What are the Mistakes to Avoid when Buying Medical Insurance Coverage in Canada?

When you get your health insurance in Canada, you feel safe, secure, and all sorted out, right? But guess what? Sometimes, people make mistakes when they’re picking their insurance.

It’s easy to skip reading all the little details in your insurance plan. Then there’s figuring out what you really need. Everyone’s different, so what works for one person might not be right for you.

By avoiding such slip-ups, you’ll be on your way to getting the best medical insurance coverage in Canada. So, let’s dive into the medicare basics of what to avoid when buying health insurance.

Mistake# 1: Not assessing your personal healthcare needs.

Not understanding what you need in your basic health insurance plan is the biggest mistake. Imagine buying shoes without knowing your shoe size – it just won’t fit right! So, knowing your healthcare needs is like knowing your shoe size for staying healthy.

First, think about what kinds of health stuff you might need – like doctor visits, medicine, or check-ups. Then, check what your insurance covers. If you don’t do this, you might end up paying more or not getting the right care.

Mistake# 2: Not reading the fine print.

Skipping over the tiny words in your medical insurance coverage brochures or agreements can lead to huge problems. These small details often hold important information, like hidden fees, exclusions, limitations, deductibles, or other rules.

So, taking the time to go through the fine print carefully is a pro tip in medicare basics. It helps you avoid future surprises and make smarter decisions.

Mistake# 3: Overlooking coverage for alternative therapies.

When you forget to check if your insurance covers alternative therapies like acupuncture, chiropractic care, or naturopathy, you might miss out on some helpful treatments. These therapies can be really good for certain health issues. But if your insurance doesn’t cover them, you might have to pay money out of your pocket.

The solution is simple – do some research!

Look for insurance plans that do cover medicare basics and these alternative therapies if they’re important to you. This ensures your healthcare needs and preferences are taken care of without worrying about extra costs.

Mistake# 4: Hiding or ignoring pre-existing conditions.

When you ignore pre-existing conditions, it means you’re not thinking about how they might affect your insurance. It can be a colossal mistake with significant disasters.

So read your insurance policies carefully. Look for any information about pre-existing conditions and see what they say about them. Most importantly, never ever hide your pre-existing condition from your insurance provider.

Mistake# 5: Ignoring network providers.

Not checking provider networks is another big mistake when getting medical insurance coverage. They usually cost you less money because they have special deals with your insurance.

Going to doctors or hospitals outside this network can make you pay more from your own pocket. Check if your doctors are in the network before choosing a plan. If not, consider another plan to save money.

Mistake# 6: Neglecting mental health coverage.

Mental health is just as important as physical health, but it’s often overlooked. In Canada, approximately 9.1 million individuals, which equals one in three people, are expected to encounter a mental illness at some point in their lives.

Therapy and counselling can be essential for managing conditions like anxiety, depression, or trauma. Without proper coverage, accessing these services can be difficult and expensive. This lack of support can worsen your mental health issues and impact your overall well-being.

So, it is recommended to go for an insurance plan that offers comprehensive coverage for medicare basics and mental health services. This means checking if therapy sessions, counselling, and psychiatric care are included.

Mistake# 7: Neglecting lifestyle factors.

When buying any basic health insurance plan, understanding medicare basics is required. It’s super important not to ignore your lifestyle habits. Things like smoking or doing risky activities can affect your coverage.

If you don’t tell the insurance company about these things, it could mess up your coverage later on. Plus, you might get less coverage than you actually need.

So, the smart move is, to be honest about your lifestyle when you’re getting medical insurance coverage. That way, your policy can be tailored to fit your actual risk.

Mistake# 8: Not considering renewal options.

When it’s time to renew your insurance, check the terms to ensure they still suit you. If you don’t, you might miss changes that could affect your medical insurance coverage or costs.

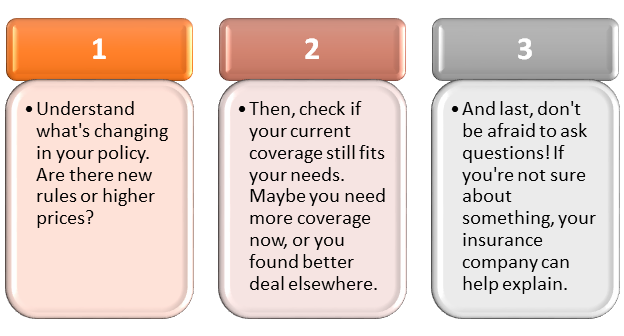

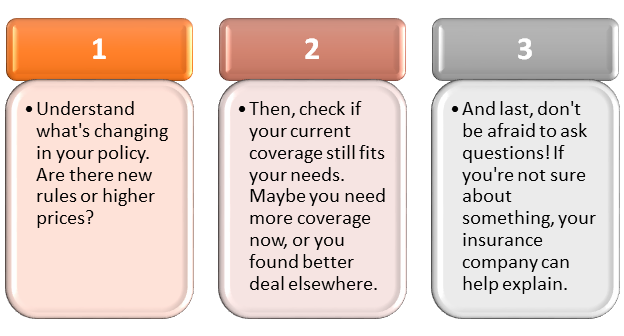

To avoid this, there’s a pro tip in medicare basics. Take time each year to review your renewal options. You can do this in the following 3 primary ways:

Reviewing your options yearly ensures you have the best insurance for your needs.

Mistake# 9: Disregarding family coverage options.

It’s not smart in medicare basics to ignore family coverage when getting health insurance. Sometimes, it’s cheaper to get a plan that covers everyone in your family instead of individual ones. Plus, having everyone on the same medical insurance coverage can make things simpler.

But if you don’t even check out family plans, you might miss out on these benefits. To fix this, look into family insurance options. See if they offer better coverage and prices for your whole family. It’s like buying in bulk—you might get a better deal!

Mistake# 10: Not seeking professional advice.

Insurance policies can be tricky, with lots of fine print. If you don’t talk to insurance experts, you might miss important details about different plans. They know the ins and outs of insurance stuff, so their advice can be super helpful.

So, don’t go it alone. Talk to insurance professionals and they can guide you through the process. This makes sure you understand your options and choose the best medical insurance coverage for your needs.

The Concluding Lines

As we finish talking about the mistakes to avoid when getting medical insurance coverage in Canada, let’s learn from them. These mistakes, like not thinking about our lifestyle or ignoring family coverage, can teach us important lessons. But they also show us how to make smart choices.

Remember, there are many things to consider when it comes to insurance. So, let’s be mindful as we go forward and see our mistakes as steps toward understanding the medicare basics. This will lead us to the right insurance coverage and peace of mind.

People Also Ask

Q. Am I also making a mistake by not comparing different insurance plans?

Yes, comparing plans helps you find the best coverage for the best price.

Q. Is it okay to choose the cheapest medical insurance coverage?

Not always. Cheaper plans might not cover everything you need, so make sure it meets your needs.

Q. Should I get insurance just because it’s offered by my employer?

It’s good to consider. But you should still compare it with other plans to make sure it’s right for you.

Q. Is it okay to wait until I’m sick to buy the best basic health insurance?

No, it’s best to have insurance before you need it. This is because there might be waiting periods for coverage.

Q. Can I make a mistake by not considering deductibles and copayments?

Yes, these can affect how much you pay out of pocket, so it’s important to understand them.

Q. Should I skip researching the insurance company’s reputation?

No, you want to make sure they’re reliable and have good customer service.

Q. Is it okay to buy a basic health insurance plan without considering my family’s needs?

No, you should consider everyone’s needs to make sure the plan covers everyone.

Q. Should I choose a plan with a high deductible to save money?

It depends on your situation. A high deductible means you pay more out of pocket before insurance kicks in.