CIBC Smart Account versus Meridian Credit Union – Pay as You Go Chequing Account – Which is a better chequing bank account?

The CIBC Smart Account is a flexible chequing account that covers most of your daily banking. Click here to get this account.

The Pay-as-you-go chequing account is from Meridian Credit Union second largest credit union in Canada. It also offers flexibility in transactions and lets you perform online, mobile, and in-branch telephone banking. Open this account now.

Let us compare these chequing accounts and see the perfect option for you.

1. CIBC Smart Account

WELCOME OFFER

As part of the special chequing offer, you can earn up to $400 ($350 + $50) as an opening cash bonus. However, satisfy the following conditions:

- You must be 25 years or older

- Within the first two months, you will get $350 when:

- You make one ongoing direct deposit in your chequing account

- And

- You perform any of the three transactions mentioned below:

- Two ongoing pre-authorized debits

- 2 Visa debits

- Two online bill payments, each of $50 or more

- Post this, and you are eligible to earn an extra $50. It will happen when –

- Within the first two months:

- You transfer $200 from your new CIBC Smart™ Account into your CIBC eAdvantage Savings Account

*Note that the bank will credit the cashback of $400 to your chequing account within the first 7 months of account opening

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Have valid contact details – Email address, Phone No., Name, and Residential Address |

| c. | Be a major as per the age of majority set by your province. |

| d. | You must have your passport, driver’s license, or any other government ID |

- Interest Rate:

- This chequing account does not offer any interest on balances maintained

- Minimum Balance:

- There is no requirement for any minimum balance unless you want to avoid a monthly fee

- Transactions:

- You can perform 12 transactions for FREE every month

- Every additional transaction will cost you $1.25. The maximum monthly fee you will pay is $16.95

- However, you do not have to pay any monthly fee if your daily end-of-day balance is more than $4,000

*The term transaction covers:

- Debit purchases

- CIBC withdrawals (including CIBC ATM)

- Interac e-Transfer transactions

- Transfers

- Cheques

- Pre-authorized payments

- Bill payments

- Monthly Fees:

- There is a monthly fee of $6.95 per month

- However, it will increase when you do over 12 transactions in a month.

- The upper limit set for the monthly charge is $16.95

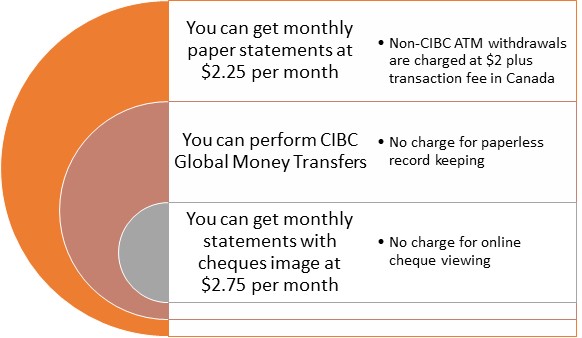

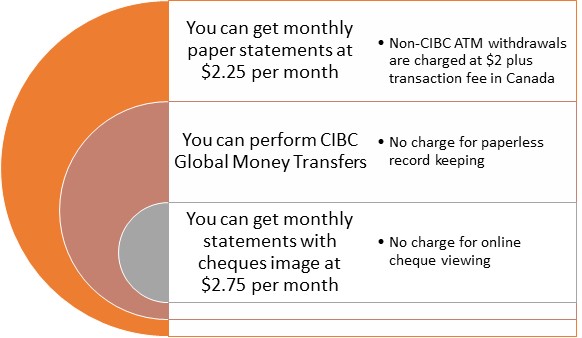

- Additional Benefits

2. Pay as You Go Chequing Account – Meridian Credit Union

The Pay as You Go Chequing Account allows you to pay for what you use. This chequing account is highly affordable and covers all your banking needs.

WELCOME OFFER

Meridian Credit Union is not offering any opening cash bonus or other introductory offers with this chequing account.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Have a valid email address |

| c. | Be a major as per the age of majority set by your province. |

| d. | You must have your Social Insurance Number (SIN) |

Interest Rate:

- You do not get any interest in this chequing account

Minimum Balance:

- There is no requirement for any minimum balance. Transactions:

- Pay a fee of $1 for each transaction

- However, it gets waived if you maintain a balance of $2,000 in your chequing account

- You also get 4 FREE Interac e-Transfer every month when you keep a balance of $2,000

Monthly Fees:

- There is no monthly fee

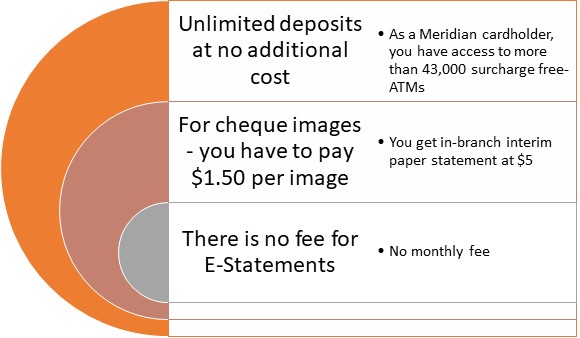

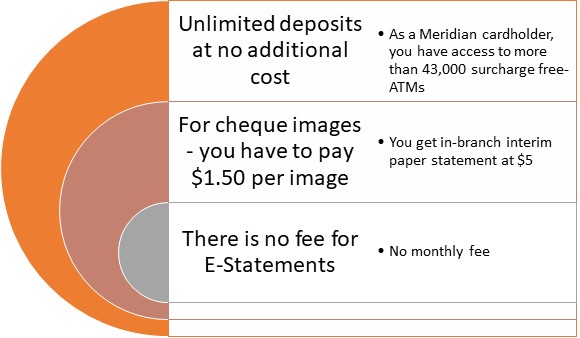

Additional Benefits

COMPARATIVE ANALYSIS

Let us now compare both these chequing accounts:

| Parameters | CIBC Smart Account | Pay as You Go Chequing Account – By Meridian Credit Union |

| Opening Cash Bonus | $400 ($350 + $50) | $0 |

| Monthly Fees | $6.95, capped at $16.95 | $0 |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | $4,000 if you want to avoid the monthly fee | $2,000 if you want to make transactions FREE |

| Debit Transactions | 12 free per month, additional at $1.25 each | $1 each, no fee when you keep a minimum balance |

| Interac e-Transfers | 4 free per month | 4 free per month, when you keep a minimum balance |

OPINION of Expertbyarea.Money

The chequing accounts compared in this article are flexible for banking transactions. The CIBC Smart Account offers you 12 free bank transactions every month. For transactions 13 to 20, you will pay $1.25 per transaction.

After this, all your transactions are free. You also get to enjoy an opening cash bonus of $400.

The Pay as You Go Chequing Account–By Meridian Credit Union charges you $1 per transaction. You can avoid paying this fee when you maintain a minimum balance of $2,000.

Evaluate your requirements. Choose the best account that better serves your needs.