Financial Freedom Accelerated: The Ultimate Guide to Paying Off Your Mortgage Early

Indeed, everybody wants to pay off their debts. It not only saves you from making interest payments and from making interest payments but also gives you immense mental satisfaction. Of course, nobody wants to part away with a large portion of their income towards EMIs. This blog discusses the best steps to pay off your mortgage early. Hence, keep reading and end your debt slavery at the earliest

Top Steps for Clearing Your Mortgage Loan Early

Let us assume that you have a mortgage loan having a principal amount of $500,000 at a mortgage rate of 4.25% per annum for 20 years. Now you want to pay it off. How will you do this? –

- You will exceed your monthly mortgage payments. That is, if your regular EMI is $3,096, you will wish to pay more than that every month

- You might prefer to repay more frequently so that you can reduce your outstanding principal amount as well as pay less interest

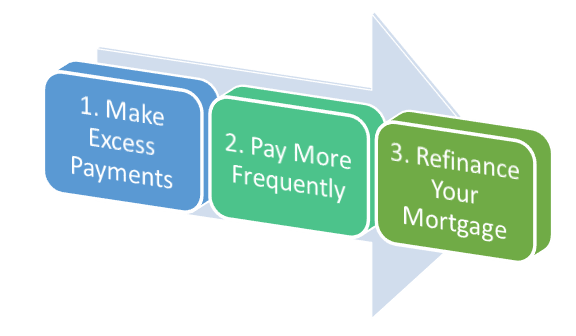

Below are the top ways to pay your mortgage loan early. These are:

1. Making Excess Payments

It is the simplest method of paying off your mortgage loan early. If you go by the repayment schedule given by the lender, you will never be able to pay off your loans before the decided tenure.

Hence, to do this, you need to pay more than you are required to pay monthly. For example, if your monthly mortgage payment is $5,000, you can pay $30,000. This excess of $25,000 will directly reduce your outstanding mortgage debt.

Doing it regularly every month, you can pay off your mortgage debt well before the tenure. Moreover, you will be saving several hundred dollars in interest costs.

The Prepayment Privilege and Penalty

While making any excess payments, you must consider the limit of prepayment privilege. It refers to the amount that you can contribute every month towards your mortgage loan without attracting any penalty.

Usually, it is about 15-20% of the mortgage loan amount. For example, if your mortgage debt is $400,000, then in a single year, you can contribute a maximum of $60,000 to $80,000.

If you surpass or breach the limit of prepayment privilege, you will be required to pay a penalty to the lender.

Why do lenders levy prepayment penalties?

You might be thinking that why are you penalized for paying early? Prepayments provide ready cash to the lenders that can be disbursed again and even reduces the default risk. But still, they levy penalties – why so?

Well, by making an excess payment you have disturbed the cash flow of your lender since they were not expecting any additional money from your end. The amount your prepaid could not be deployed by your lender at attractive interest rates.

As a result, they suffer losses and levy penalties to get compensated. Hence, while making excess payments, you must ensure you are within the ambit of prepayment privilege.

2. Pay More Frequently

You can even make payments towards your mortgage loan more frequently. That is, instead of making one payment once a month, you can choose to pay weekly. It will reduce the outstanding debt quickly and save your interest cost.

Below are some mortgage payment options using which you can make excess payments.

| Name of the Mortgage Payment Option* | Divide the yearly mortgage payment by | Frequency of Repayment |

| Monthly Mortgage Payment | 12 | Once a Month |

| Bi-weekly Mortgage Payment | 24 | Twice a Month |

| Accelerated Bi-weekly Mortgage Payment | 26 | Every Second Week |

| Weekly Mortgage Payment | 52 | Every Week |

| Accelerated Weekly Mortgage Payment | 52 | Every Week (with a higher amount) |

| Lumpsum Mortgage Payment | Pay lump sum amounts any time of the year | |

* Note that while making lumpsum payments every year or paying any excess amount, you must consider the limit of prepayment privilege.

3. Refinancing Your Mortgage

Under refinancing – You retire your existing debt by assuming a loan at an interest rate lower than your current.

It helps you in two ways:

- Firstly, you will be required to pay lesser interest.

- Secondly, a large portion of your monthly mortgage payment will apply toward repaying the principal amount.

Let us understand this via a practical example.

Alex and Emma took a mortgage loan of $600,000 in 2018 at a mortgage rate of 4% per annum for 20 years. The current outstanding mortgage debt at the end of 2021 is $524,501.

They have decided to refinance their mortgage loan and obtained a good deal at 3% per annum.

Alex availed of the loan at a cheaper rate and has retired his existing mortgage debt. By doing so, he will be paying a lesser monthly mortgage payment of $3,400 compared to $3,600.

It allows Alex additional room to make excess payments, directly reducing his outstanding principal amount.