What’s the Role of Basic Liability Insurance in Canada’s Economic Growth?

As Aristotle once said, ‘The greatest virtues are those which are most useful to other people’.

This quote speaks volumes about the importance of helping others. And, in Canada’s economy, basic liability insurance does just that. It shields businesses from legal troubles, ensuring they can thrive. Without it, the nation’s economy wouldn’t be as robust.

So, let’s uncover its crucial role in Canada’s economic development.

How Does a Basic Public Liability Insurance Work?

Also known as Commercial General Liability Insurance, Basic Public Liability Insurance is designed to cover injuries and property damages caused to the people visiting your business premises. It’s like a safety net for both the public and businesses.

Let’s say you own a small shopping mall on Toronto’s bustling streets. Someone slips on its wet floor and ends up getting hurt. On proper diagnosis, you came to know from the hospital that the person’s leg had been fractured.

Your basic liability insurance steps in to cover the medical bills for that person. Without it, you might have to pay those bills out of your own pocket, which could be challenging for your mall.

So, this insurance makes sure you’re not on the hook for all the costs if something unexpected happens. It’s like having a shield that protects you from financial trouble if someone gets hurt or property gets damaged because of your business.

How Basic Liability Insurance Drives Economic Growth in Canada?

Basic Liability Insurance can act as a catalyst for driving economic growth in the following manners:

- Managed Risks for Better Growth

No matter how strict safety rules you have deployed in your business, accidents can happen anywhere, anytime. It can lead to unexpected injuries and property damages, that may cost you a fortune. Moreover, people are very clever nowadays in finding tricks to sue businesses.

Basic business liability insurance helps by covering the costs of these accidents.

For example, Isabel Parker, a scammer, faked slips in stores and won 49 times, costing businesses over $500,000. This 72-year-old woman had a simple but sneaky trick. She’d pretend to fall in stores, then claim insurance money. Despite getting caught, she got off easy with just a year of probation in 2000.

Such shocking incidents are funny to read but they can shake the whole budget of a business. However, with basic public liability insurance, the insurance company will cover the medical and legal costs at least, that may arise after the incident.

This way, the company can focus on its work without worrying about financial losses. By transferring these risks to the insurance company, the businesses can manage their operations more efficiently. This allows them to invest in growth opportunities, contributing to economic growth.

- Generating Jobs

The commercial insurance industry is truly the backbone of Canada’s economy. A recent report showed just how big its impact is. The report said that every year, the commercial insurance industry adds almost $15 billion to Canada’s GDP, which is a lot!

Its policies like basic liability insurance don’t just protect businesses but also create jobs and help people earn money. Around 115,000 people in Canada have jobs because of commercial insurance. These jobs are all over the country, not just in big cities. People do all kinds of different jobs in this sector, like managing claims and providing customer care services.

Additionally, the report said it brings in about $8 billion in wages every year. That’s a huge amount of money! And it’s not just the people who work in the insurance industry who benefit. When employees of basic liability insurance providers earn money, they spend it on things, that help other businesses too. This means more money goes around, making the whole economy stronger.

- Rising Innovations

Not only this, but the basic business liability insurance sector also helps businesses to be innovative.

One way insurance helps with innovation is by giving businesses the confidence to try new things. If they know insurance will cover them if something goes wrong, they are more likely to take risks and try out new ideas. This helps businesses grow and come up with new innovative products and services.

This insurance also encourages insurance companies to come up with new ways to protect against risks. For example, if a medicare business suffers cyberattacks, it can lead to downtime and significant operational disruptions.

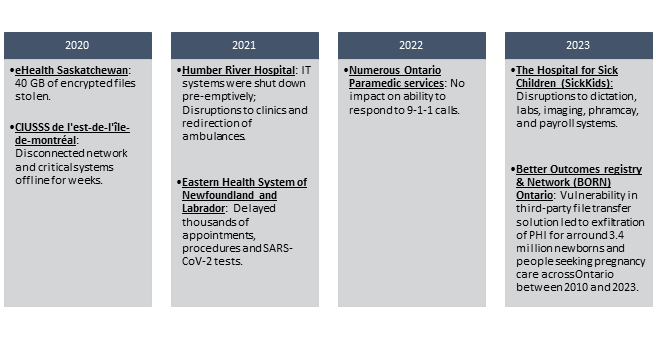

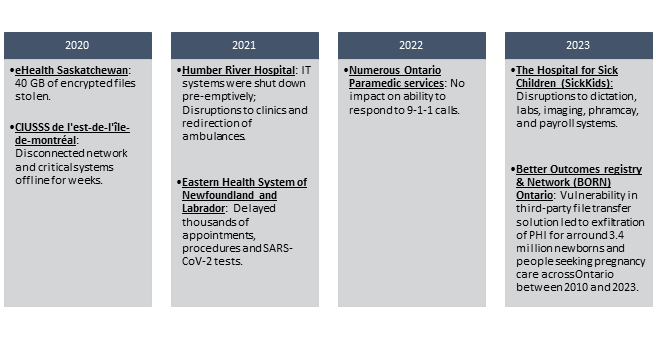

Kindly have a look at some of the cyberattacks on Canadian Health Information Systems!

For more information, click here.

You cannot imagine the loss these attacks caused in the medical industry. However, by designing advanced basic liability insurance, insurers can reduce the risk of such cyber-attacks and ensure continuous business operations. This continuity is highly essential for sustaining economic growth.

- Encouraging Business Expansion

Basic Public Liability Insurance isn’t just about protection—it’s also a key factor in helping businesses expand and thrive. In the world of business contracts and leases, having insurance is often a must. It’s like a badge of responsibility that shows businesses, whether it’s a clothing or medicare business, are serious about managing risks.

When businesses have liability insurance, it signals to clients, partners, and investors that they’re careful and responsible. This vote of confidence can make them more appealing to work with or invest in. It’s like saying, “We’ve got our bases covered, so you can trust us!”

As businesses grow, their positive reputation for being careful with risks can pay off big time. They attract more clients, form stronger partnerships, and secure funding for expansion. With more resources at their disposal, they can hire more people, buy new equipment, and invest in cutting-edge technology. This not only boosts their own growth but also ripples through the economy, creating more jobs, increasing consumer spending, and driving overall economic activity.

Conclusion Points: Basic Liability Insurance as a Backbone to Canada!

In conclusion, basic liability insurance fulfills Aristotle’s timeless wisdom as discussed in the beginning. It offers crucial support to businesses and protects them from legal troubles. Not only this, but it also increases job opportunities and encourages business expansion.

So, by understanding how important basic public liability insurance is, we can keep making Canada a great place for everyone.

People Also Ask

Q1. How does basic liability insurance differ from other types of insurance?

Basic liability insurance protects individuals and businesses from financial losses arising from third-party claims for property damage, bodily injury, or other liabilities. It differs from other types of insurance, such as property insurance or professional liability insurance, which cover specific risks.

Q2. What types of liabilities does basic public liability insurance cover?

It typically covers liabilities arising from property damage, bodily injury, legal fees, and settlements resulting from third-party claims against the insured party.

Q3. Do all businesses in Canada need basic liability insurance?

While basic public liability insurance is not legally required for all businesses in Canada, it is highly recommended, especially for those involved in activities that pose a risk of causing harm to third parties.

Q4. Can individuals benefit from basic public liability insurance as well?

Yes, individuals can benefit from this insurance by protecting themselves against potential legal liabilities arising from accidents or incidents involving third parties.

Q5. What factors should businesses consider when purchasing this insurance?

Businesses should consider factors such as their industry, the nature of their operations, the level of risk exposure, coverage limits, and premium costs when purchasing basic liability insurance.

Q6. Are there any exclusions or limitations to the insurance coverage?

Yes, basic liability insurance policies may have exclusions or limitations, such as coverage for intentional acts, professional errors, or punitive damages. Businesses need to review their policies carefully to understand the extent of coverage.

Q7. How can businesses reduce risks in addition to buying insurance?

In addition to basic liability insurance, businesses can implement risk management strategies, maintain safety protocols, and engage in proactive measures to minimize the likelihood of accidents or incidents.