Protecting Your Financial Identity in the GTA: Safeguarding Against Fraud and Scams

Introduction

Protecting Your Financial Identity in the GTA: Safeguarding Against Fraud and Scams Introduction The risk of financial fraud and frauds has increased as technology has developed, impacting people in the Greater Toronto Area (GTA). In this article, we will examine the essential safeguards and measures GTA residents should take to guard themselves against fraud and con artists.

Understanding the Threat Landscape

Understanding the many hazards that residents of the GTA can face is essential before diving into particular preventative strategies. Identity theft, phishing schemes, credit card fraud, investment fraud, online shopping fraud, and other fraudulent practices are all included in the threat environment.

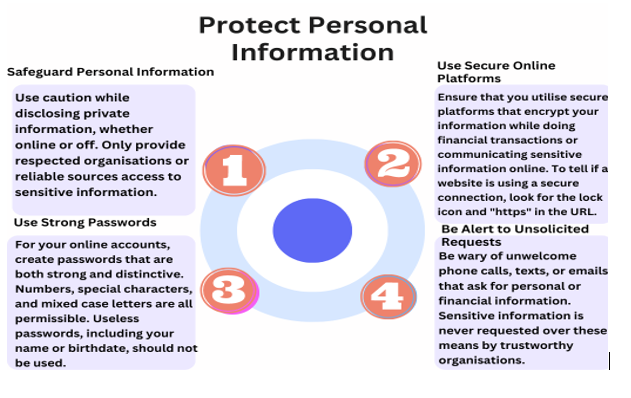

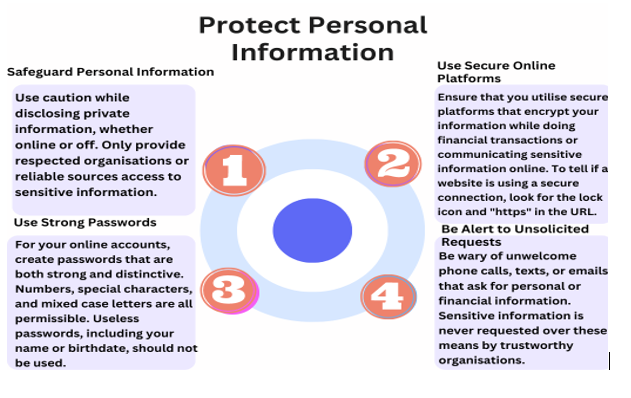

Protect Your Personal Information from Identity Theft

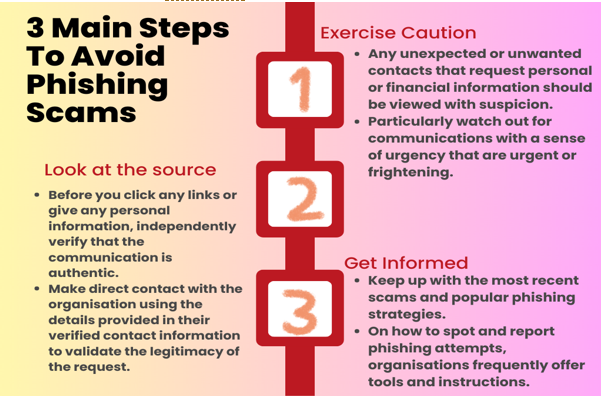

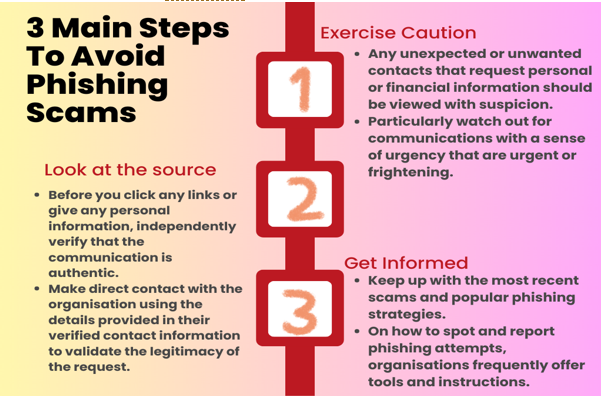

Phishing Scams: Exercise Caution and Check

Phishing scams are sneaky attempts to obtain access to personal information by impersonating a reliable organization. These scams generally manifest themselves as emails, messages, or phone calls that appear to be coming from reputable companies. In order to avoid phishing scams:

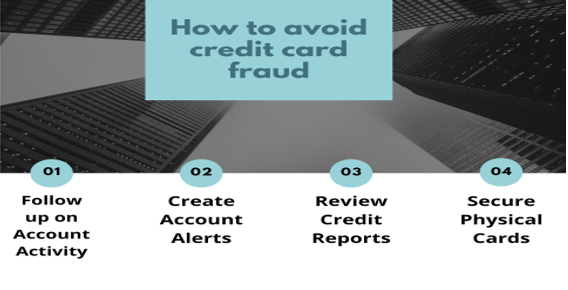

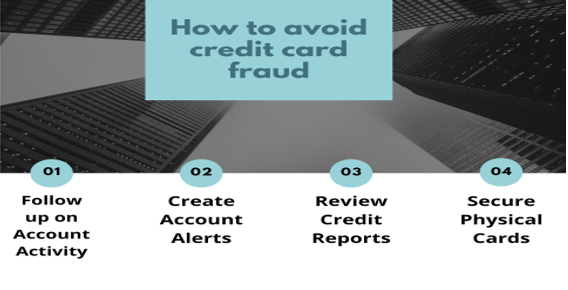

Credit Card Fraud: Secure Your Financial Accounts

Misuse of someone else’s credit card number without their permission to carry out erroneous purchases or transactions is known as credit card fraud. To avoid credit card fraud:

Follow up on Account Activity:

- Review your credit card statements to look for any unauthorized or questionable purchases.

- If you detect anything strange, get in touch with your credit card provider right away.

Create Account Alerts:

- Make use of the account alert features offered by your credit card provider.

- Any odd behavior, such as significant transactions or changes to your account information, can be informed of via these alerts.

Review Credit Reports:

- Request a copy of your credit report at least once a year from credit reporting bureaus.

- Make that all the stated accounts and transactions are valid by carefully going over everything.

Secure Physical Cards:

- Store your physical credit cards in a safe location and never loan them out.

- Report a lost or stolen credit card to the credit card company ASAP.

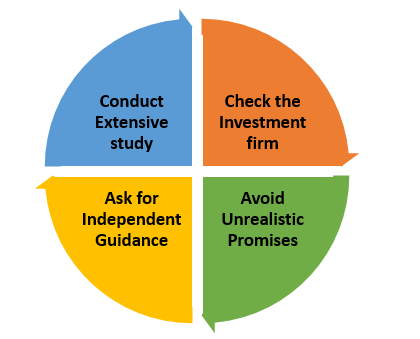

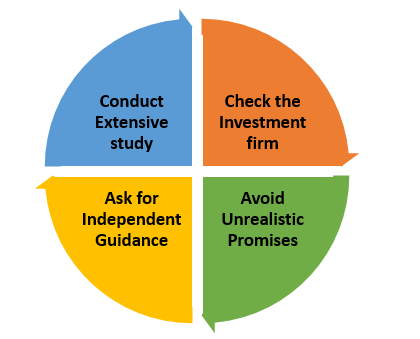

Investment Scams: Exercise Due Care

Investment fraud is to trick people looking to enhance their wealth by providing false investment possibilities. These frauds can take many different shapes, including Ponzi schemes, pyramid schemes, or fictitious investment firms. To ward from investment fraud:

Conduct Extensive study:

- Do an extensive study on the investment opportunity, the company, and the persons involved before making any investment.

- Seek data from dependable sources, such as regulatory organizations, financial news publications, and trustworthy investment advisors.

Check the Investment firm:

- Check the Investment firm or advisor’s standing with regard to registration with the relevant regulatory bodies, such as the Ontario Securities Commission (OSC), to ensure their legitimacy.

- Registered professionals are governed by regulations and are required to follow specific rules.

Avoid Unrealistic Promises:

- Use caution if an investment offer guarantees exceptionally large returns with little to no risk.

- Keep in mind that all investments include some level of risk and that reputable investments often provide reasonable and long-term returns.

Ask for Independent Guidance:

- Speak with a dependable financial counselor with a solid reputation and knowledge about investing alternatives.

- They may offer unbiased advice and aid in your decision-making regarding your investments.

Online Shopping Fraud: Shop Securely

Online purchasing has grown in popularity, but there are also hazards associated with fraud. In order to safeguard oneself from online purchasing fraud:

Shop at Reputable Websites:

- Rely on well-known and reputable e-commerce websites or platforms. To evaluate the trustworthiness and authenticity of the vendor, read customer reviews and ratings.

Safe payment option:

- Elect for safe payment options, such as credit cards or reputable payment processors like PayPal.

- These techniques frequently include supplemental defenses and dispute resolution procedures.

Examine the Website for Secure Connections:

- Before entering any payment or personal information, check to see if the website is connected securely.

- Look for the lock icon and the prefix “https” in the website address, which signify that the connection is secured.

Conclusion:

Protecting your financial identity in the Greater Toronto Area (GTA) requires vigilance and proactive measures. By understanding the threat landscape and implementing precautions, you can safeguard yourself against fraud and scams. Remember to protect your personal information, be cautious of phishing scams, secure your financial accounts, conduct thorough research for investments, shop securely online, and be skeptical of advance fee fraud. Following these steps and staying informed about the latest scams can protect your financial well-being and maintain peace of mind in an interconnected world.