What Is A Global Cashless Economy Upsurge? Complete Explanation [Updated 2023]

In the present global economy, digital payment is the order of the day. The ever-increasing internet coverage, the network of smartphones, and the emergence of mobile-based payment applications have led governments and economists to usher into a cashless economy. Is it sustainable? Let us discuss what a cashless Canadian economy would like.

What Is a Cashless Economy?

A cashless economy is one in which cash transactions are non-existent. No usage of physical legal tenders (banknotes and coins) to transact. Instead, we make all the transactions through digital payment:

- Transfer of money through net banking, Interac e-transfers, and other online banking facilities

- Leverage mobile-based payment applications, like Apple Pay Canada, PayPal Canada, Alipay, Samsung Pay Canada, etc.

- Usage of debit cards and credit cards

- Any other manner which does not involve the physical notes and coins

How Cashless is Canada?

Canadians have learned the art of making payments digitally. Payments Canada conducted a study. Based on it, there has been a whopping 40% decline in the usage of cash transactions between 2013 and 2018.

The internet, smartphones, and associated technology help Canadians to carry less cash and pay in a cashless mode.

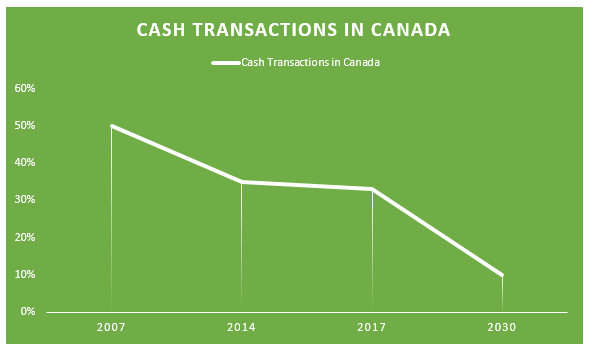

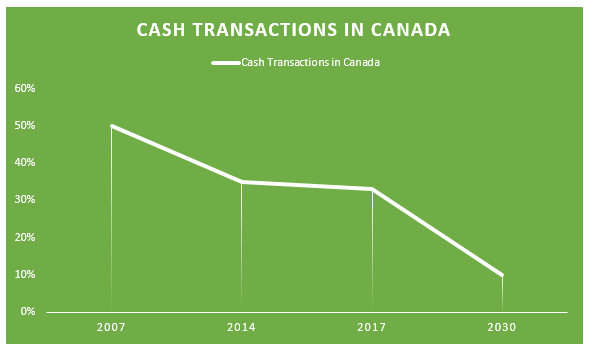

We can further understand this through the payment trends in Canada:

It is clear from the graph above that Canada is moving towards becoming a cashless society. There has been a steady decline in cash transactions. Economists have contemplated that by 2030, cash transactions will account for a mere 10% of the total volume of transactions.

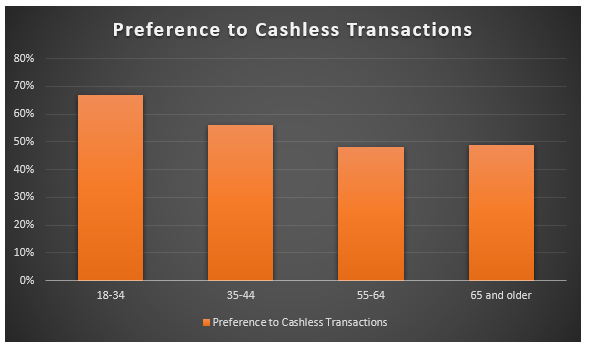

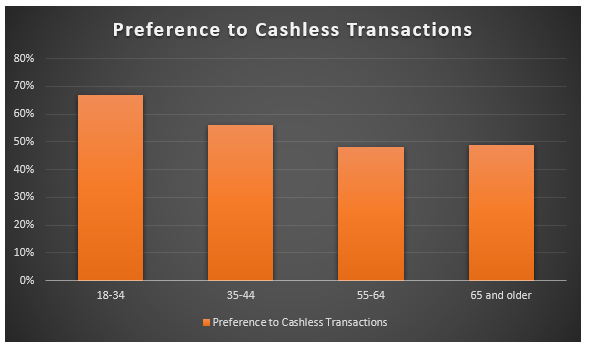

If we study this trend demographically, based on the age of the Canadians, we can get the following results:

We can observe from the chart above that 67% of younger Canadians in the age bracket of 18 to 34 prefer cashless transactions, while it is popular among the older folks.

What Are the Advantages of a Cashless Economy?

Making payments through digital wallets or using plastic money, such as credit and debit cards, is quite convenient. You are not required to carry physical cash. It also curbs the spread of the contagious virus, such as Covid-19, that can spread via physical notes and coins.

Besides, we often consider a cashless economy every government’s dream. It is primarily because of the following advantages:

1. Culmination of Black Economies

- One of the significant advantages of a cashless economy is that it is almost impossible for the underground markets and black economies to sustain.

- You cannot conceal them, as the economy records the transactions electronically.

- This way, we can unearth black money from the system and what we left with is the legal tender earned via legitimate means.

- In a cashless economy, we can see a drop in drug trafficking, terrorism, extortion, human trafficking, and other criminal activities.

2. Reduced Fake Currency

When most transactions happen via the digital route, there is a reduced dependence upon physical notes and coins. In effect, this leads to a fall in the circulation of digital currency and even discourages the offenders from printing counterfeit notes or minting counterfeit coins.

3. Improved Tax Collection

You pay income tax on whatever you earn per the applicable tax laws. In a cashless society, all your transactions get recorded digitally with minimal scope for tax evasion.

When all your receipts are digital, you cannot hide them. Instead, assess your tax liability under the Income Tax Act and other prevailing laws.

It improves the tax net of the economy and leads to better revenue collection. Thus, a cashless society also leads to reduced revenue leakage.

What Are the Disadvantages of a Cashless Economy?

It is not all spick and span. Several experts often criticize a cashless economy on the following grounds:

1. Digital Payments are Vulnerable

- Cyber-attacks, cyber-frauds, and cyber-threats are some typical terms becoming popular with the acceptance of digital payments.

- In Canada, cybercrimes numbers are increasing almost three times from 2016 (23,996 reports of cybercrimes) to 2020 (63,523 reports of cybercrimes).

- It makes digital wallets, plastic money, and net banking vulnerable to online theft and fraud.

2. Problematic For a Few

- Total elimination of cash from society could make unbanked people rely on cash transactions.

- As per a chart presented above, only 49% of the people aged 65 and older prefer to transact via digital mediums. The rest relies on cash.

- Hence, a completely cashless economy is not sustainable unless the citizens learn about modern technology.

3. Chances of Data Breach

- When you transact digitally, you usually leave behind a lot of digital traces and financial information.

- This information is always on the radar of hackers and fraudsters who use it for unjust gains.

- Data analytics companies mine personal information to prepare a database of your profile. All this usually happens without your consent.

Wrapping It Up

A cashless economy will lead to lesser revenue leakage and even make it difficult for black economies to survive.

But a completely cashless economy is not foreseeable because of a substantial unbanked population in any economy. The elderly is not in tune with the operation of this latest technology. Often these are the ones who fall prey to fraudsters and eventually lose their hard-earned money.

Hence, complete digitalization might be a dream today, but in times to come, it can indeed become a reality.

These were the top pros and cons of a cashless economy. Do you have something to add?