HSBC Advance Chequing Account vs. Bank of Montreal Premium Account – Which one would you prefer?

The HSBC Advance Chequing Account is a flexible checking account allowing unlimited day-to-day banking and free Interac e-Transfer. It offers a secure payment platform for convenient international money transfers.

The Bank of Montreal Premium Account allows you to control your finances and manage them efficiently. Using it, you can enjoy unlimited money transfers with no fee.

Let us compare both chequing accounts and see the perfect option for you.

1. HSBC Advance Chequing Account

The HSBC Advance Chequing Account offers several exciting features and benefits. You even get eligible for the full suite of HSBC credit cards, including all the rewards, cashback, and travel benefits. You can easily open this account by clicking on this link.

WELCOME OFFER

In the first 6-months, the bank waives your monthly fee of $25.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Be a major as per the age of majority set by your province. |

| c. | Must have any of the following IDs: Passport Driver’s License An ID issued by the Provincial Government |

- Interest Rate:

- This chequing account does not offer any interest on balances maintained.

- Minimum Balance:

- There is no requirement for any minimum balance

- Transactions:

- Unlimited and free Interac e-Transfer

- Free and unlimited day-to-day banking transactions

- Monthly Fees:

- There is a monthly fee of $25

- However, you will get a waiver if:

- The aggregate of personal deposits & investments maintained with the bank is $5,000 or more

or

- You are holding a personal mortgage loan from the bank, having an original amount of $150,000 or more

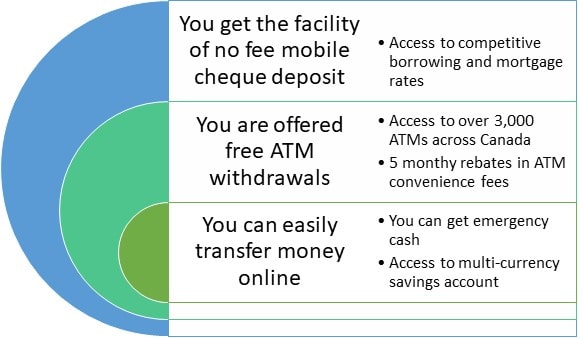

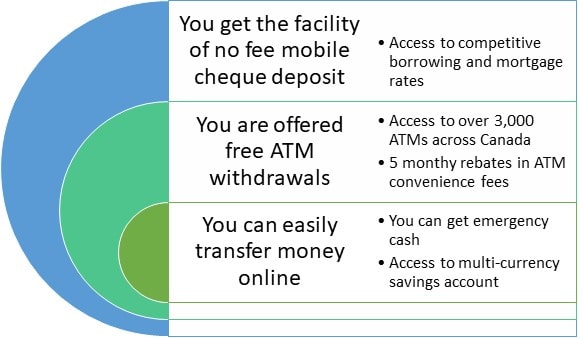

- Additional Benefits

2. Bank of Montreal Premium Account

The Bank of Montreal Premium Account offers you several exciting benefits, such as BMO Family Bundle, Unlimited non-BMO ATM withdrawals, no-fee money transfers, etc. It gives you an interest rate on your balances.

WELCOME OFFER

- You can get a welcome/ opening cash bonus of $350, subject to terms and conditions.

- You are also eligible for a promotional interest rate of 3.50% per annum*.

*The promotional interest rate applies only on deposits made between August 1, 2022, to December 31, 2022.

To be eligible, you need to:

- Open a new Premium Chequing Account

- Open a new Savings Amplifier Account

- Deposit money into the Savings Amplifier Account

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Be a major as per the age of majority set by your province. |

| c. | You must have a valid Social Insurance Number (SIN). |

- Interest Rate:

- You get an interest rate of 3.50% p.a.

- You can also get a benefit of 0.15% p.a. when you purchase or renew a GIC (General Investment Certificate) (having a 1–5-year term)

- Minimum Balance:

- There is no requirement for any minimum balance.

- You can maintain a $6,000 monthly balance to get a waiver of the fee

- Transactions:

- Unlimited and free banking transactions, as well as Interac e-Transfer

- Monthly Fees:

- There is a monthly fee of $30

- You get a waiver if you maintain a $6,000 monthly

- For kids under 18 and seniors over 60, the bank waives the monthly fee

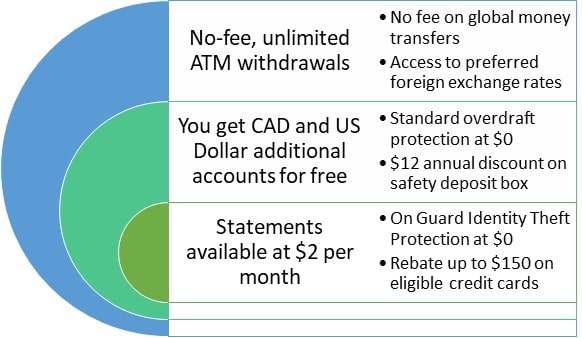

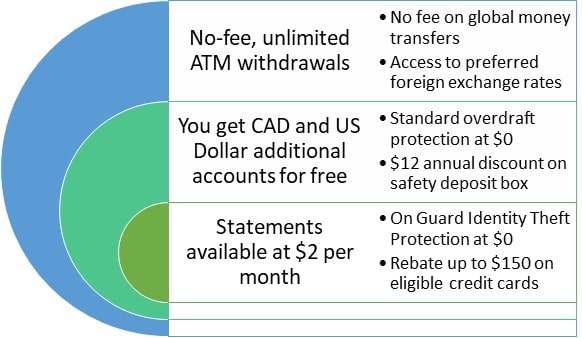

- Additional Benefits:

COMPARATIVE ANALYSIS

We compare the common features of the accounts through a table.

| Parameters | HSBC Advance Chequing Account | Bank of Montreal Premium Account |

| Opening Cash Bonus | Not applicable | $350 |

| Monthly Fees | $25 | $30 |

| Interest Rates | 0.00% | 3.50% |

| Minimum Balance | Not applicable | Not applicable |

| Transactions | Free and Unlimited | Free and Unlimited |

Out of the five parameters mentioned above, the Bank of Montreal Premium Account scores better. There is a tie in two parameters, while the HSBC Advance Chequing Account wins only in one parameter.

OPINION of Expertbyarea.money

With access to promotional interest rates, a lucrative opening cash bonus, and a nominal monthly fee that is avoidable, the Bank of Montreal Premium Account looks promising.

The HSBC Advance Chequing Account does not offer any opening cash bonus or interest on balances. You can avoid monthly fees after meeting comparatively strict standards.

Evaluate your requirements. Choose the best account that better serves your needs.