Why are More Canadians Choosing Guaranteed Life Insurance? Top Plans in Canada!

Life is full of surprises! While we can’t predict them all, one thing we all want is security for our loved ones, even when we’re not there.

However, many Canadians face a hurdle: they can’t pass the medical exam for life insurance, leaving them vulnerable to life’s uncertainties and emergencies. But what if I tell you that there exists an insurance plan that does not require you to undergo any medical examination?

It’s called guaranteed life insurance, and it’s changing the game for Canadians all across the country. Stick around as we explore why more Canadians are choosing this option and uncover the top plans available.

What’s Guaranteed Life Insurance?

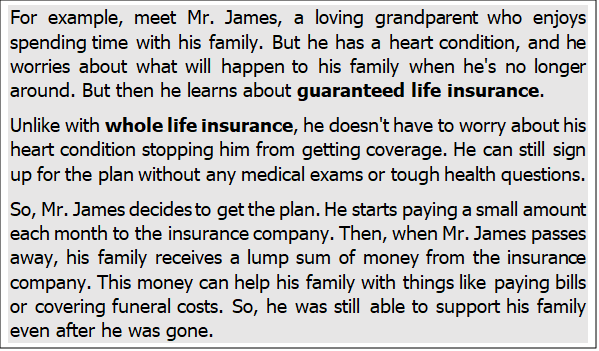

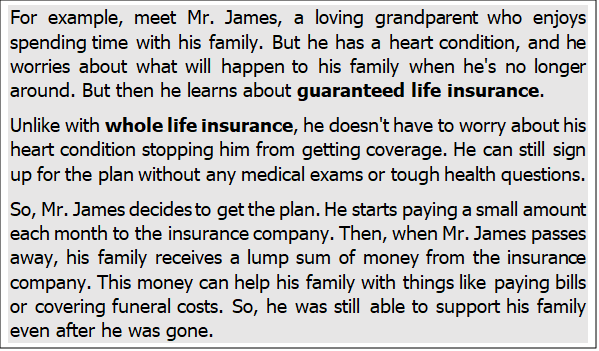

Guaranteed life insurance is also known as guaranteed issue or guaranteed acceptance life insurance. It’s a special type of insurance that doesn’t ask a lot of questions about your health.

So, even if you have health problems or you’re older, you can still get it. You just pay your premiums, and when you’re unfortunately not present, your loved ones get money to help them out.

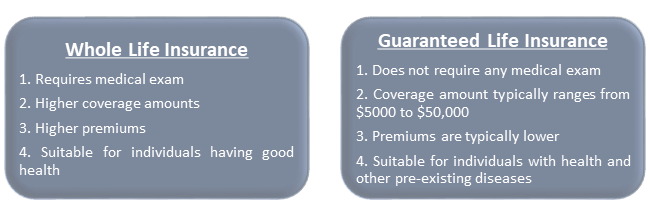

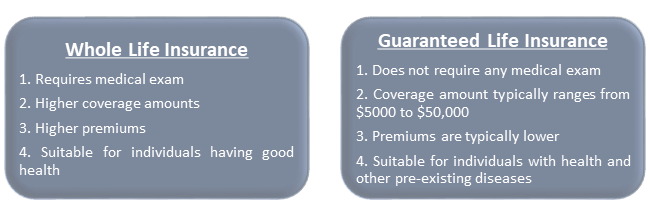

Comparison Between Whole Life Insurance and Guaranteed Life Insurance

Why Guaranteed Life Insurance is Popular in Canada?

Let’s explore why more and more Canadians are turning to guaranteed life insurance and how it’s making a difference in their lives.

- Financial Security and Peace of Mind

The primary purpose of this life insurance is to offer financial protection to your loved ones. When you’re not around anymore, they’ll get money to help with things like groceries, bills, and even paying off the house debt. This is known as the ‘death benefit’.

But here’s the cool part: it’s not just about the basics. In addition to providing for loved ones, the plan can also serve as a source of supplemental income. This income can be used for final expenses such as funeral costs and medical bills. So, instead of worrying about money, your family can focus on being together and getting through a tough time.

- Accessibility and Inclusivity

Guaranteed life insurance opens its doors to everyone, regardless of their health status or age. Unlike traditional policies like whole life insurance, which typically deny coverage based on pre-existing conditions, this insurance ensures that everyone can financially protect their loved ones.

With the plan, there’s no need to undergo stressful medical exams or answer complex health questions. This makes the application process simple and hassle-free, allowing individuals to secure coverage without worrying about their health history.

- Flexibility in Coverage and Payment Options

The insurance lets you pick and choose what works best for you. Whether you want a little bit of coverage or a lot, there’s a plan that fits your budget and needs perfectly.

And what’s more? You’re in control! With guaranteed issue life insurance, you can customize your coverage to match exactly what you need. No more paying for stuff you don’t need – it’s all about keeping things simple and affordable.

- Best for Serious Medical Pre-Conditions

It’s a harsh reality that a lot of Canadians deal with serious health issues. In fact, almost half (45.1%) of them faced at least one major chronic disease in 2021. For people with really serious conditions, like advanced cancer or extreme obesity, a regular plan like whole life insurance might not be an option.

In such cases, guaranteed life insurance emerges as a true beacon of hope for these individuals. Even if they’re dealing with tough health conditions, they can still get financial protection for their families.

- Rising Awareness and Education

Additionally, more and more people are learning about how important it is to do financial planning. That’s why insurance companies in Canada are working extra hard to teach folks about guaranteed acceptance life insurance.

Moreover, the Government of Canada even celebrates “Financial Literacy Month” every November! They put on all sorts of events and workshops to help people learn about money stuff, like budgeting and saving. They even cover topics like life insurance, so you know it’s important! All such factors have also led to the popularity of guaranteed life insurance in Canada.

What are the Top Guaranteed Life Insurance Plans in Canada?

Here’s the list of top guaranteed life insurance providers in Canada!

| Plan Name | Entry Age | Coverage Amount |

| Canada Protection Plan – Guaranteed Acceptance Life Insurance | 10 to 75 Years | $5000 to $50,000 |

| RBC Guaranteed Acceptance Life Insurance | 40 to 75 Years | $5,000 to $40,000 |

| Manulife CoverMe Guaranteed Issue Life Insurance | 40 to 75 Years | $5,000 to $25,000 |

| SunLife Guaranteed No Medical Life Insurance | 30 to 74 Years | $5,000 to $25,000 |

| TD Guaranteed Acceptance Life Insurance | 50 to 75 Years | $5,000 to $25,000 |

What are the Tips for Choosing the Right Guaranteed Life Insurance Plan?

Choosing the right guaranteed life insurance plan can feel overwhelming. So, here are some simple tips to help you navigate through the options and find the perfect plan for you and your loved ones:

- Assess Needs: Think about what you need from insurance. Consider things like age, health, and what you want to leave for your family. This helps you find the right plan.

- Compare Quotes: Look at different insurance companies and what they offer. Compare how much coverage you get and how much you pay each month. This helps you find the best deal.

- Understand Fine Print: Read all the details carefully. Pay attention to things like what’s not covered or any rules about who can get it. This helps you avoid surprises later on.

- Get Advice: If you’re not sure, ask for help from a professional like an insurance agent. They can help you figure out what you need, which will help you make a smart choice.

- Check Service: Think about how the insurance company treats its customers. Look for companies known for being helpful and easy to deal with. This makes things easier if you need to make a claim later on.

Conclusion

In simple terms, guaranteed life insurance is great because you don’t need to go through any medical exams to get it. More and more Canadians are realizing how easy it is to get and how it gives them peace of mind.

So, think of this insurance as a big hug for your loved ones. It’s there to wrap them up and keep them safe when you’re not around. And that’s something worth smiling about, isn’t it?

People Also Ask

Q. Can I customize my coverage with guaranteed issue life insurance?

Yes, you can often customize your coverage amount to fit your needs and budget.

Q. Is guaranteed life insurance expensive?

The cost of this insurance depends on factors like your age and the coverage amount. However, it’s not more expensive than whole life insurance.

Q. Can I borrow money against my guaranteed life insurance policy?

Some insurance providers offer the option to borrow money against your policy’s cash value, but it’s best to check with your provider for details.

Q. Do I need to have a certain income to qualify for the insurance?

No, there’s usually no income requirement to qualify for guaranteed issue life insurance.

Q. Will my coverage be affected if I travel outside of Canada?

It depends on the policy, but some of these plans may provide coverage worldwide.

Q. Can I get this insurance if I smoke or have other lifestyle habits?

Yes, you can still get guaranteed life insurance even if you smoke or have other lifestyle habits.