The Ultimate Guide to Refinancing Your Mortgage in GTA

Are you also feeling the squeeze of rising living costs in the GTA (Greater Toronto Area)? You are not alone!

Since 2017, the cost of living has shot up by a jaw-dropping 33% for single adults in the region. Whether it’s your home loan, transportation, or even just putting aside enough for retirement, it feels like everything’s going up – and fast!

So, how do you keep your head above water without feeling like you’re drowning in bills?

Well, here’s a thought: refinancing your mortgage!

It could actually be a smart move to lower your monthly payments, access cash from your home’s equity, or even secure a better interest rate. Let’s explore how mortgage refinance deals could help you take control of your finances!

What is Mortgage Refinancing?

Mortgage refinancing means replacing your old home loan with a new one. Generally, people do this to get a better refinance deal (if possible).

For example, if you have a high-interest rate, refinancing can lower your monthly payments. You might also shorten the loan term or switch from an adjustable to a fixed rate.

Imagine you owe $150,000 on your home at 6%. If you do refinancing at 4%, you could save you a lot of money. It’s like trading in your old loan for a cheaper one!

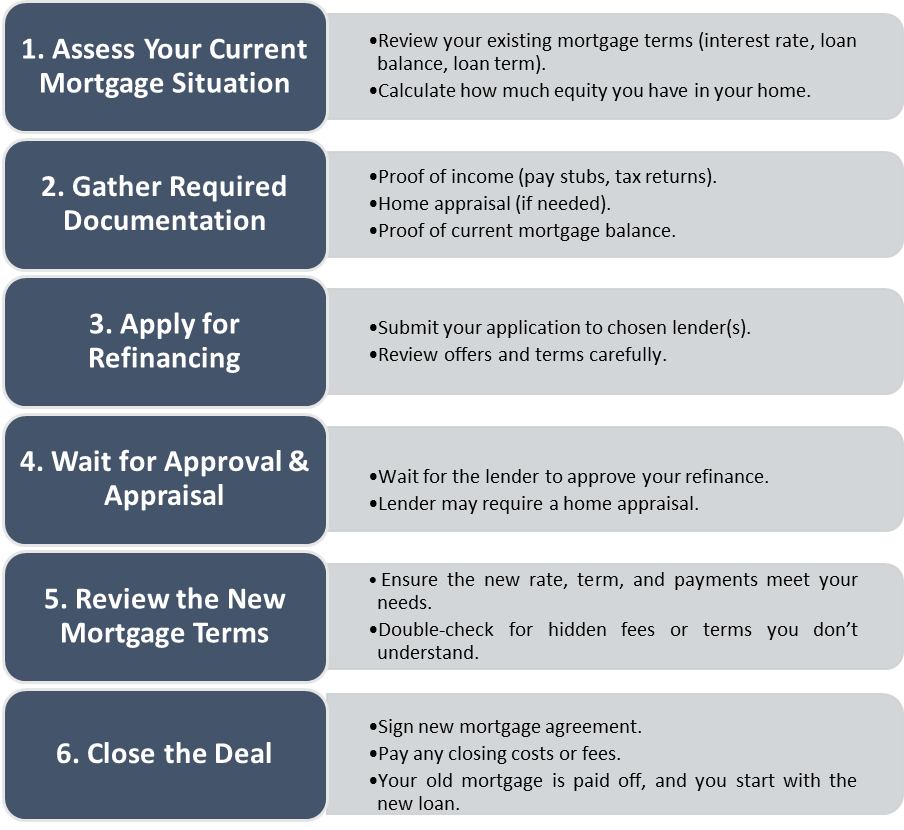

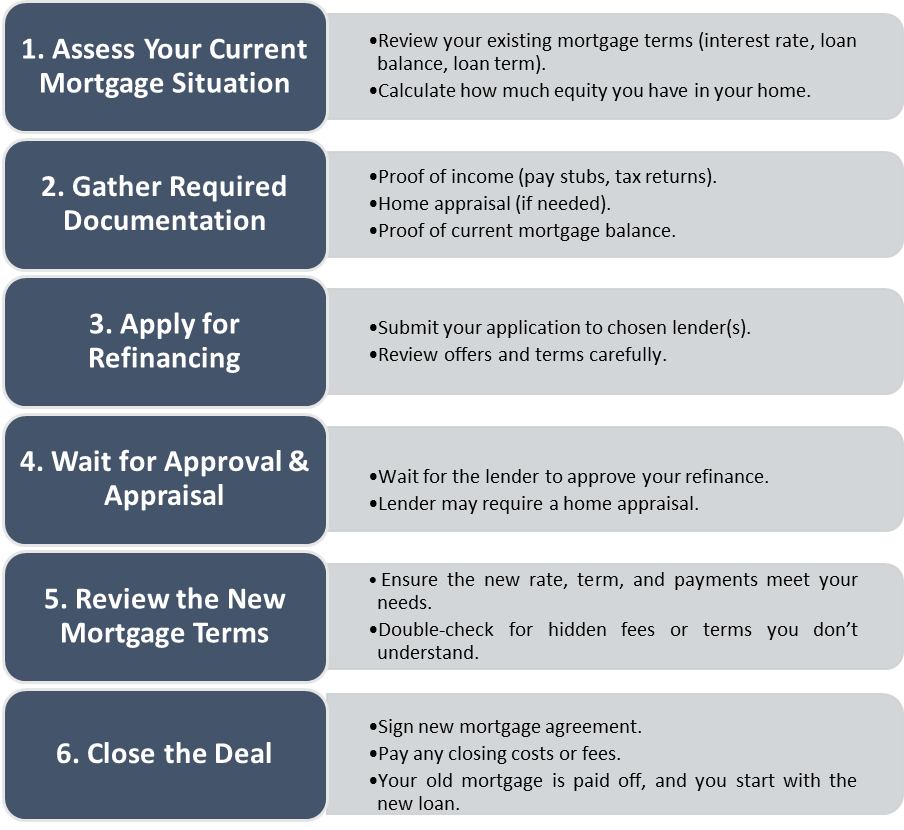

How to Refinance Your Mortgage in the GTA?

Here’s a step-by-step guide to refinancing your mortgage in the GTA:

Why Should You Consider Refinancing Your Mortgage?

Let’s take a look at some of the top benefits of refinancing your mortgage:

- Lower Your Interest Rate

If you got your mortgage when rates were high, refinancing can help you get a better rate. Lower rates mean lower monthly payments. That extra money can go toward other expenses or savings.

- Pay Off Your Loan Faster

Some homeowners refinance to shorten the length of their loan. If you’ve been paying your mortgage for a while, you might want to pay it off faster.

Refinancing your mortgage to a shorter loan term (like 15 years instead of 30) means you’ll own your home outright sooner. While your monthly payments may increase, the interest you pay over the life of the loan will be much less.

- Reduce Your Monthly Payments

If money’s tight, you can refinance to lengthen the term of your loan. This will reduce your monthly payment. It’s helpful if you need a little breathing room in your budget. However, always remember the fact that you’ll end up paying more interest over time.

- Switch to a Fixed Rate

Many people start with an adjustable-rate mortgage (ARM), where the interest rate can change over time. So, if you are looking for the best refinance deals, shopping around for competitive rates can help you secure a fixed-rate mortgage. This means your monthly payments won’t change, and you’ll know exactly what to expect.

- Cash-Out Refinance

A cash-out refinance lets you borrow against the value of your home. It’s the amount your home is worth minus what you still owe on your mortgage.

For example, if your home is worth $200,000 and you owe $150,000, you have $50,000 in equity. Refinancing can give you some or all of this equity in cash, which you can use for things like home improvements, paying off debt, or even funding education.

What are the Cons of Refinancing Your Mortgage?

Refinancing your mortgage can seem like a great idea, but it’s not always perfect. Here are some downsides to think about.

- Closing Costs

Refinancing isn’t free. You’ll need to pay closing costs, which can be 2% to 5% of your loan amount. These fees can add up quickly. For example, if you refinance a $200,000 loan, you might pay up to $10,000 in fees. That’s a big chunk of change.

- Longer Loan Term

While you may find great refinance deals that lower your monthly costs, stretching out the loan term can lead to paying more in the long run. You might save money now, but it could cost you later.

- Resetting Your Loan

When you refinance, you’re essentially starting over. If you’re already halfway through a 30-year loan, refinancing means you’re back to square one.

- Risk of Higher Payments

If you choose a shorter loan term to pay off your mortgage faster, your payments may increase. Make sure you can afford the new payments before refinancing your mortgage.

- Possible Penalties

Some mortgages have prepayment penalties. Refinancing early might trigger fees if your current loan has one.

Assessing Your Readiness to Refinancing Your Mortgage

Refinancing your mortgage can save you money, but it’s important to know if you’re ready. It’s not just about getting a lower rate; it’s about making sure it makes sense for your situation.

Here’s how to assess your readiness.

- Check Your Credit Score

Your credit score is a big factor in getting a good refinance deal. Most lenders prefer a score of at least 660, but the higher, the better. If your score is low, take some time to improve it before refinancing.

- Consider Your Home Equity

Home equity is the part of your home that’s truly yours — what it’s worth minus what you still owe. It’s what your home is worth minus what you still owe on your mortgage.

If you have at least 20% equity, you’re in a good position to refinance. The more equity you have, the better your chances of getting a favorable rate.

- Review Your Financial Situation

Can you afford the new mortgage payments?

Refinancing can lower your monthly payments, but it can also increase them depending on the terms you choose. If you’re looking for the best refinance deals, be sure to consider your job security, income stability, and other financial goals. Refinancing should fit comfortably into your budget.

- Understand Your Long-Term Goals

What are you hoping to achieve with refinancing? Do you want to pay off your mortgage faster, lower payments, or access cash from your home equity? Make sure the refinance terms line up with your goals.

- Consider the Costs

Refinancing comes with costs, such as closing fees, appraisal fees, and sometimes prepayment penalties. These fees can add up to thousands of dollars as shown below. Be sure the savings from refinancing outweigh these costs.

| Type of Fees | Estimated Cost |

| Legal Fees | $750 – $1,250 |

| Home Appraisal | $300 – $600 |

| Mortgage Registration | $70 |

| Mortgage Discharge | $200 – $350 |

| Mortgage Prepayment Penalties | Depending on the Mortgage Type |

For more details, click here!

The Bottom Lines

Refinancing your mortgage can be a smart way to save money, pay off your loan faster, or access cash from your home’s equity. But before you decide, make sure to weigh the pros and cons.

Check your credit score, understand your goals, and be aware of the costs involved. If you’re in the GTA, shop around for the best refinance deals that suit your needs. With the right approach, refinancing could be a great tool to help you take control of your finances and achieve your long-term goals.

Just make sure you’re ready!