EQ Bank Savings Plus Account versus HSBC Premier Chequing Account – Which is better for chequing

The EQ Bank Savings Plus Account gives you 165X more interest than Canada’s “Big 5” banks. It lets you do simple banking that makes you earn.

The other chequing account on our agenda today is the HSBC Premier Chequing Account, which offers you premier banking, investing, and borrowing services and provides several lucrative benefits.

Let us compare both chequing accounts and see what the perfect option for you is.

1. EQ Bank Savings Plus Account

Either your urge to earn a higher interest or your need to be covered by the CDIC EQ Bank Savings Plus Account, which lets you enjoy banking. It is a go-to bank account and is free to open.

WELCOME OFFER

You can get a sign-up bonus of up to $150 in cash after three months. Just follow these three simple steps:

- First, you need to sign up. You can do this easily online.

- Second, switch your eligible recurring payroll direct deposit to EQ Bank*.

- Third, ensure that your payroll gets deposited directly into the bank account for three consecutive months.

*You must receive the first deposit within 60 days of opening your Savings Plus Account.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Be a major as per the age of majority set by your province. |

| c. | must have a valid Social Insurance Number (SIN) |

Interest Rate:

- This account offers you an interest rate of 1.65% p.a.

Minimum Balance:

- There is no requirement for any minimum balance.

Transactions:

- This bank account allows you free

- Interac e-Transfers

- EFTs

- Bill Payments

- EQ to EQ transfers

Monthly Fees:

- There is no monthly fee.

Additional Benefits

2. HSBC Premier Chequing Account

The HSBC Premier Chequing Account gives you priority banking service and global support. You get the status of the “premier” with this account that extends into 29 markets.

WELCOME OFFER

If you open this account till December 31, 2022, you will get a welcome bonus of up to $500. You can get this money in the following manner.

| What do you have to do? | What will you get? |

| Complete any two of the following: The first six months of account opening–Set up a recurring payroll Within three months of account opening–Perform two separate merchant pre-authorized debits Within three months of account opening–Send two separate Interac e-Transfer Three months of account opening–Make two distinct online bill payments | $300 |

| Open the account using the “online” website | $100 |

| Do both: One month of account opening–Deposit $25,000 Maintain the balance for at least six months | $100 |

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Be a major as per the age of majority set by your province. |

| c. | Must have any of the following IDs: Passport Driver’s License ID issued by the Provincial Government |

Interest Rate:

- This account does not offer you any interest.

- Check out the latest information using this link.

Minimum Balance:

- There is no requirement for any minimum balance.

Transactions:

- This bank account allows you unlimited transactions and Interac e-transfers.

- However, satisfy the eligibility criteria*.

Monthly Fees:

- There is a monthly fee of $34.95

- Bank waives the entire fee off if you meet the eligibility criteria*.

* Eligibility Criteria – You must meet any of the below-mentioned conditions:

- A minimum balance of $100,000. It can be in any combination of personal deposits and investments

- You have taken a mortgage worth at least $500,000

- Your minimum income deposit is $6,500 within a calendar month

- You have at least $100,000 or more in assets under management in Canada

- You qualify for HSBC Premier in another country

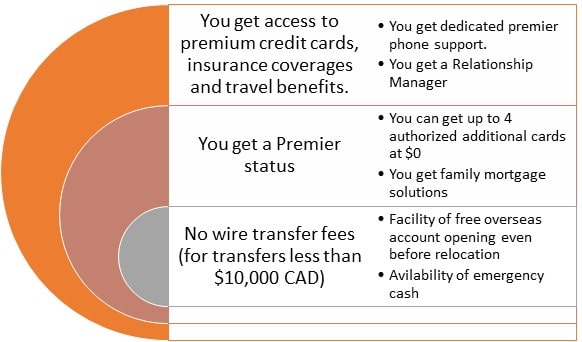

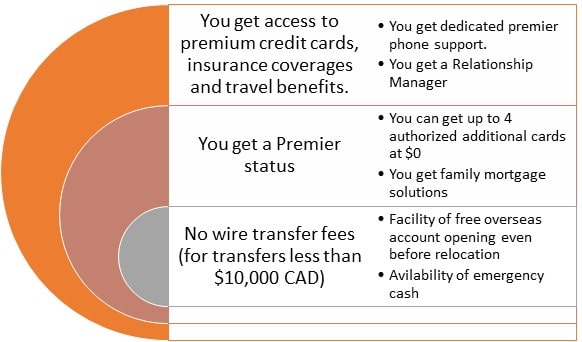

- Additional Benefits

COMPARATIVE ANALYSIS

We compare the features of the accounts.

| Parameters | EQ Bank Savings Plus Account | HSBC Premier Chequing Account |

| Welcome Benefits | $150 | $500 |

| Monthly Fees | $0 | $34.95 ($0 on meeting eligibility criteria) |

| Interest Rates | 1.65% p.a. | 0.00% p.a. |

| Minimum Balance | Not applicable | Not applicable |

| Transactions | Unlimited free transactions | Unlimited free transactions |

Of the five parameters mentioned above, EQ Bank Savings Plus Account scores were higher in two. There is a tie in two parameters, while the HSBC Premier Chequing Account wins only in one parameter.

SECTION IV: OPINION of Expertbyarea.money

The EQ Bank Savings Plus Account has zero monthly fees (with no condition) and even offers you 1.65% interest payments on all account balances. The transfers are free and unlimited.

The HSBC Premier Chequing Account has several additional benefits and gives you welcome benefits. You get a premier status but at the cost of a 0.00% interest rate.

Evaluate your requirements. Choose the best account that better serves your needs.