Understanding Variable Vs. Fixed Rate Mortgages: Which is Right for You?

Are you finding it difficult to choose between a fixed-rate and a variable-rate mortgage?

It’s like picking between two mystery boxes. One is steady, the other is a bit of a gamble.

At the end of 2022, 69% of Canadian mortgage holders chose the steady path of a fixed-rate mortgage, locking in their rates for the long haul. But is that the right move for you, or are you ready to take a chance with a variable rate?

Don’t worry—we’ve got you covered! Let’s explore the functioning and pros-cons of variable vs. fixed rate mortgages, so you can make a choice that fits your financial personality.

What’s a Variable Vs. Fixed Rate Mortgage?

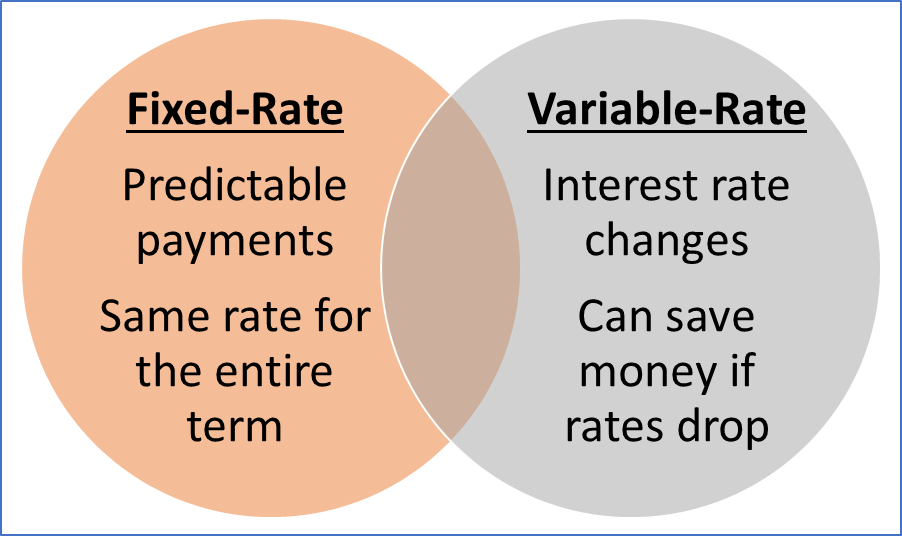

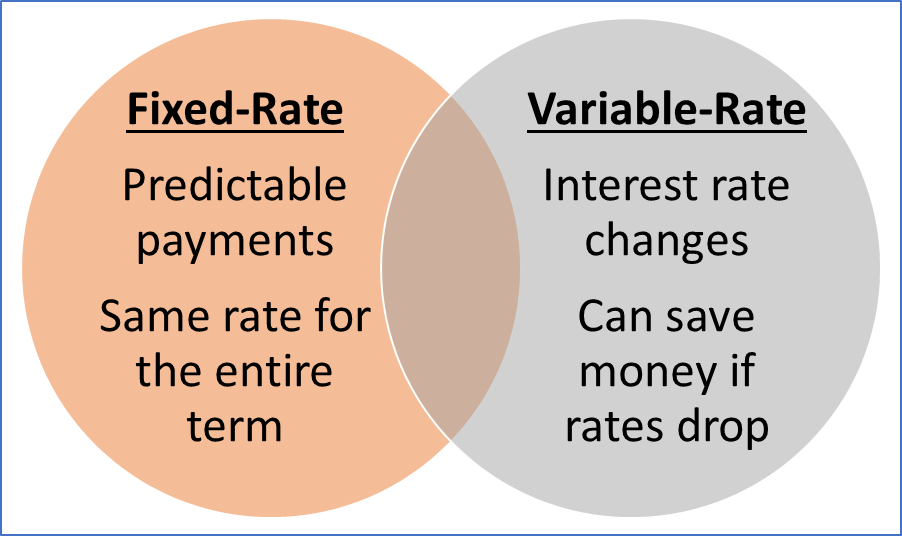

In a fixed-rate mortgage, your monthly payments stay the same for the entire loan term, no matter what happens with interest rates. This makes budgeting easy because you know exactly what to expect.

However, in a variable-rate mortgage (also known as adjustable-rate mortgage), your payments can go up or down based on the market. In the beginning, the rate might be lower, but it can rise later on. This means it could save you money early but might cost you more in the future if rates go up.

Latest Mortgage Rates in Canada

As of today, mortgage rates are competitive in Canada and range from low fixed rates to flexible variable options with top lenders like CIBC, BMO, TD, Scotiabank, RBC, National Bank, Desjardins, nesto, Tangerine, and First National. Whether you’re buying or refinancing, now’s the time to explore deals that could save you big in the long run!

| Mortgage Type | Lowest Rates | Average Rates (10 Lenders) |

| 1-Year Fixed | 5.74% | 6.79% |

| 2-Year Fixed | 4.99% | 6.31% |

| 3-Year Fixed | 4.09% | 5.29% |

| 4-Year Fixed | 4.29% | 5.07% |

| 5-Year Fixed | 4.09% | 4.76% |

| 5-Year Variable | 4.75% | 5.43% |

For more information, click here!

Functioning of Variable Vs. Fixed Rate Mortgage

When it comes to mortgages in Canada, fixed-rate and variable-rate options have very different functions. Understanding how each works is crucial to picking the right one for your financial situation.

Fixed-Rate Mortgage: Stability in Your Payments

A fixed-rate mortgage means locking in your interest rate for a specific period, usually 1-5 years. Once you choose a rate, it stays the same for the entire term. This gives you predictability and stability. Your monthly payments will remain constant, allowing you to do budgeting easily.

The interest rate on a fixed mortgage is typically influenced by Canada bond yields. When bond yields rise, fixed mortgage rates go up. Similarly, when bond yields fall, mortgage rates also get impacted. However, fixed rates will usually be slightly higher than bond yields, creating a “spread” between the two.

Variable-Rate Mortgage: Flexibility, but Riskier

A variable-rate mortgage works differently. The interest rate is connected to your lender’s prime lending rate. This rate fluctuates based on the key interest rate of the Bank of Canada. For instance, if the prime rate is 5%, and your mortgage is set at prime minus 0.5%, you’ll pay 4.5% interest to start.

The key difference? Interest rates change.

If the Bank of Canada lowers its key rate, your mortgage rate drops. If the bank raises its rate, so does your mortgage rate. This gives you the chance to benefit from lower rates but also exposes you to the risk of rising payments.

So, the core difference between the functioning of variable vs. fixed rate mortgages is flexibility vs. predictability. With a fixed-rate mortgage, you know exactly what you’ll pay each month, while a variable-rate mortgage offers the potential for lower rates but comes with the risk of higher payments if rates rise.

Pros and Cons of Variable Vs. Fixed Rate Mortgage

When choosing between variable vs. fixed rate mortgages in Canada, it’s important to weigh the pros and cons of both options. Both have their advantages and drawbacks depending on your financial goals and risk tolerance.

Pros of Fixed-Rate Mortgages

- Certainty: Your interest rate and payments stay the same for the entire term.

- Budgeting Ease: Predictable monthly payments help with financial planning.

- Good During High Inflation: If rates rise, your rate stays the same, protecting you from hikes.

- Peace of Mind: No surprises, making it ideal for risk-averse individuals.

Cons of Fixed-Rate Mortgages

- Higher Initial Rates: Fixed rates are often higher than variable rates when you first sign up.

- Less Flexibility: You can’t switch to a variable mortgage without breaking your contract.

- Penalties for Breaking: If you need to break the mortgage, the penalty is typically based on the interest rate differential, which can cost you thousands.

Pros of Variable-Rate Mortgages

- Lower Starting Rates: Variable rates are often lower than fixed rates, saving you money initially.

- Historically Cheaper: Over time, variable rates have saved homeowners more than fixed rates in the past (around 90% of the time).

- Benefit from Falling Rates: If the Bank of Canada lowers its rate, you pay less each month or reduce your principal faster.

- Lower Penalties for Breaking: The penalty is typically only three months of interest, much cheaper than a fixed mortgage penalty.

- Flexibility: You can switch to a fixed-rate mortgage at any time without penalty.

Cons of Variable-Rate Mortgages

- Risk of Rising Rates: If interest rates go up, your payments may increase.

- Unpredictability: Rising rates can either increase your payments or extend your amortization period, leading to higher total costs.

Variable Vs. Fixed Rate Mortgages: Which is Better?

Choosing from variable vs. fixed rate mortgages depends on your personal financial situation and risk tolerance.

If variable rates are lower and the Bank of Canada is hinting at future rate cuts, a variable mortgage could be a smart choice. For example, if variable rates are around 5%, and a fixed rate is a full percentage point higher, it might make sense to go with a variable mortgage, especially if you expect rates to drop in the future.

On the other hand, if variable rates are high and there’s no indication that rates will fall soon, a fixed-rate mortgage might be safer. Fixed rates can provide certainty, locking in your interest rate and protecting you from future increases.

But choosing the right mortgage is about more than just variable vs. fixed rate mortgages. Consider your entire financial plan—the size of your mortgage, the term, monthly payments, and options like prepayment privileges and penalties. These factors can all impact your ability to manage debt, save for retirement, and pay off your mortgage faster.

In short, if you want certainty and predictability, a fixed-rate mortgage is the better choice. If you’re okay with some risk and want the potential to pay less, a variable-rate mortgage might work better for you.