What Is Excess Liability Insurance In Canada?

Safeguarding your future with additional insurance is always beneficial. Read this blog to find out more about excess liability insurance in Canada.

Source: Freepik

Are you looking for ways to secure your future via additional insurance? Do you want to get paid for all your claims over and above your existing insurance limit? You can certainly do so by opting for Excess Liability Insurance. This article contains everything that you need to know.

What Do You Mean by Excess Liability Insurance? Explain to Me in Simple Language.

Excess liability insurance is nothing but an insurance product which allows you to cover all your additional claims, which exceed the cover provided by your existing insurance policy.

It gives you enhanced financial protection by increasing your overall insurance coverage. It helps you expand your dollar limit and gives you a broader protection net.

Let us understand the excess liability insurance through a practical example.

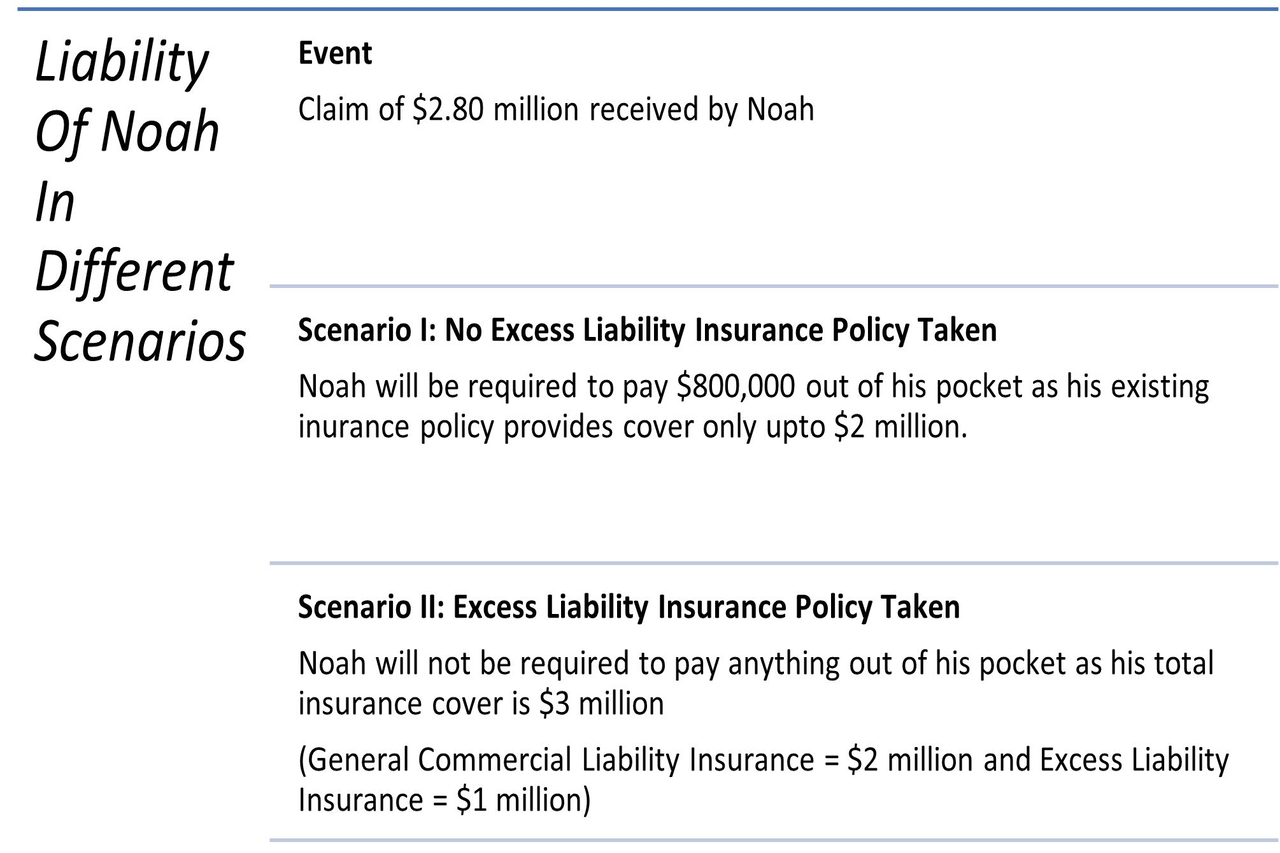

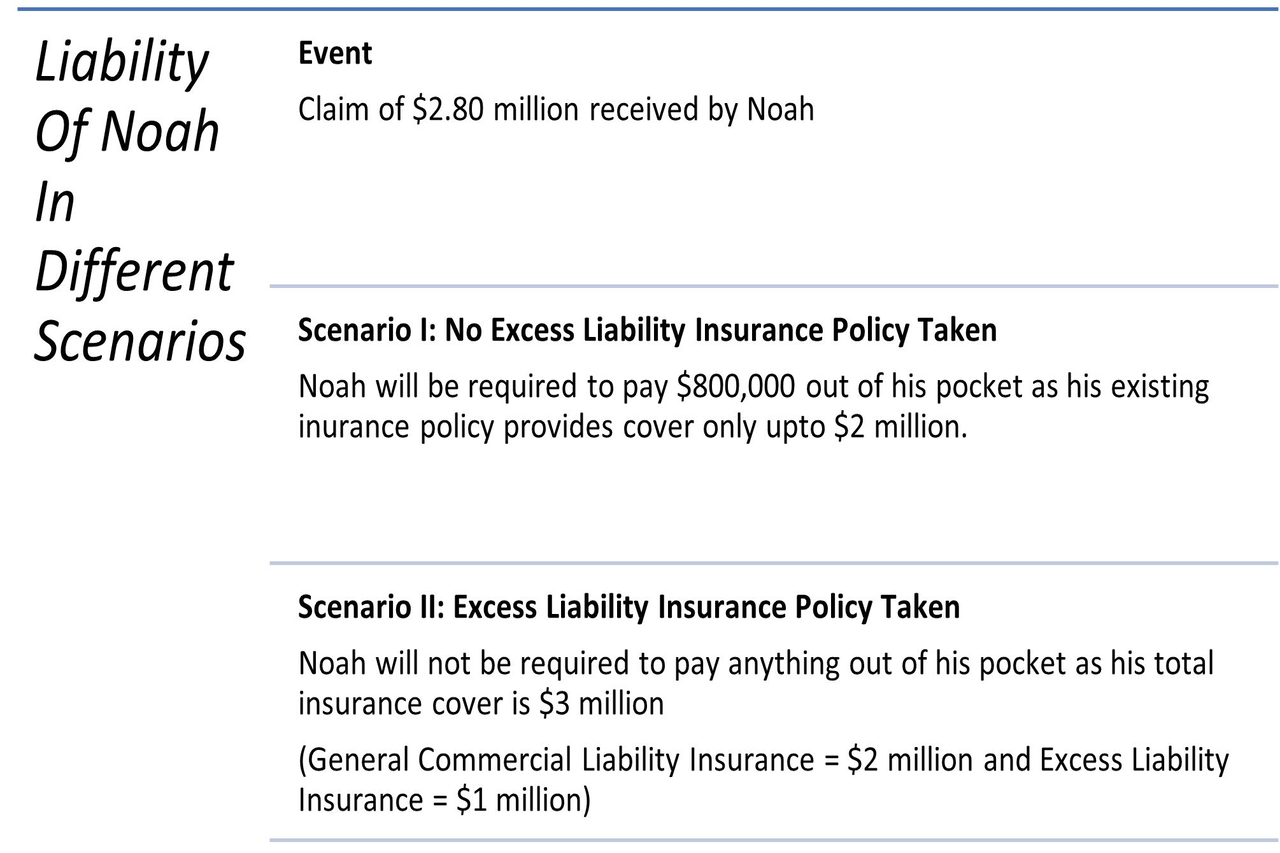

- Noah Jackson is a self-employed individual who runs an IT consulting company in the Greater Toronto Area.

- To protect himself from commercial claims that arise during business, he has taken General Commercial Liability Insurance from a reputed insurance company.

- The cover provided by this General Insurance Policy is $2 million.

The business world is uncertain, and Noah received a compensation claim worth $2.80 million from one of his aggrieved clients.

Since Noah has only a single General Commercial Liability Insurance, which covers claims up to $2 million, he will pay the additional claim worth $800,000 out of his pocket.

Now, let us suppose Noah had taken an excess liability insurance policy that provides additional coverage of $1million.

In such a scenario, Noah would have got even the additional claim of $800,000 from the insurance company. He would have paid nothing out of his pocket.

We can summarize the liabilities of Noah in both the cases via the table below:

Does Excess Liability Insurance Works in Unique Situations?

The “Excess Liability Insurance” works in association with your existing insurance policy, anything from a Business Commercial Liability Insurance to Commercial Property Insurance to Commercial Auto Insurance.

It comes into the picture when you have exhausted the cover provided by your existing insurance policies. It is pertinent to note that:

- Excess Liability Insurance plays second fiddle to your primary insurance policy.

- It acts as a subordinate, and you cannot use it until you have reached the maximum coverage limit offered by your traditional insurance policy.

Let us now notice the practical usage of “excess liability insurance” in different situations and circumstances.

| Situation | Primary Insurance Policy | Description |

| I | General Liability Insurance | 1. You are a contractor and are working on an extensive project. 2. Unfortunately, one of your painters tripped the ladder and has sustained multiple injuries. 3. You have received a medical claim worth $50,000. 4. However, your existing insurance policy can cover claims only up to $40,000. 5. In such a case, having an “excess liability insurance” can help you get reimbursement for your additional claim worth $10,000. |

| II | Commercial Auto Insurance | 1. You are a salaried professional, and to get some fresh air, you traveled downtown in your car. 2. You suddenly lost control of the steering and accidentally collided with a parked car. 3. The owner of the other vehicle suddenly approached you for damages, which amounted to $25,000. 4. Your existing insurance policy could cover only up to $18,000 worth of claims. 5. You had an excess liability insurance policy, which covered your balance claim worth $7,000. |

| III | Employer’s Liability Insurance | 1. You run your own small-scale business and have even employed about 50 employees. 2. You are fighting a personal injury claim worth $2 million that you received from one of your employees. 3. You settled the matter of $1.55 million, out of which your primary insurance policy has covered $1million. 4. Having an excess liability insurance policy can help you cover additional liability of $550,000 |

What Are the Pros and Cons of Taking Excess Liability Insurance?

Excess Liability insurance has its pros and cons. Let us now have a look at them:

Pros:

- Maintains Your Cash Flow:

- Excess liability insurance gives you a broader protection net and aims to cover all your additional claims, which otherwise you would have paid out of your pocket.

- Hence, it preserves your cash flows and protects them from getting disturbed.

- Buys You Peace of Mind:

- It provides you with an additional cushion and protects you from financial hardships could arise if you receive a high insurance claim.

- It helps you to remain satisfied and peaceful.

Cons:

- Increased Cost of Premiums:

- The additional insurance cover comes at a cost.

- This policy can increase your overall premium liability and lay extra financial stress on you.

- Only Enhances Your Coverage Limit:

- Excess liability insurance only increases your financial cover.

- It will not compensate you for any event or expense not covered by your primary insurance policy.

- Restricted to Only A Single Primary Policy:

- Excess liability insurance applies to only a single primary insurance policy.

- If you wish to enhance your cover for different insurance policies, you will buy separate excess liability policies.

- Let us understand with this example:

- You have purchased “excess liability insurance” for your Commercial Auto Insurance.

- If you need additional cover for your employer’s Liability Insurance, you will be required to purchase another “excess liability insurance” policy.

- Your “excess liability insurance” associated with your Commercial Auto Insurance will not work in this case.

Is an Excess Liability Insurance Similar to Umbrella Liability Insurance?

The answer is NO. Both these insurance products are distinct and operate in different ways. Where an “Excess Liability Insurance Policy” aims to enhance your overall coverage limit, an umbrella liability insurance:

- Provides cover for all the insurance claims not covered by your primary/existing insurance policies

- Can apply to all your existing liability insurance policies and not restrict to any single insurance policy

While claiming any money under the “Umbrella Liability Insurance”:

You will be required to bear the burden of a compulsory deductible known as “Self-insured retention (SIR)” and pay it out of your pocket.

This deductible and your insurance company will reduce all your liability claims will pay you the balance.

For example:

- You had taken an Umbrella Insurance Policy that can cover claims up to $250,000

- The SIR on this policy is 10%.

- You claimed reimbursement from your insurance company under this policy worth $100,000

- In the instant case:

- You will pay SIR $10,000 (10% of $100,000) from your pocket and

- You will get a reimbursement of $90,000 (90% of $100,000) from the insurance company