What Is Recoverable Depreciation?

Understand what recoverable depreciation is and how it can be helpful for you from this blog.

Source: Freepik

Nature swings, and we encounter tornadoes, hurricanes, and ice storms, enough to rip off the roof of our homes in a few seconds. Wait! What about the other possessions, such as cars, landscaping, and even your innocent couch?

Nature spares nobody! Be it the impact of time or natural calamities lot gets destroyed over a period. Thus, getting an insurance policy with a recoverable depreciation clause becomes significant. Let us study this clause and help you become smart!

What Is “Recoverable Depreciation?”

The term depreciation in different meanings and contexts varies, from the Insurance industry to the financial sector. However, its underlying meaning remains the same, “a fall or reduction in the value of an asset because of many factors, such as obsolescence, regular wear & tear on account of usage, the impact of time, natural calamities, etc.”

The term “recoverable” refers to an arrangement, scheme, or policy which will help you get compensation for such a fall in value.

For example, let us assume you purchased a television five years ago for $2,500 with a life span of 20 years. After 15 years, its reasonable value has reduced to $900. The value of your television depreciates by $1,800 on account of depreciation.

In the insurance industry, “Recoverable depreciation” refers to an insurance policy that allows you to get money for the lost value of the item/ assert that you have insured.

In the above example, you have insured your television through a recoverable depreciation insurance policy and receive the depreciation of $1,800 with the cash value/ reasonable value of $900.

How Can I Calculate Recoverable Depreciation and Actual Cash Value (ACV) of My Insured Asset?

The “actual cash value” or the “depreciated value” and the “recoverable depreciation” are some terms used in an insurance policy. Let us understand calculating both these values.

Calculation of Recoverable Depreciation

Calculating recoverable depreciation is known as the straight-line method, where you need to divide the purchase price of your insured asset by its useful life. In effect, this translates into the following formula:

Annual Recoverable Depreciation = Purchase Price or Cost of Acquisition / Useful Life (In years)

Do you want to arrive at cumulative recoverable depreciation or accumulated recoverable depreciation? Multiply the annual recoverable depreciation by the number of past years. It translates into the following formula:

Accumulated Recoverable Depreciation = Annual Recoverable Depreciation * Number of Years

Calculation of Actual Cash Value (ACV)

You can calculate the actual cash value or the depreciated value of your insured asset after calculating the cumulative value of recoverable depreciation. To do this, you will be required to subtract the accumulated recoverable depreciation from your purchase price. Its formula is:

Actual Cash Value: Purchase price – Accumulated Recoverable Depreciation

Let us practically understand this with the help of an example:

- Noah recently purchased a new personal vehicle for a $60,000 life of 15 years.

- He took a recoverable depreciation insurance policy for his newly purchased car to get reimbursement for even the “fall in value.”

- He has calculated the recoverable depreciation, which is $4,000 per annum.

($60,000/15 years)

- Now let us suppose that after 12 years, Noah’s car got destroyed by fire. In the instant case:

- The accumulated recoverable depreciation will be $48,000 ($4,000 * 12 years)

- The actual cash value of Noah’s car will be $12,000 ($60,000 – $48,000)

How Does a Recoverable Depreciation Work?

An Example.

Most insurance companies pay the compensation under a recoverable insurance depreciation policy in two distinct phases are:

Phase I: Compensation for Actual Cash Value (ACV)

To begin with, you will first get an amount equivalent to the actual cash value (ACV) of your insured asset as reduced by the deductible value.

For the unaware, “deductible” represents an amount that is compulsorily required to be paid by you to the insurance company before it processes your claim.

If your claim or reimbursement or insurance compensation is less than the amount fixed as deductible, the insurance company is not bound to pay you.

Hence, you will get a net cash value from the insurance company.

Phase II: Compensation for the Recoverable Depreciation

To trigger the occurrence of this phase, you will be first required to either repair or replace the insured item. You get the cheque from the insurance company for the recoverable depreciation.

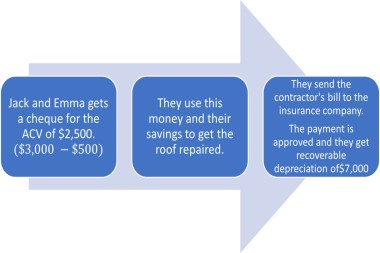

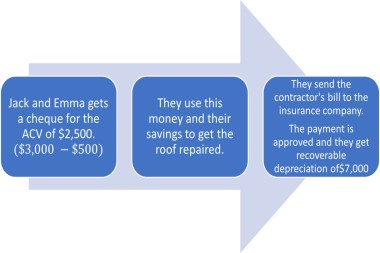

To make you understand the complete process of claiming recoverable depreciation under an insurance policy, we have created a practical example. Read it out below:

- Jack and Emma bought a new house in 2015 in the Greater Toronto Area.

- In the recent fresh spell of rains in the year 2022, they discovered to get their roof replaced

- After searching the market and the local dealers, they have found that the cost to replace the entire roof is $15,000

- The purchase cost of the roof was $10,000 and had a life span of 10 years

- The annual recoverable deprecation is $1,000 ($10,000/10 years)and the accumulated recoverable depreciation of 7 years (from 2015 to 2022) is $7,000 ($1,000 * 7 years)

- The actual cash value of the property is $3,000 ($10,000 – $7,000)

- The mandatory deductible value is $500

Jack and Emma have contacted their insurance policy and will now have to follow the below-mentioned steps to get compensated.