3. Professional Liability Insurance (Errors and Omissions Insurance)

Professional Liability Insurance, sometimes known as errors and omissions insurance, covers your legal costs.

- If a lawsuit with claims of errors of negligence or error related to your work shows up, this insurance will cover all the legal fees associated with it.

These three insurances are the most common types of insurance. There are several other insurances to choose from.

- If you are unable to operate your business due to any unfortunate event, you must have business interruption coverage.

- Crime coverage helps you in case of cyberattacks.

- Management liability insurance helps cover damage due to any error committed by your company officers or directors.

You must consider demography, your business type, and potential liabilities or exposures that may occur if an event arises.

When must you insure your business?

Credits: pixabay

You are not legally bound to purchase business insurance in Canada.

- There are no laws in Canada that force a business owner to buy insurance if they reach a certain revenue threshold or number of employees.

- It is advised by financial experts to have coverage if your business is growing.

When your company gets bigger, the damages or repercussions you can face increase steadily, and you might face a lot of damages if not insured.

- As your business increases, your customer increases, and you sell many products or services, hence chances of errors or damages might occur to a consumer’s product that might land you in trouble.

The type of insurance you need will depend on your industry. People working in the engineering or construction business must have professional liability insurance.

While freelancers who are into graphic designing (working from home) might require additional coverage because home insurance might not cover the high-end camera or laptop that is your business equipment.

The Cost of Insurance for a Small Business

Credits: Pixabay

The insurance sector is very competitive, and the market rates vary from policy to policy.

Several factors that influence the cost of an insurance policy:

- Revenue of the company

- Number of employees

- Business owner’s experience

You must go through multiple policies to find the best business insurance policy that protects your business.

You must know the risks associated with your business and all the events that might happen that can shake the foundation of your business.

Conclusion

In Canada, laws don’t demand business insurance, but wisdom does. When your business is thriving and growing, it’s time to shield it with insurance.