First-Time Home Buyer Incentives in Canada: What You Need to Know?

Buying your first home can feel like a dream come true—but it also comes with a lot of challenges. With down payments, mortgage rates, and all the fine print, it’s easy to get overwhelmed.

But here’s the good news: in Canada, there are several incentives designed to help first-time homebuyers. Think of them as your cheat codes to make homeownership a little more affordable.

In this guide, we’ll walk you through the key first-time home buyer incentives in Canada, so you can understand how they work and which ones might benefit you the most.

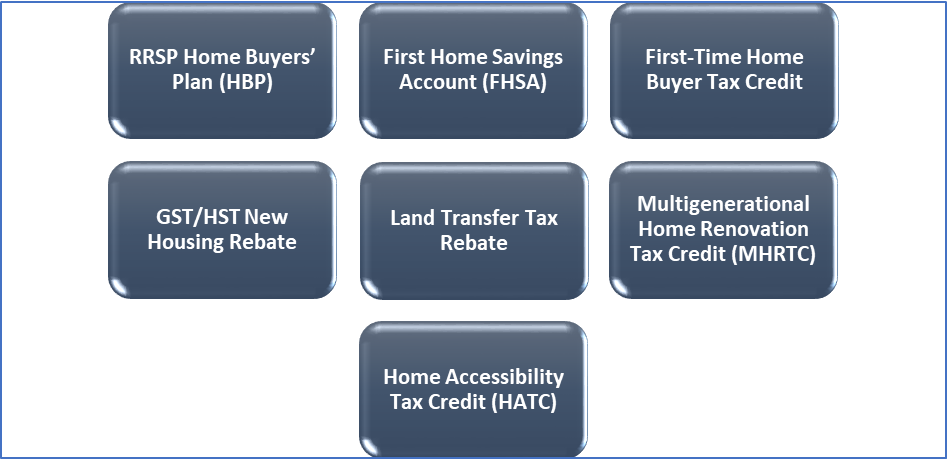

List of Latest First-Time Home Buyer Incentives in Canada

Let’s take a look at some of the latest first-time home buyer incentives that could make your home-buying dreams a whole lot more affordable!

A. RRSP Home Buyers’ Plan (HBP)

The RRSP Home Buyers’ Plan (HBP) allows you to withdraw up to $60,000 with a down payment. In case you are purchasing with a partner, both of you can withdraw $35,000, giving you a total of $70,000. Here’s what you should know about this scheme!

How It Works?

You can use the funds for the purchase of a home, and you’ll have 15 years to pay the amount back into your RRSP.

Eligibility

- You must be a first-time homebuyer (or haven’t owned a home in the last 4 years).

- The home must be your primary residence within one year of buying it.

What’s Great About It?

Using your RRSP as a first-time home buyer incentive to fund your home purchase means you’re not taking on extra debt. Plus, when you repay the funds, you get that money back into your RRSP.

Pro Tip: Make sure you plan your repayment schedule. If you miss a repayment, the amount will be added to your income and taxed.

B. First Home Savings Account (FHSA)

Introduced in 2023, the Tax-Free First Home Savings Account (FHSA) is a brand-new tool for first-time homebuyer incentives in Canada. It combines the best features of an RRSP and a TFSA (Tax-Free Savings Account).

How It Works?

- You can contribute up to $8,000 per year, up to a lifetime limit of $40,000.

- Contributions are tax-deductible, reducing your taxable income in the year you contribute.

- Withdrawals for purchasing your first home are tax-free.

Eligibility

- You must be a first-time homebuyer, meaning you haven’t owned a home in the past 4 years.

- The funds must be used for purchasing your first home.

Pro Tip: Start saving early. This scheme can assist you in building a solid down payment for purchasing your new home.

C. First-Time Home Buyer Tax Credit

The First-Time Home Buyer Tax Credit is a federal tax benefit. If you’ve bought a home for the first time in the past year, you could claim this credit when filing your taxes.

How Does It Work?

The HBTC gives you a tax credit of $1,500, thanks to the 2022 budget increase (previously $750). This credit can be claimed when you file your taxes in the year you purchased your home.

Who Is Eligible?

- The home must be your primary residence.

- You must be a first-time homebuyer or someone who hasn’t owned a home in the last 4 years.

Pro Tip: Make sure to claim this credit on your tax return to help offset the costs of buying a new home.

D. GST/HST New Housing Rebate

When you buy a newly constructed home, you’re required to pay GST (Goods and Services Tax) or HST (Harmonized Sales Tax), depending on the province. However, first-time buyers may be eligible for the GST/HST New Housing Rebate, which is one of the greatest first-time home buyer incentives.

How Much Can You Get?

- You can receive a rebate of up to 36% of the GST you paid, or up to $6,300.

- If you buy in a province with HST, the rebate could be as high as $24,000.

Eligibility

- The home must be your primary residence.

- The purchase price must be under a certain threshold (e.g., $350,000 in many provinces).

Pro Tip: If you’re building your home or buying one from a builder, make sure to apply for this rebate to lower the overall cost of your home.

E. Land Transfer Tax Rebate

One of the largest closing costs when buying a home is the land transfer tax. This tax is calculated as a percentage of the home’s purchase price and can range from 0.5% to 2.0%. Fortunately, several provinces offer rebates on this tax as a first-time homebuyer incentive.

Maximum Rebates

| City of Toronto | Up to $4,475 |

| Ontario (outside Toronto) | Up to $4,000 |

| British Columbia | Up to $8,000 |

| Prince Edward Island | Up to $2,000 |

For more information, click here!

Eligibility

- You must be a first-time homebuyer.

- The home must be your primary residence.

Pro Tip: If you’re buying a home in Ontario, make sure to claim both the provincial and municipal rebates if you’re purchasing in Toronto. That’s double the savings!

F. Multigenerational Home Renovation Tax Credit (MHRTC)

If you’re planning to renovate your home to accommodate multiple generations of your family, you might be eligible for the Multigenerational Home Renovation Tax Credit (MHRTC).

What Is It?

- This credit helps pay for renovations that create self-contained secondary suites, such as “in-law suites,” to accommodate multiple family members.

- You can claim up to $50,000 in expenses for eligible renovations, with a credit of 15% of the costs, up to a maximum of $7,500.

Eligibility

- The renovations must create a secondary suite that is used for living purposes by family members.

Pro Tip: If you’re renovating to accommodate a parent or grandparent, this credit can significantly reduce your renovation costs.

G. Home Accessibility Tax Credit (HATC)

If you or someone in your household has a disability, the Home Accessibility Tax Credit (HATC) can help cover the costs of making your home more accessible.

How It Works?

- The HATC provides a non-refundable tax credit for eligible home renovations that improve accessibility for people with disabilities.

- You can claim up to $20,000 in expenses and receive a credit of up to $3,000.

Eligibility

- The renovations must improve mobility or functionality within the home, make the home easier to access, or reduce the risk of harm.

Pro Tip: This credit is available even if you’re not a first-time homebuyer, so if you have a disability or live with someone who does, you can still benefit from this incentive.

How to Maximize These First-Time Home Buyers Incentives?

You may be eligible for more than one of these first-time home buyer incentives, so it’s important to take full advantage of all the programs that apply to your situation.

Here are some tips on maximizing your benefits:

- Combine Incentives: Stack programs like FTHBI, HBP, and GST/HST Rebate to lower your down payment and mortgage payments.

- Start Saving Early: Open an FHSA or contribute to your RRSP to maximize tax-free savings.

- Get Professional Help: A financial advisor can guide you on using incentives and navigating the application process.

- Check Local Programs: Some provinces offer additional incentives, so research regional rebates and grants.

- Plan for the Long-Term: Take advantage of long-term savings options to build a solid foundation for homeownership.

The Bottom Lines

There are plenty of first-time home buyer incentives in Canada designed to help first-time homebuyers reduce the financial challenges that come with purchasing a home. Whether it’s lowering your mortgage payments, reducing your closing costs, or getting tax credits to offset renovation expenses, these incentives make homeownership more attainable.

Take the time to explore these programs, plan your home purchase wisely, and don’t hesitate to reach out to professionals for advice. With the right preparation, owning your first home in Canada can be more affordable than you think!